How To Calculate Income Tax Payable On Balance Sheet For example if a business tax for the coming tax period is recognized to be 1 500 then the balance sheet will reflect a tax payable amount of 1 500 which needs to be paid by its due date Deferred income tax liability on the other hand is an unpaid tax liability upon which payment is deferred until a future tax year

Income tax payable is typically the tax incurred and due within a year It is the amount firms have to pay to the government as part of their earnings Income tax payable on a company s balance sheet falls under the current liabilities portion of the balance sheet You are free to use this image on your website templates etc ASC 740 10 10 1 to 10 2 requires an entity to calculate its income tax provision income tax expense within the financial statements in two steps 1 Recognize the amount of estimated taxes payable or refundable for the current year i e the amount expected to be reflected on its income tax returns for the current year 2

How To Calculate Income Tax Payable On Balance Sheet

How To Calculate Income Tax Payable On Balance Sheet

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Solved Requirement 1 Calculate Income Tax Payable 2021 2022 2023

https://www.coursehero.com/qa/attachment/32973342/

Amount Due To Director In Balance Sheet VictoriasrGoodman

https://i.pinimg.com/736x/c4/e5/3f/c4e53fedadb7e055d3b52dd8606829e3.jpg

Add the balance of your sales tax payable account as well as any state income tax or other local taxes List the final sum of all of your tax accrual accounts under the Tax Payable section of your Income tax payable is a crucial concept in financial accounting representing the taxes an organization expects to pay within 12 months This liability is reported on a company s balance sheet and is determined based on applicable tax laws It differs from income tax expense which is reported on income statements

Definition and Examples of Income Tax Payable Income tax payable equals the amount that a company expects to owe in income taxes Even though this expense is not necessarily clear cut as it can be hard to fully anticipate taxes owed it gets accounted for as a liability on a company s balance sheet because the company expects to pay out At the end of an accounting period one of the adjusting entries is to accrue for estimated income tax payable due on the profits of the business In this case the balance sheet liabilities income tax payable has been increased by 14 000 and the income statement has an income tax expense of 14 000 The expense reduces the net income

More picture related to How To Calculate Income Tax Payable On Balance Sheet

How To Calculate Income Tax Payable Accounting

https://cdn3.vectorstock.com/i/1000x1000/93/62/tax-payment-savings-calculation-income-vector-13969362.jpg

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

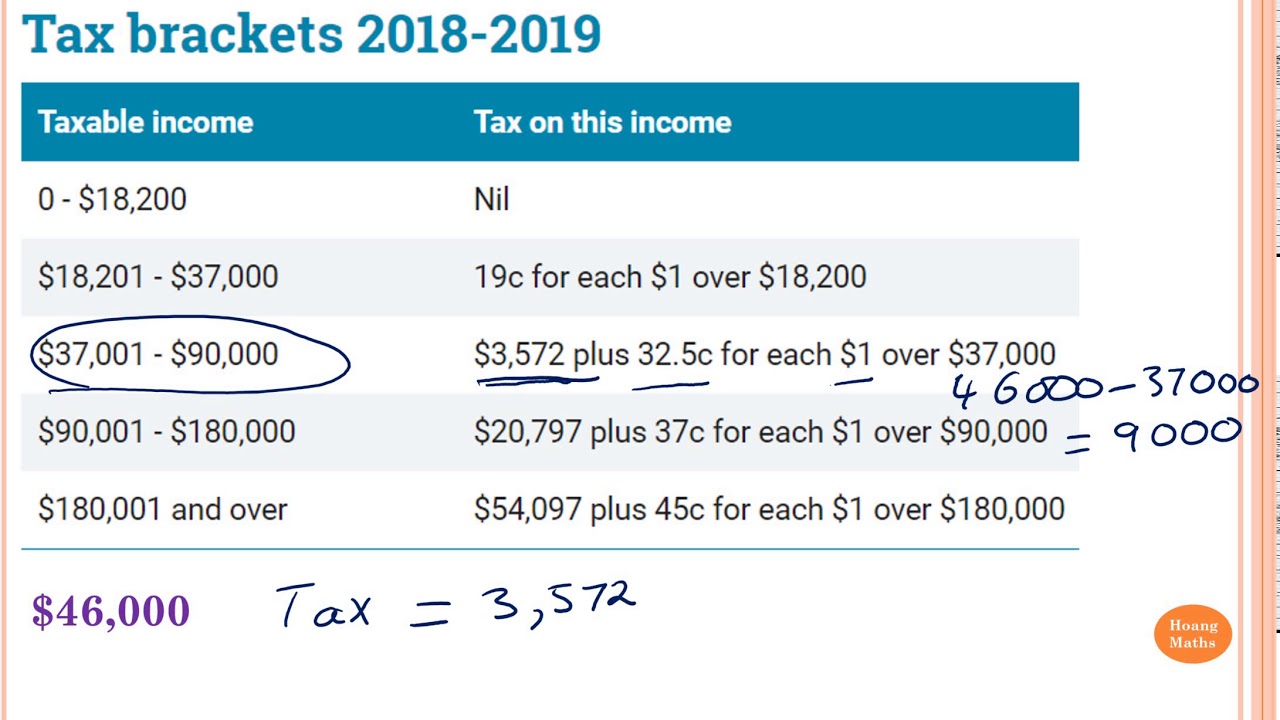

Calculating Tax Payable Part 1 YouTube

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

Any income tax payable within a longer period is instead classified as a long term liability Example of Income Tax Payable If ABC International has 100 000 of before tax profits and the federal government imposes a 20 income tax then ABC should record a debit to the income tax expense account of 20 000 and a credit to the income tax The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period Before delving further into the income taxes topic we must clarify several concepts that are essential to understanding the related income tax accounting The concepts are noted below

[desc-10] [desc-11]

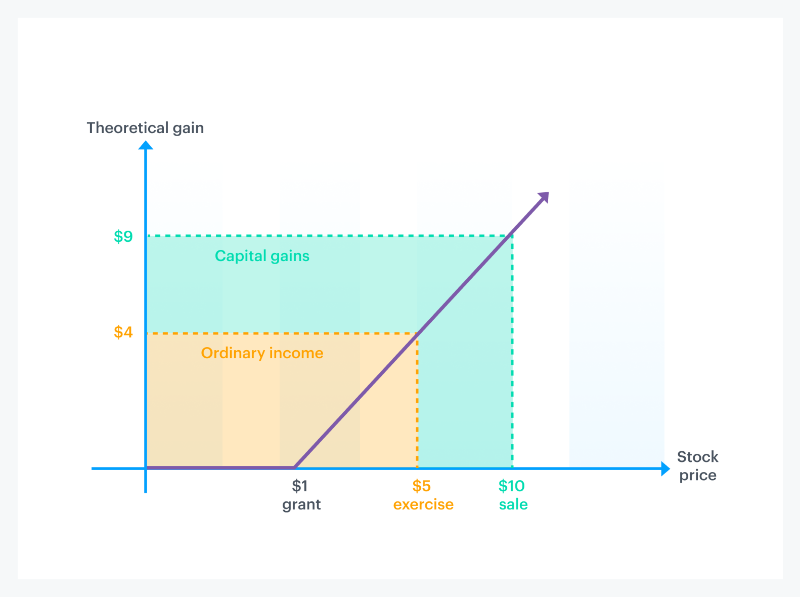

How To Calculate Income Tax Payable On Salary

https://carta.com/wp-content/uploads/2019/11/Frame-5-1.png

How To Calculate Income Tax That s Due Or Tax Payable YouTube

https://i.ytimg.com/vi/OqJHGcpkapo/maxresdefault.jpg

How To Calculate Income Tax Payable On Balance Sheet - [desc-14]