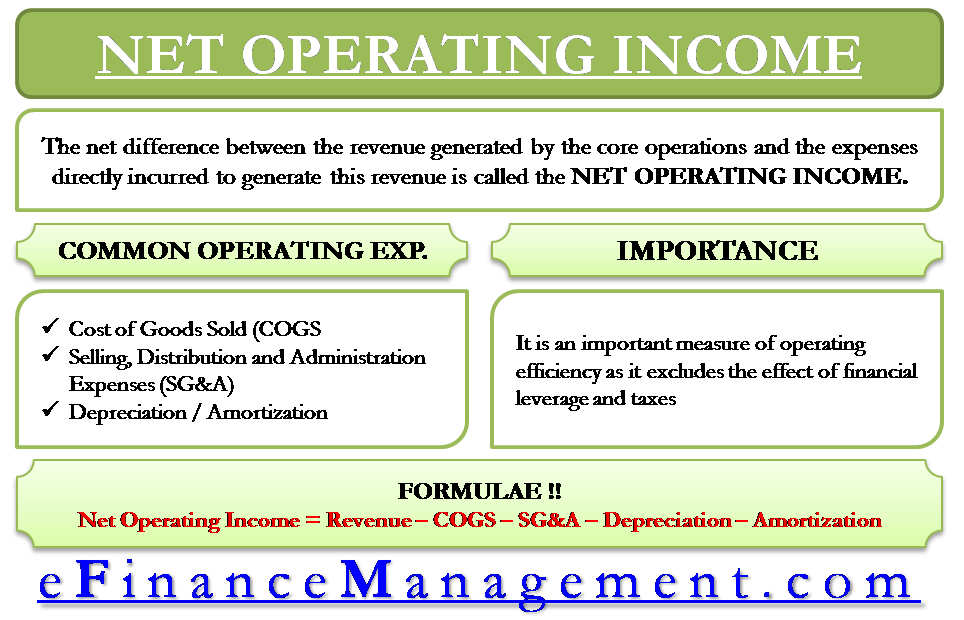

Net Operating Income Approach Formula Guide to Net Operating Income NOI meaning Here we explain its formula hoe to calculate examples and its applications All other expenses should be excluded from the net operating income calculation formula In Colgate we note that Operating Expense 2015 COGS SGA 6 635 5 464 12 099 million

