Net Operating Income Approach Diagram This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a

Net Income Approach Explained Durand presented the Net Income Approach The theory suggests increasing the firm s value by decreasing the overall cost of capital which is measured in terms of the Weighted Average Cost of Capital This can be done by having a higher proportion of debt which is a cheaper finance source than equity finance Following diagram Leverage debt to total capital 0 20 50 70 and 100 Point of noting Ke EAT S value of equity Practically this approach encompasses all the ground between the Net Income Approach and the Net Operating Income Approach i it may be called Intermediate Approach

Net Operating Income Approach Diagram

Net Operating Income Approach Diagram

https://i.ytimg.com/vi/kZFnooRhtMA/maxresdefault.jpg

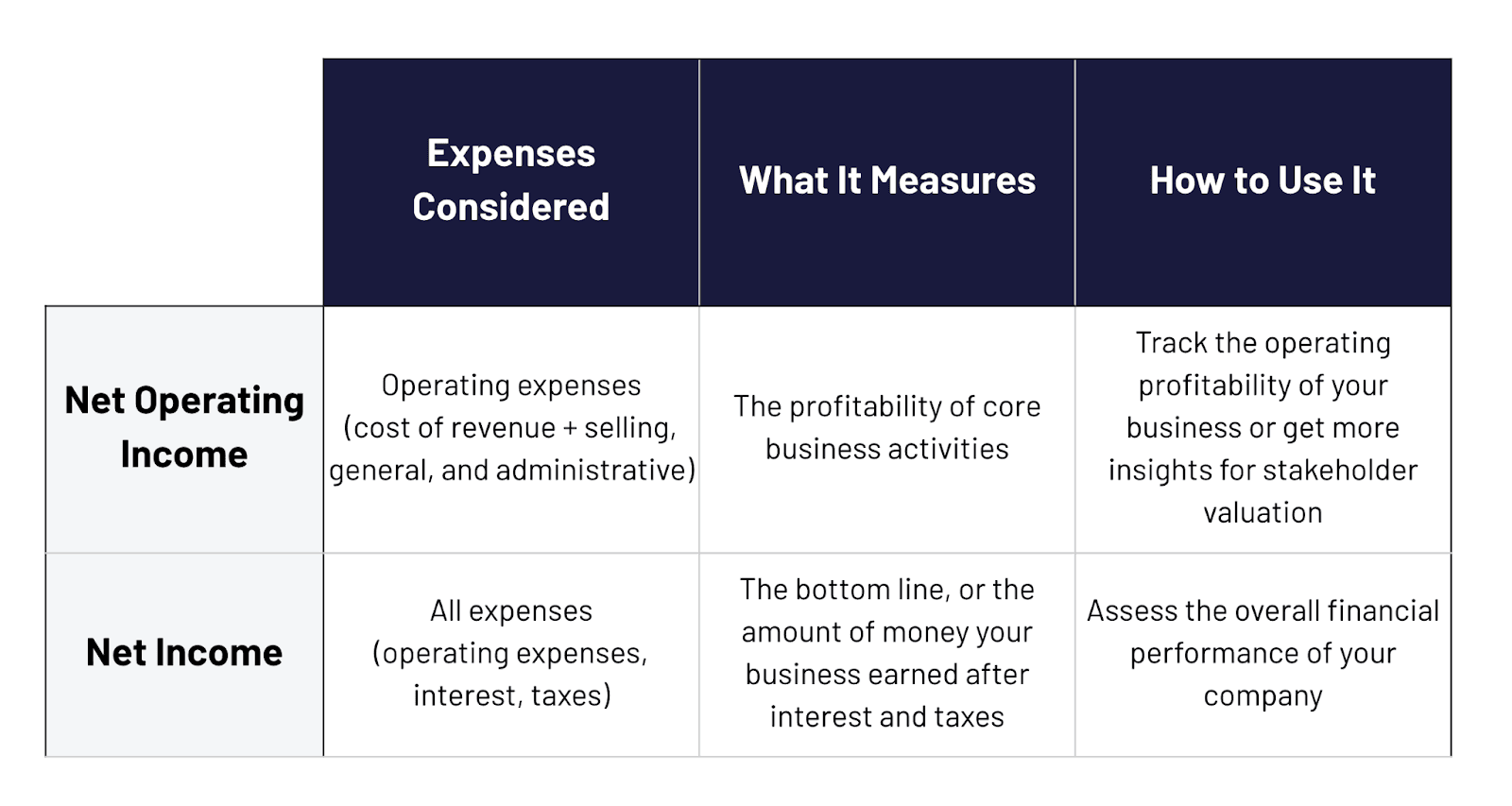

Net Operating Income In SaaS Definition Formula More

https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F08%2FNet-Operating-Income-vs.-Net-Income-Chart.png&w=3840&q=75

What Is Net Operating Income NOI How To Calculate It

https://navi.com/blog/wp-content/uploads/2022/10/net-operating-income.jpg

The net income approach which argues that changing capital structure affects overall cost of capital and firm value 2 The net operating income Modigliani Miller approach which argues that changing capital structure does not affect overall cost of capital or firm value 3 5 Net Operating Income Approach NOI According to this approach capital structure decisions of the firm are irrelevant Any change in the leverage will not lead to any change in the total value of the firm and the market price of shares as the overall cost of capital is independent of the degree of leverage As per NOI Approach

Net income approach and net operating income approach were proposed by David Durand According to NI approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm Thus with an increase The net operating income approach proposed by Durand argues that a company s total market value and overall cost of capital remain constant regardless of its debt equity ratio so every capital structure is optimal 3 The document provides examples to illustrate how to calculate a firm s value and capitalization rates under each approach

More picture related to Net Operating Income Approach Diagram

3 NI Net Income Approach NOI Net Operating Income Approach

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

How To Calculate Net Income Formula Examples

https://www.profitwell.com/hubfs/Net Income-01.jpg#keepProtocol

THEORIES OF CAPITAL STRUCTURE PART 1 NET INCOME APPROACH NET

https://i.ytimg.com/vi/xsnXRb6gIpM/maxresdefault.jpg

According to Net Operating Income Approach which is just opposite to NI approach the overall cost of capital and value of firm are independent of capital structure decision and change in degree of financial leverage does not bring about any change in value of firm and cost of capital The Net approach suggest that the market value of the firm is not affected by the capital structure changes The Net Operating Income NOI approach provides a compelling perspective on the relationship between capital structure and firm value suggesting that the choice between debt and equity financing does not impact the overall value of the firm or its cost of capital By understanding the theoretical underpinnings assumptions and implications

[desc-10] [desc-11]

Net Operating Income How To Interpret Net Operating Income

https://cdn.educba.com/academy/wp-content/uploads/2021/07/Net-Operating-Income.jpg

How Are You Going To Improve Net Operating Income YouTube

https://i.ytimg.com/vi/OB7OVK2dK08/maxresdefault.jpg

Net Operating Income Approach Diagram - 5 Net Operating Income Approach NOI According to this approach capital structure decisions of the firm are irrelevant Any change in the leverage will not lead to any change in the total value of the firm and the market price of shares as the overall cost of capital is independent of the degree of leverage As per NOI Approach