How To Calculate Income Tax Payable Australia Up next in Work and tax GST calculator How to calculate Australian goods and services tax 1 min read Income tax Find out how much tax you need to pay 4 min read Lodging a tax return Simple steps to lodge your 2024 tax return online 6 min read Salary packaging Sacrificing part of your salary can reduce your tax 1 min read Returning

Use this pay calculator to calculate your take home pay in Australia PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 2023 2024 and current 2024 2025 financial years That means you pay a total of 7 797 in income tax 1 000 in Medicare Levy and get 250 in tax offset 41 453 is Australian income is levied at progressive tax rates Tax bracket start at 0 known as the tax free rate and increases progressively up to 45 for incomes over 180 000 In addition to income tax there are additional levies such as Medicare Individuals on incomes below 18 200 are also entitled to the Low and Middle Income Tax Offset LMITO

How To Calculate Income Tax Payable Australia

How To Calculate Income Tax Payable Australia

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

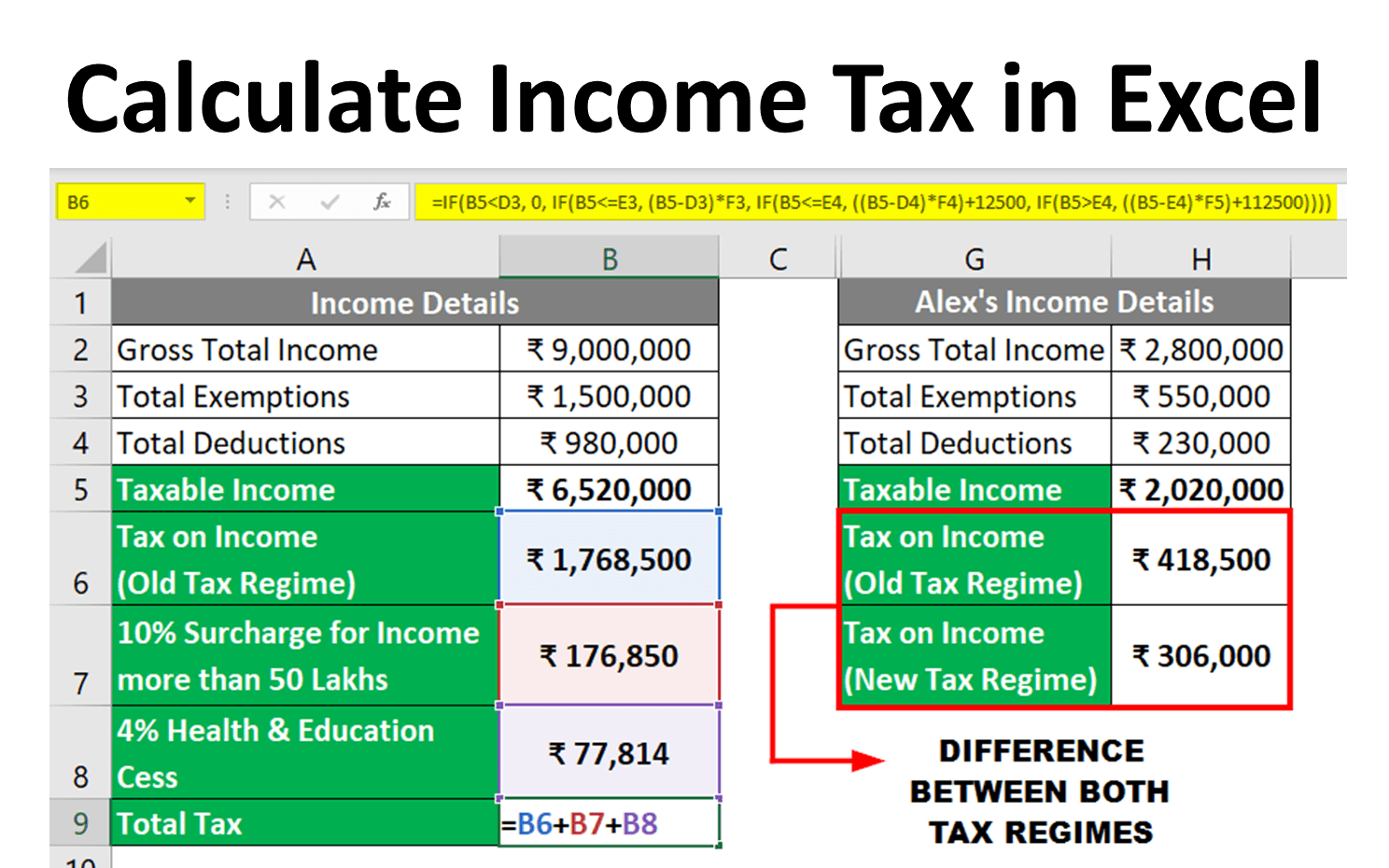

How To Calculate Income Taxes The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/Calculate-Income-Tax-in-Excel-1.png

How To Calculate Income Before Taxes Business Blog

https://images.pexels.com/photos/4386372/pexels-photo-4386372.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

Unlike deductions which reduce your taxable income offsets reduce your tax payable Some common tax offsets in Australia include Low and Middle Income Tax Offset LMITO Available to individuals with taxable incomes below a certain threshold reducing their tax payable Low Income Tax Offset LITO Provides tax relief for low income earners Calculate how much tax you ll pay In Australia income is taxed on a sliding scale The Australian Government has made changes to individual income tax rates and thresholds from 1 July 2024 For most taxpayers this means you will pay less tax each payday and keep more of what you earn The changes will not affect your 2023 24 tax return

