How Do I Calculate Income Tax Paid Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

Curious whether you ll owe taxes or get money back in April 2025 Estimate your tax bill or refund with our free federal income tax calculator Step one Your gross income First the IRS starts with your gross income which includes all of the money that you make In addition to income from your job this also includes business income

How Do I Calculate Income Tax Paid

How Do I Calculate Income Tax Paid

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

Where Can I Calculate Income Tax Aapka Consultant

https://www.aapkaconsultant.com/blog/wp-content/uploads/2016/10/FreeIncomeTaxHelp.jpg

Gross Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17235937/Gross-Income-Calculator.jpg

Calculating the Federal Income Tax Rate The United States has a progressive income tax system This means there are higher tax rates for higher income levels These are called marginal tax rates meaning they do not apply to total income but only to the income within a specific range These ranges are referred to as brackets The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison

Below are the steps to calculate your federal taxes by hand followed by examples or you can simply use the free PaycheckCity calculators to do the math for you Steps to Calculate Federal Income Tax Before you begin you will need your paycheck W 4 form and a calculator Find the paycheck s gross pay earnings before taxes The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied

More picture related to How Do I Calculate Income Tax Paid

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

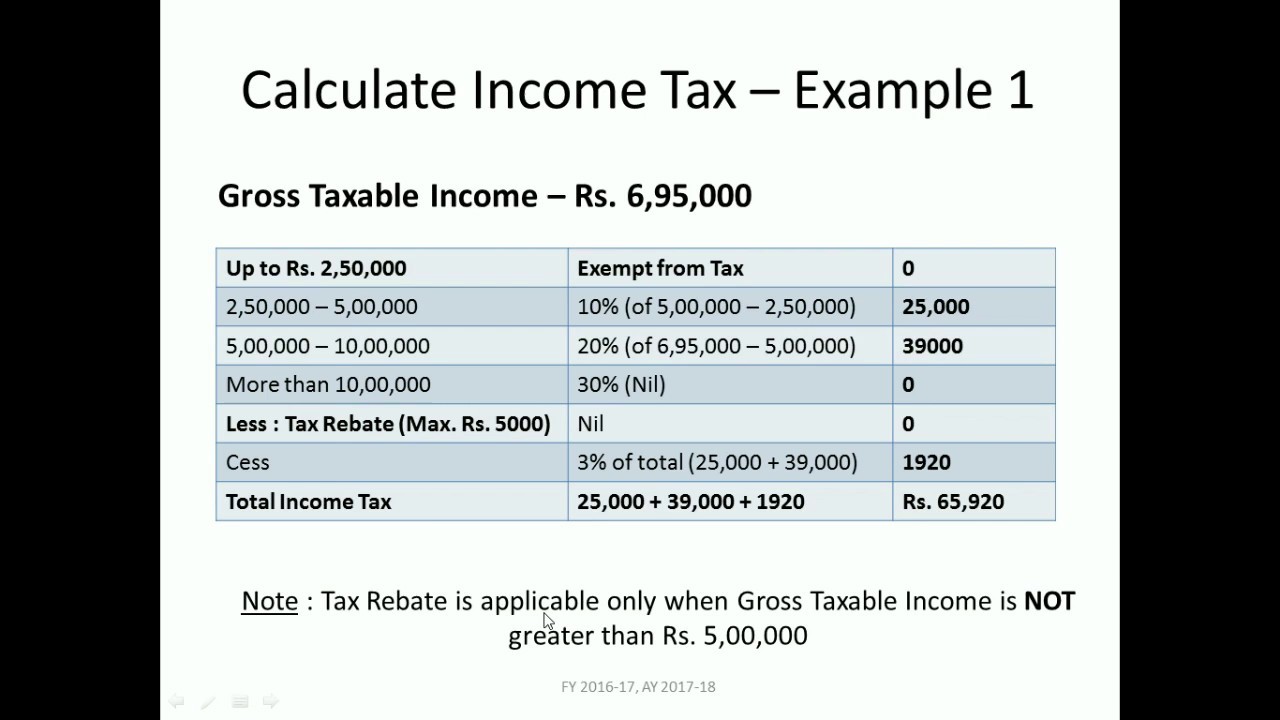

How To Calculate Income Tax FY 2016 17 FinCalC TV YouTube

https://i.ytimg.com/vi/n88iQ1EfB-Y/maxresdefault.jpg

Step 4 Local income tax liability Some cities or counties impose local income tax The formula is Gross income or State taxable income Local income tax rate Local income tax liability Step 5 Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable The federal personal income tax that is administered by the Internal Revenue Service IRS is the largest source of revenue for the U S federal government Nearly all working Americans are required to file a tax return with the IRS each year and most pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks

[desc-10] [desc-11]

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

How Do I Calculate Income Tax Paid - The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison