What Is Net Operating Income Approach Net Operating Income NOI is a measure of profitability that represents the amount the company has earned from its core operations and is calculated by deducting operating expenses from operating revenue It excludes non operating expenses such as loss on the sale of a capital asset interest tax expenses etc

Net Operating Income Approach to capital structure believes that the value of a firm is not affected by the change of debt component in the capital structure It assumes that the benefit that a firm derives by infusion of debt is negated by the simultaneous increase in the required rate of return by the equity shareholders Net Operating Income Approach The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm s value The cost of capital for the firm will always be the same No matter what the degree of leverage is the firm s total value will remain constant

What Is Net Operating Income Approach

What Is Net Operating Income Approach

https://efinancemanagement.com/wp-content/uploads/2013/02/Net-Income-Approach.png?x23181

What Is Net Operating Income NOI How To Calculate It

https://navi.com/blog/wp-content/uploads/2022/10/net-operating-income.jpg

How To Calculate Net Operating Income In Real Estate Investing

https://myhappynest.com/wp-content/uploads/2023/05/NOI-Calculation-Image-Improved.jpg

Key Highlights NOI is a standardized metric that serves as a proxy for cash flow and is used to compare different property types and assess their economic value NOI is to commercial real estate what EBITDA is to corporate finance a capital structure and tax rate agnostic profitability measure The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on

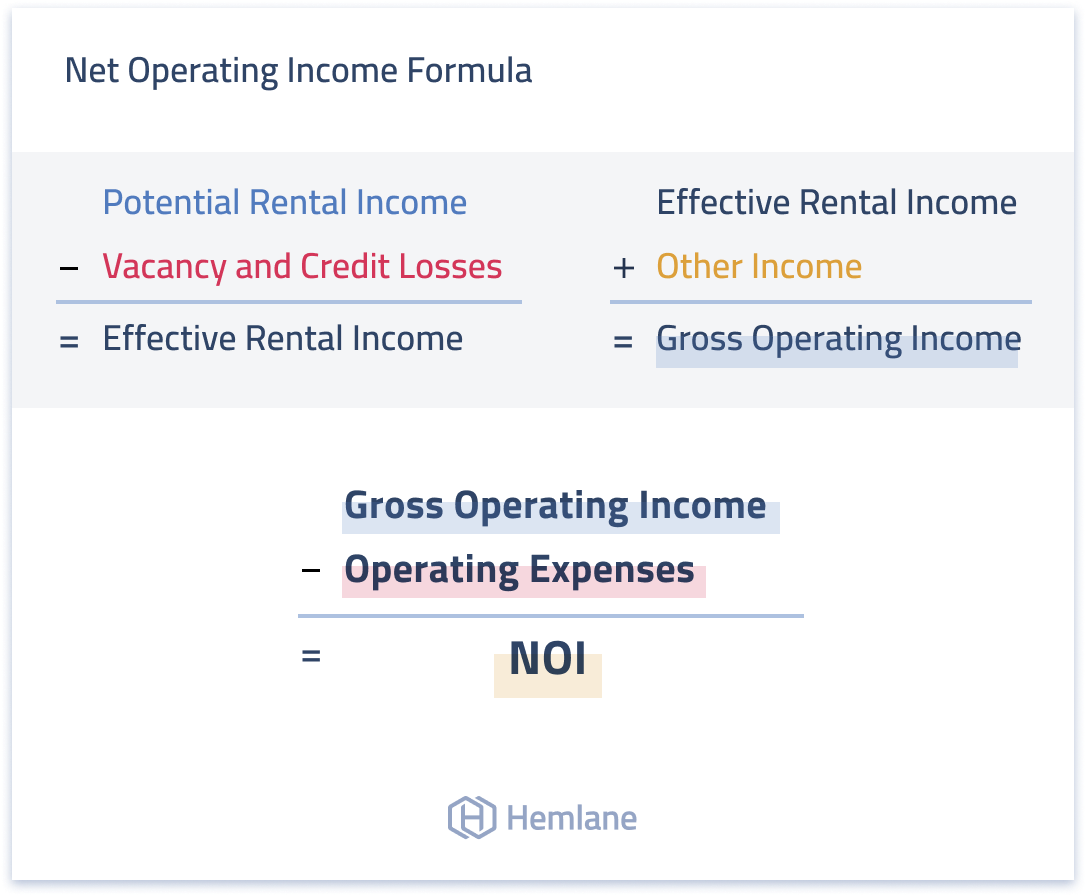

The net operating income NOI formula starts by calculating the sum of a property s rental and ancillary income which then subtracts any direct operating expenses incurred NOI is intended to determine the profitability of a given property before accounting for the depreciation expense financing costs interest income taxes corporate Net operating income NOI is a real estate valuation method that measures the profitability of a real estate property based on revenue and expenses NOI is calculated by subtracting all operating expenses a property incurs from the revenue it generates The NOI of a real estate property is typically included on its cash flow and income statements

More picture related to What Is Net Operating Income Approach

Net Operating Income NOI Definition Calculation Examples

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1311870317/image_1311870317.jpg?io=getty-c-w640

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

What Exactly Is Net Operating Loss

https://generisonline.com/wp-content/uploads/2022/05/PhotoGrid_1618425477477-1024x683-1.jpg

Key Takeaways Operating income is revenue less any operating expenses while net income is operating income less any other non operating expenses such as interest and taxes Operating The net operating income from the office building is NOI Total Operating Revenue Operating Expenses 500 000 200 000 300 000 In this example the net operating income NOI for the office building is 300 000 per year This means that after accounting for the operating expenses the property generates 300 000 in income that

The net operating income approach claims that valuation of a firm is irrelevant to capital structure In other words the market value of a firm will be the same regardless of the proportion of debt The reason is that any benefit from the increase of cheaper debt will be offset by a higher required rate of return on equity The net operating income is defined as the total operating income for a property minus the total operating expenses for a property The net operating income is useful because it describes a property s ability to generate income without considering its capital structure Since different owners will have different capital structures and

Questions With Solution Net Income Approach Net Operating Income

https://i.ytimg.com/vi/ZCCSOT_0sdE/maxresdefault.jpg

Net Income Approach YouTube

https://i.ytimg.com/vi/WvnonMCUGtA/maxresdefault.jpg

What Is Net Operating Income Approach - The net operating income NOI formula starts by calculating the sum of a property s rental and ancillary income which then subtracts any direct operating expenses incurred NOI is intended to determine the profitability of a given property before accounting for the depreciation expense financing costs interest income taxes corporate