How Do You Calculate Credit For Taxes Paid To Other States You have to be in a particular TurboTax state income tax return to get to the Credit Paid To Other States or Country screens When you are preparing more than one state income tax return each state will ask if you paid taxes to another state See the screenshot example below Once you ve determined that you need to file a part year nonresident

Residents typically get a tax credit for taxes paid to any other state Example A California resident receives 20 000 from a rental building in Arkansas The resident reports only the 20 000 to Arkansas and pays 2 000 in tax to Arkansas In some states you calculate your tax as if you were a resident the whole year and then pay a Most of the states that have income taxes offer a credit for taxes paid to another state on the same income although how that credit is calculated is not identical from state to state Most of the states use a proportion of the amount of taxes paid on the income in one state usually your home state to the amount due to the other state

How Do You Calculate Credit For Taxes Paid To Other States

How Do You Calculate Credit For Taxes Paid To Other States

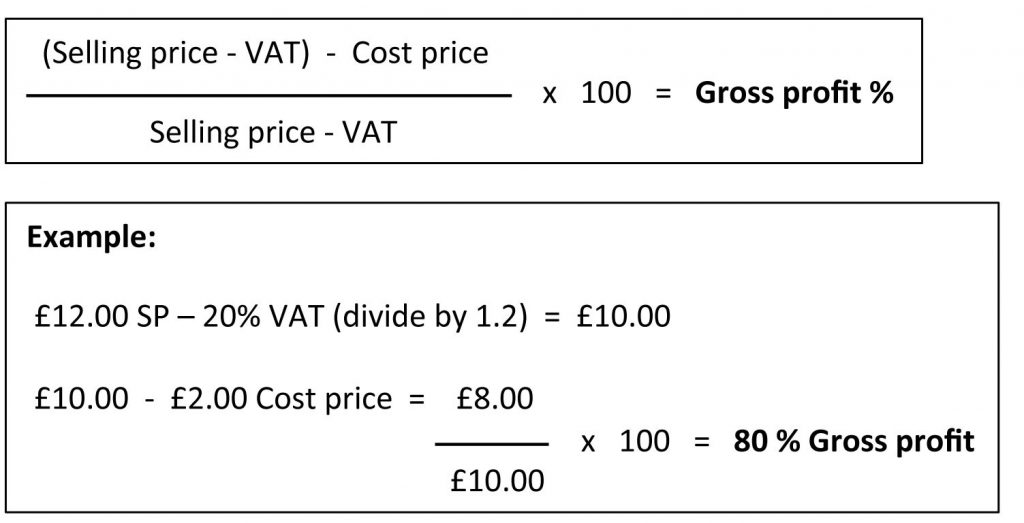

https://www.kitchencut.com/wp-content/uploads/2015/03/my-gross-profit.jpg

How To Get Your Credit Score And Credit Reports For FREE In Canada

https://debtmedic.ca/wp-content/uploads/2018/05/CreditScoreAgain2.jpg

Which States Pay The Most Federal Taxes MoneyRates

https://www.moneyrates.com/wp-content/uploads/imagesrv_wp/5015/Federal-tax-by-state.png

The credit for taxes paid to other states is allowed only to Colorado residents Please see Part 1 of the Colorado Individual Income Tax Guide for information about how Colorado residency is determined credit the taxpayer must calculate the credit limitation for each as well as the limitation on the total credit as Although not all states require it you should attach a copy of the nonresident return when claiming a credit for taxes paid on your resident return If you choose to e file the return just keep a copy of the nonresident return with your tax records Your resident state agency may request a copy if verification is needed

The tax paid to the other state must have been an income or franchise tax in order to qualify for the credit You may not claim credit for other taxes paid are not incomethat or franchise taxes such as a severance tax personal property tax sales and use tax or real estate tax Components of the Credit Calculation Before you can calculate any credit for taxes paid to another jurisdiction s you must understand the components of the credit calculation You must also know how to determine each of those components for each jurisdiction and each tax for which a credit is being claimed You must determine

More picture related to How Do You Calculate Credit For Taxes Paid To Other States

Accounting Debit Vs Credit Examples Guide QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/[email protected]

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

How Do You Calculate Rental Coverage Rental Income Required Calculator

https://www.bowfin.co.uk/wp-content/uploads/2022/10/How-Do-You-Calculate-Rental-Coverage-768x539.jpg

Before you can calculate any credit for taxes paid to another jurisdiction s you must understand the components of the credit calculation You must also know how to determine each of those components for each jurisdiction This is any state of the United States other than New Jersey a political subdivision e g county or municipality Usually if you are required to file taxes in multiple states you might be eligible for a credit for taxes paid to another state Various state laws provide these credits so that you don t pay taxes to multiple states on the same income Note A credit for taxes paid to another state is different from reciprocity agreements which allow residents of one state to request an exemption from tax

[desc-10] [desc-11]

How To Calculate Your Net Worth Plus Why It Matters That You Know

https://publish.purewow.net/wp-content/uploads/sites/2/2022/05/how-to-calculate-your-net-worth-fb.jpg

HI6028 Tutorial Question Assignment 1 Week 1 Taxes Are Mandatory

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/342411ac1a2f2e17d74c9026865373a2/thumb_1200_1698.png

How Do You Calculate Credit For Taxes Paid To Other States - Although not all states require it you should attach a copy of the nonresident return when claiming a credit for taxes paid on your resident return If you choose to e file the return just keep a copy of the nonresident return with your tax records Your resident state agency may request a copy if verification is needed