What Is Net Operating Income Theory Let us understand the concept of net operating income theory in depth with the help of an example Let s take the example of a pizza outlet owned by Mr X in California that cooks the best pizza in their area Mr X is working on the refinancing of his current loans with a nearby bank so he needs to calculate NOI

This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a Net operating income NOI was developed by David Durand According to net operating income approach firm value is not affected by change in company or firm s debt components Net operating income approach says that value of a firm depends on operating income and associated business risk

What Is Net Operating Income Theory

What Is Net Operating Income Theory

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/708bcc2555aace9d44b61e94fa205e94/thumb_1200_1697.png

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Net Profit Definition Formula Sample Calculation

https://learn.financestrategists.com/wp-content/uploads/Levels_of_Profitability.png

Net Income Approach Explained Durand presented the Net Income Approach The theory suggests increasing the firm s value by decreasing the overall cost of capital which is measured in terms of the Weighted Average Cost of Capital This can be done by having a higher proportion of debt which is a cheaper finance source than equity finance Net income approach and net operating income approach were proposed by David Durand According to NI approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm Thus with an increase

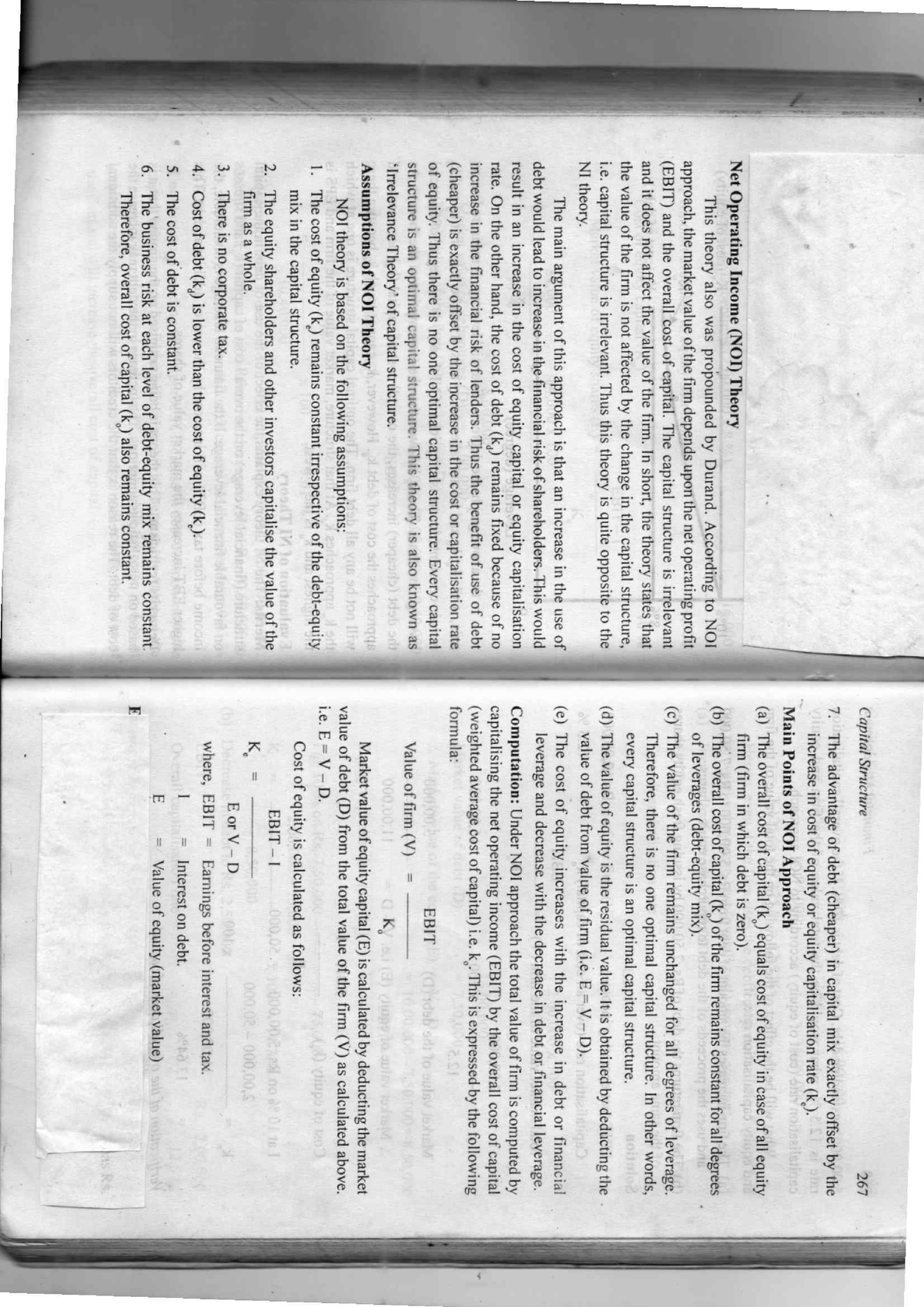

Net Operating Income NOI Theory of Capital Structure According to NOI approach there is no relationship between the cost of capital and value of the firm i e the value of the firm is independent of the capital structure of the firm Assumptions The corporate income taxes do not exist Net Operating Income Approach The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm s value The cost of capital for the firm will always be the same No matter what the degree of leverage is the firm s total value will remain constant

More picture related to What Is Net Operating Income Theory

How To Calculate Net Operating Income In Real Estate Investing

https://myhappynest.com/wp-content/uploads/2023/05/NOI-Calculation-Image-Improved.jpg

What Is Net Operating Income NOI Arrived

https://images.arrived.com/images/wp/uploads/2022/10/operating_income.jpg

What Is Operating Income Operating Income Formula And EBITDA Vs

https://remote-tools-images.s3.amazonaws.com/Operatingincome.jpg

3 The Traditional Approach The traditional approach also known as intermediate approach is a compromise between the two extremes f net income approach and net operating income approach According to this theory the value of the firm can be increase initially or the cost of capital can be decreased by using more debt as the debt is a cheaper source funds than equity The net operating income approach proposes that the capital structure decisions of a business are irrelevant to the company s value That is this capital structure theory says there is no

[desc-10] [desc-11]

What Is Net Operating Income How To Calculate NOI GlobalBusinessDiary

https://globalbusinessdiary.com/wp-content/uploads/2023/12/Net-Operating-Income.jpg

Net Operating Income NOI Definition Calculation Components And

https://livewell.com/wp-content/uploads/2023/10/Net-Operating-Income-NOI-Definition-Calculation-Components-and-Example.jpg

What Is Net Operating Income Theory - Net Operating Income NOI Theory of Capital Structure According to NOI approach there is no relationship between the cost of capital and value of the firm i e the value of the firm is independent of the capital structure of the firm Assumptions The corporate income taxes do not exist