How Do You Calculate Income Tax Payable The estimated tax you will pay Tax Bracket The tax bracket you fall into based on your filing status and level of taxable income Tax as a percentage of your taxable income Since taxes are calculated in tiers the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket Net Income after Tax is paid

Curious whether you ll owe taxes or get money back in April 2025 Estimate your tax bill or refund with our free federal income tax calculator Below are the steps to calculate your federal taxes by hand followed by examples or you can simply use the free PaycheckCity calculators to do the math for you Steps to Calculate Federal Income Tax Before you begin you will need your paycheck W 4 form and a calculator Find the paycheck s gross pay earnings before taxes

How Do You Calculate Income Tax Payable

How Do You Calculate Income Tax Payable

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

How To Calculate Income Before Taxes Business Blog

https://images.pexels.com/photos/4386372/pexels-photo-4386372.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

How Do You Calculate Federal Income Tax Withheld From Paycheck YouTube

https://i.ytimg.com/vi/oBgHk9_gpRg/maxresdefault.jpg

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison As you pay your tax bill another thing to consider is using a tax filing service that lets you pay your taxes by credit card That way you can at least get valuable credit card rewards and points when you pay your bill The IRS has authorized three payment processors to collect tax payments by credit card PayUSAtax Pay1040 and ACI Payments Inc

You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied

More picture related to How Do You Calculate Income Tax Payable

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

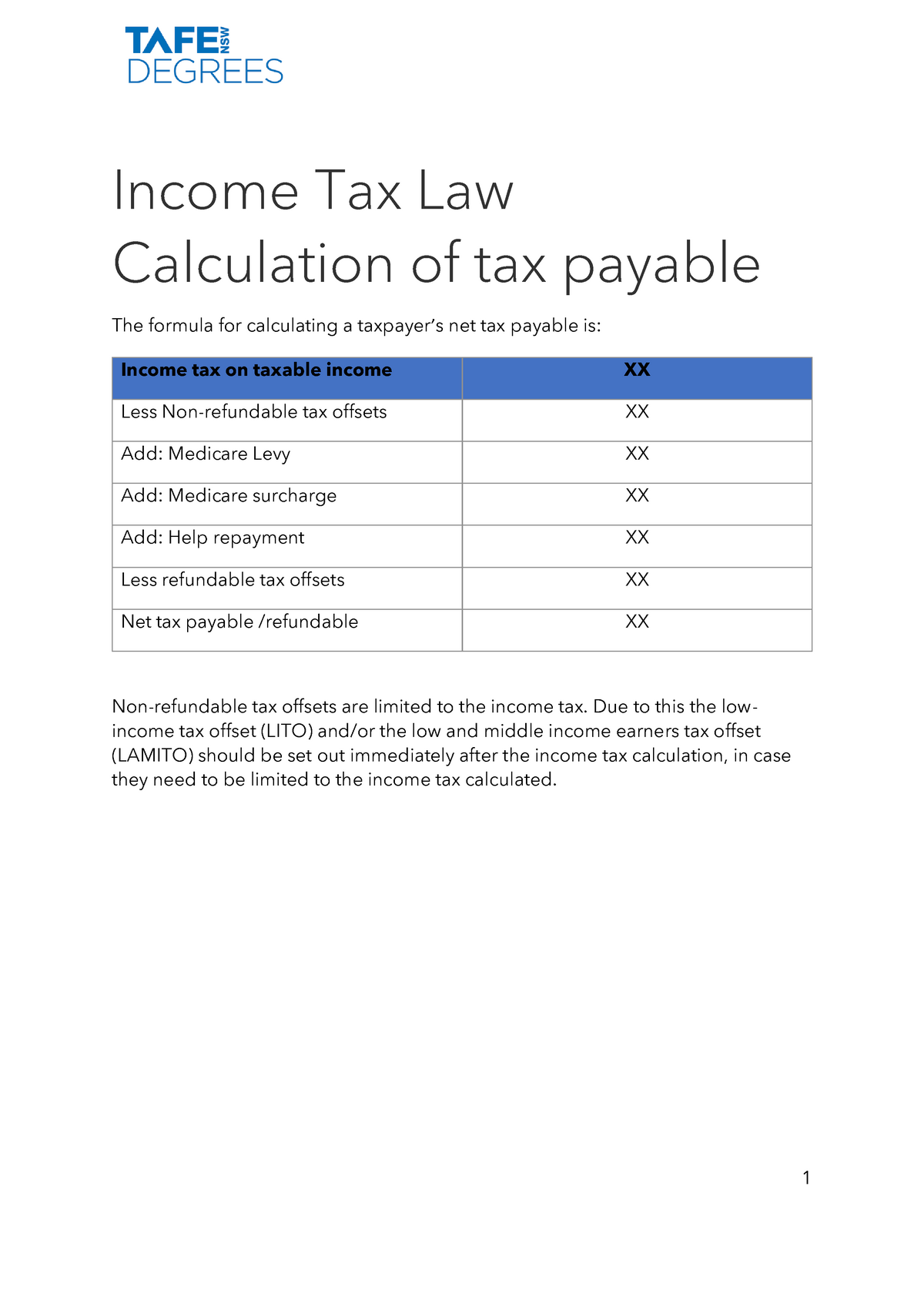

Income Tax Law Calculation Of Tax Payable Income Tax Law Calculation

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2c28c0842a2e142d492427a022dafd4e/thumb_1200_1697.png

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

Federal income tax is usually the largest tax deduction from gross pay on a paycheck It is levied by the Internal Service Revenue IRS in order to raise revenue for the U S federal government While individual income is only one source of revenue for the IRS out of a handful such as income tax on corporations payroll tax and estate tax Paycheck Calculator Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2025 tax year on Feb 14 2025 However some states still have exemptions in their income tax calculation You might be confused with deductions and exemptions so the following is a quote from Zacks

[desc-10] [desc-11]

Where Can I Calculate Income Tax Aapka Consultant

https://www.aapkaconsultant.com/blog/wp-content/uploads/2016/10/FreeIncomeTaxHelp.jpg

How To Calculate Income Tax Calculator Ay 2019 2020 Carfare me 2019 2020

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

How Do You Calculate Income Tax Payable - The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied