How Do You Compute For Your Income Tax Payable Refund In Australia Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck This is tax withholding See how your withholding affects your refund take home pay or tax due How it works Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison Curious whether you ll owe taxes or get money back in April 2025 Estimate your tax bill or refund with our free federal income tax calculator

How Do You Compute For Your Income Tax Payable Refund In Australia

How Do You Compute For Your Income Tax Payable Refund In Australia

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

FilipiKnow

https://filipiknow.net/wp-content/uploads/2020/01/how-to-compute-income-tax-featured-image.png

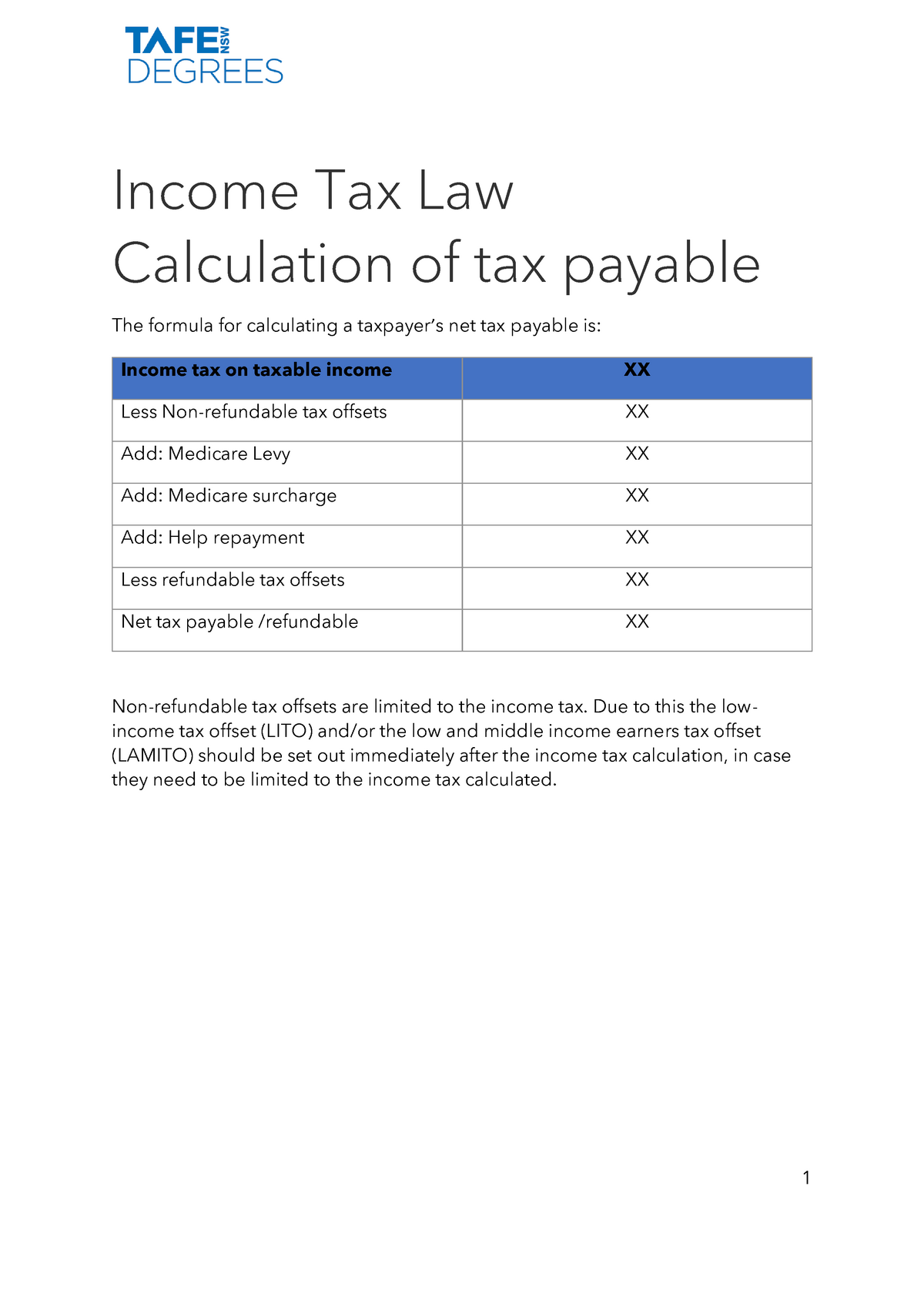

Income Tax Law Calculation Of Tax Payable Income Tax Law Calculation

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2c28c0842a2e142d492427a022dafd4e/thumb_1200_1697.png

Determine if you ll get a refund or need to pay taxes Compare the federal income tax liability that you calculated to your total projected federal income tax withholding and estimated payments for the year If the federal income tax liability you projected is greater than your withholding and payments you may have a payment due when you file Use this calculator to estimate your total taxes as well as your tax refund or the amount you will owe in taxes Use this calculator to easily calculate your taxable income your W 2 form If you re self employed your taxable income is all the money you ve received for doing that thing you do You also owe income taxes on certain

Calculate your taxes with our income tax calculator Enter your annual income and filing details to estimate your tax burden Skip to content Paycheck Calc Income Tax Calc Contact Income Tax Calculator Estimate your federal state local income tax burden Updated for 2024 tax year on Dec 19 2024 Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

More picture related to How Do You Compute For Your Income Tax Payable Refund In Australia

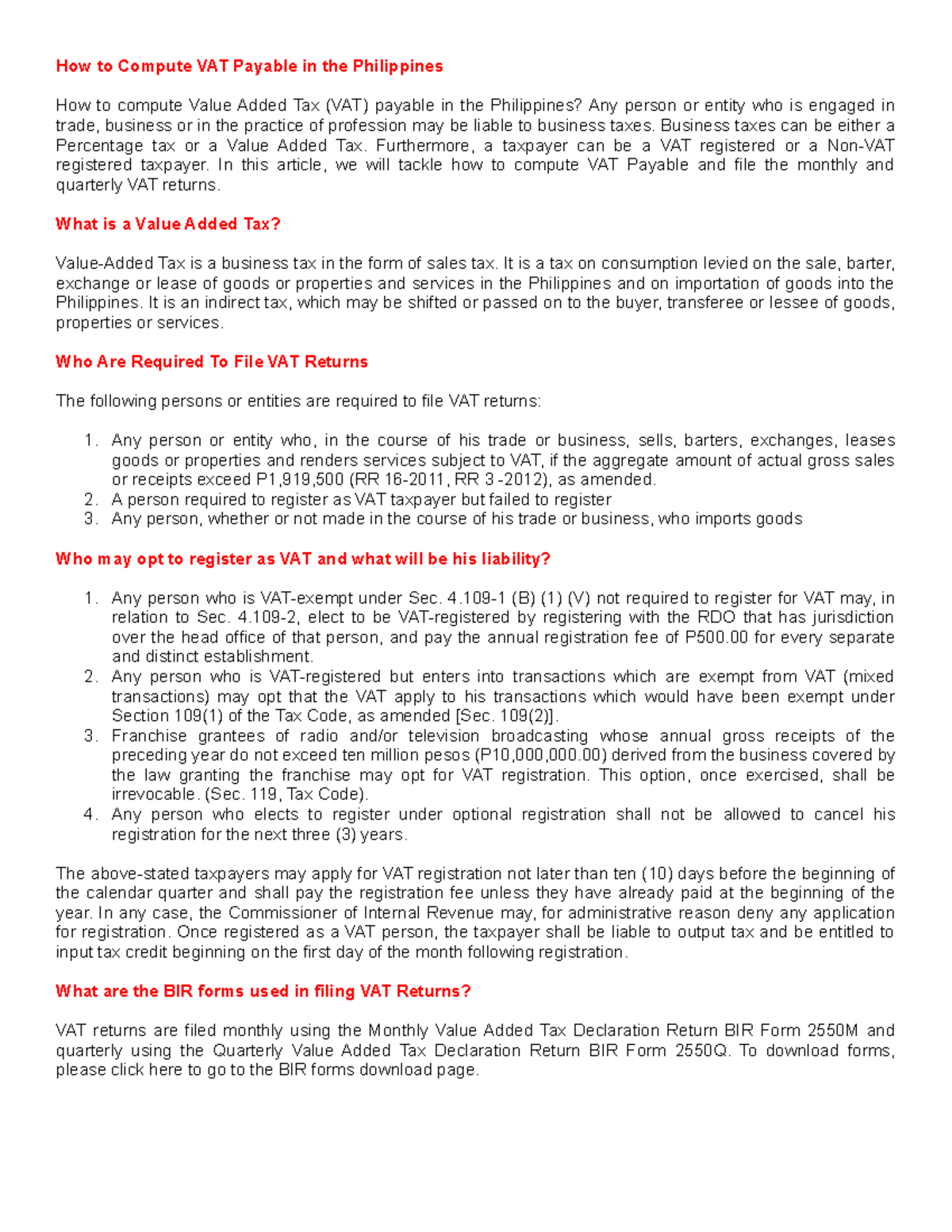

How To Compute VAT Payable Business Taxes Can Be Either A Percentage

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/83ef57b4f926837907f3b5bc4063a6c0/thumb_1200_1553.png

Free Tax Prep For Those Who Make Less Than 57K Through The United Way

https://www.newsleader.com/gcdn/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2021/01/18/USATODAY/usatsports/MotleyFool-TMOT-5529ca9e-irs-tax-forms.jpg?width=2121&height=1193&fit=crop&format=pjpg&auto=webp

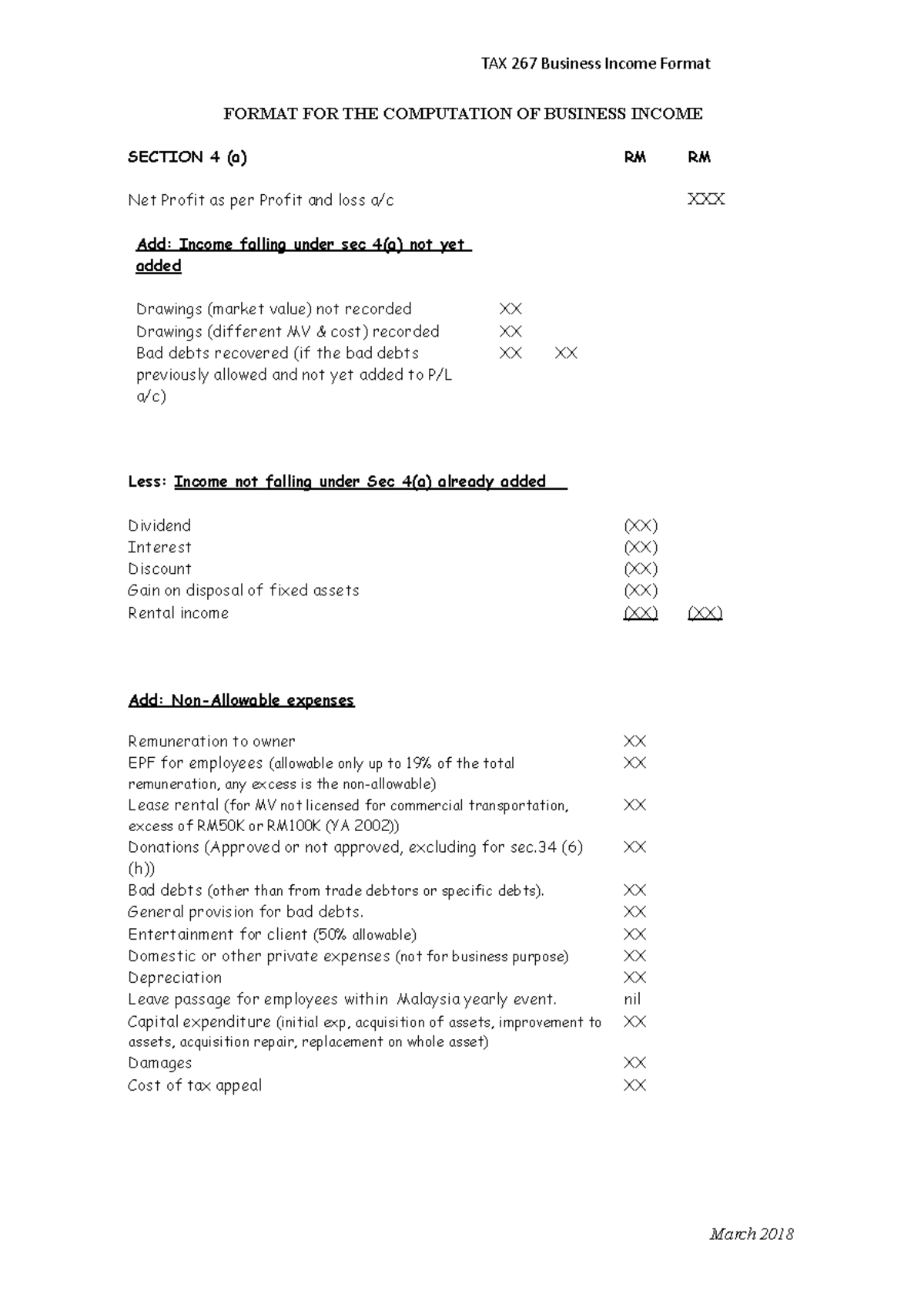

Format FOR THE Computation OF Business Income TAX 267 Business Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fa3286e8a7fef695c7d808a0fb9706ba/thumb_1200_1680.png

In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability This year you expect to receive a refund of all federal income tax withheld because you expect to have zero tax liability again If you think you qualify for this exemption you can indicate this on your W 4 Step one Your gross income First the IRS starts with your gross income which includes all of the money that you make In addition to income from your job this also includes business income

[desc-10] [desc-11]

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Income Tax Refund ITR Refund Status Check Through NSDL IndiaFilings

https://img.indiafilings.com/learn/wp-content/uploads/2018/05/12010052/Income-Tax-Refund-Status-1.jpg

How Do You Compute For Your Income Tax Payable Refund In Australia - Calculate your taxes with our income tax calculator Enter your annual income and filing details to estimate your tax burden Skip to content Paycheck Calc Income Tax Calc Contact Income Tax Calculator Estimate your federal state local income tax burden Updated for 2024 tax year on Dec 19 2024