Pay Calculator Why this PAYG Calculator Simply enter your Gross Income and select earning period This Calculator will display Income tax on your Gross earnings Medicare Levy only if you are using medicare Superannuation paid by your employer standard rate is 11 of your gross earnings Finally Your Take Home Pay after deducting Income Tax and Medicare In Australia all employees are entitled to earn at least the national minimum wage of 24 10 per hour With a standard working week lasting 38 hours the minimum wage is equal to a weekly salary of 915 90 That works out to monthly gross earnings of around 3 969 or a yearly salary of 47 627 Once taxes and the Medicare Levy have been applied a single person earning the Australian minimum

More picture related to How To Calculate Income Tax Payable Australia

How To Calculate Income Tax On Salary With Example Easy Calculation

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiZHmRXEJsZA-SxAM19rn4Ixik33w8wZUk5AqTuUzUhA_o_ZNTR4E3LKWtKk2pMf5tuC9CpMX8_NfH-w9xIB6cbLUcsk4k7MjRpLC6GL6M3S6Tg90Sk3YmVE3qAuDIOn9Rmo81yAZ24-hUgQlIQwtFE4ObEnf8GQKII8N7UCu0g0EEfxlq7ZIMQ5Hg4/s1240/New Income Tax Slab Fy 2023-24-1_Page_3.jpg

TAX Rates And Tables Page 1 TAX RATES And TABLES Individual Rates

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/03254bc9bf0ca930a94752e02b0d6f8f/thumb_1200_1697.png

Where Can I Calculate Income Tax Aapka Consultant

https://www.aapkaconsultant.com/blog/wp-content/uploads/2016/10/FreeIncomeTaxHelp.jpg

Go to the calculator Income tax estimator Our calculator takes between 15 and 25 minutes to use What you can do with the calculator For the income years 2019 20 to 2023 24 the calculator will estimate tax refund or debt The calculator uses your tax payable along with your Our simple tax calculator will estimate your income tax liability in Australia and the money you take home It s important to note that the income tax you pay weekly fortnight monthly depends on your income minus any immediate deductions like salary sacrifice and tax offsets Your Australian Tax File Number makes this work so be sure to

[desc-10] [desc-11]

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How To Calculate Income Tax Payable Australia - Calculate how much tax you ll pay In Australia income is taxed on a sliding scale The Australian Government has made changes to individual income tax rates and thresholds from 1 July 2024 For most taxpayers this means you will pay less tax each payday and keep more of what you earn The changes will not affect your 2023 24 tax return