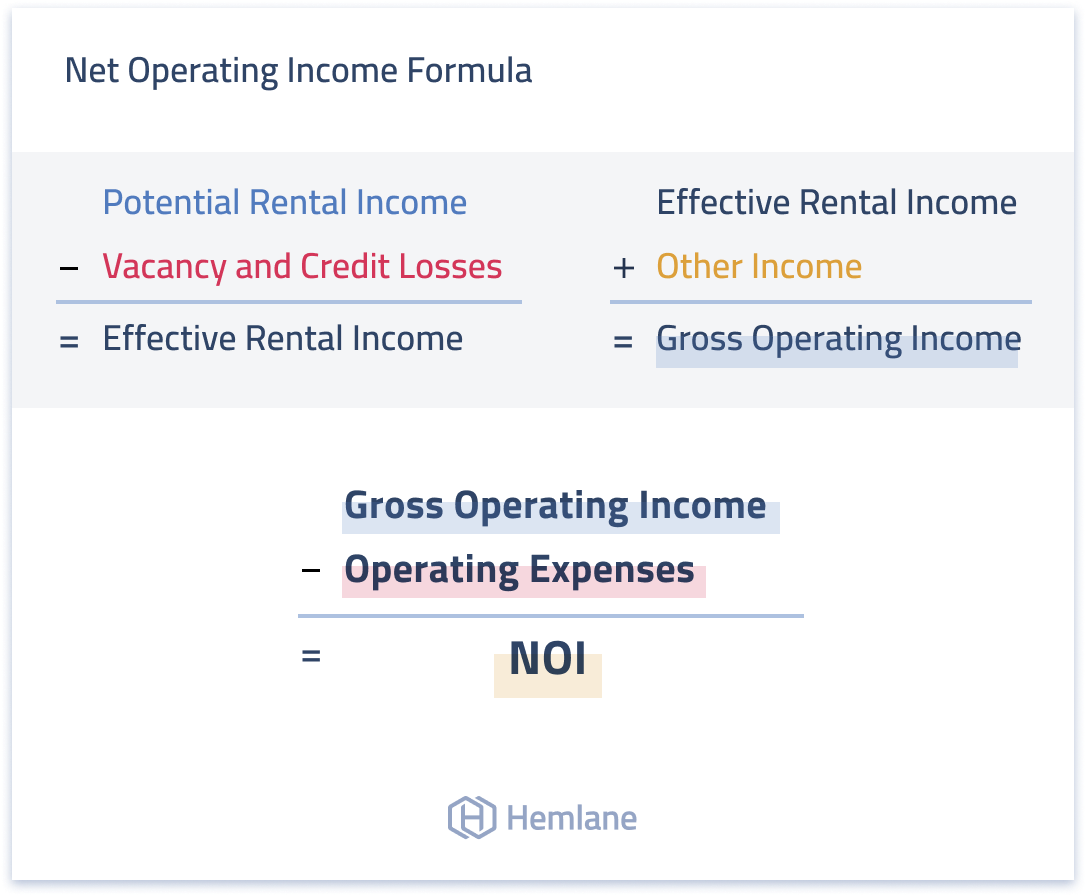

Net operating income NOI shows the profitability of income generating real estate investments NOI includes all revenue from the property minus necessary operating expenses Define NOI in Simple Terms Net Operating Income or NOI is a valuation method used by real estate owners to determine the value of their income generating properties NOI is calculated by taking the total revenue of a property and subtracting all reasonably necessary operating expenses It is a before tax figure showing up on the property s income and cash flow statements and it excludes

Net Operating Income Approach Formula

Net Operating Income Approach Formula

https://efinancemanagement.com/wp-content/uploads/2016/04/Net-Operating-Income.png

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Net Operating Income Approach YouTube

https://i.ytimg.com/vi/Suf9NAMW6Jg/maxresdefault.jpg

Net Operating Income Formula Total Net Sales Total Cost of Sales Operating Expenses 394 328M 223 546M 51 345M 119 437M Therefore Apple Inc generated a net operating income of 119 437M in 2022 Example 2 Consider UrbanEstates a real estate company that builds luxury homes in urban areas The company wants to The net operating income from the office building is NOI Total Operating Revenue Operating Expenses 500 000 200 000 300 000 In this example the net operating income NOI for the office building is 300 000 per year

NOI vs NIBT Net Income Before Taxes It s critical to understand just how different these two figures can be even for the exact same property NIBT Net Income Before Taxes NIBT is an accounting figure whether we re talking about an operating business or an investment property It s the total revenue minus the total expenses In real estate net operating income NOI is the total income of a revenue generating property minus the total operating expenses Investors use the net operating income formula figure to determine the profitability of a property and to help make investment decisions

More picture related to Net Operating Income Approach Formula

Net Income Approach YouTube

https://i.ytimg.com/vi/WvnonMCUGtA/maxresdefault.jpg

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

What Is Operating Margin Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/24195029/Operating-Margin-Formula.jpg

Net Income Approach The net income approach suggested by David Durand brings forth the relevance of capital structure in calculating the value of a firm The WACC Weighted Average Cost of Capital which is the weighted average of debt and equity will decide the firm s value The following formula can represent the net income approach The building therefore generates 2 67 in net operating income for every dollar of loan interest expense meaning the transaction is financially viable Factors that affect net operating income Net operating income and the cap rate can fluctuate based on the following factors Rent and vacancy rates Rental property income can increase if an

[desc-10] [desc-11]

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

Questions With Solution Net Income Approach Net Operating Income

https://i.ytimg.com/vi/ZCCSOT_0sdE/maxresdefault.jpg

Net Operating Income Approach Formula - [desc-14]