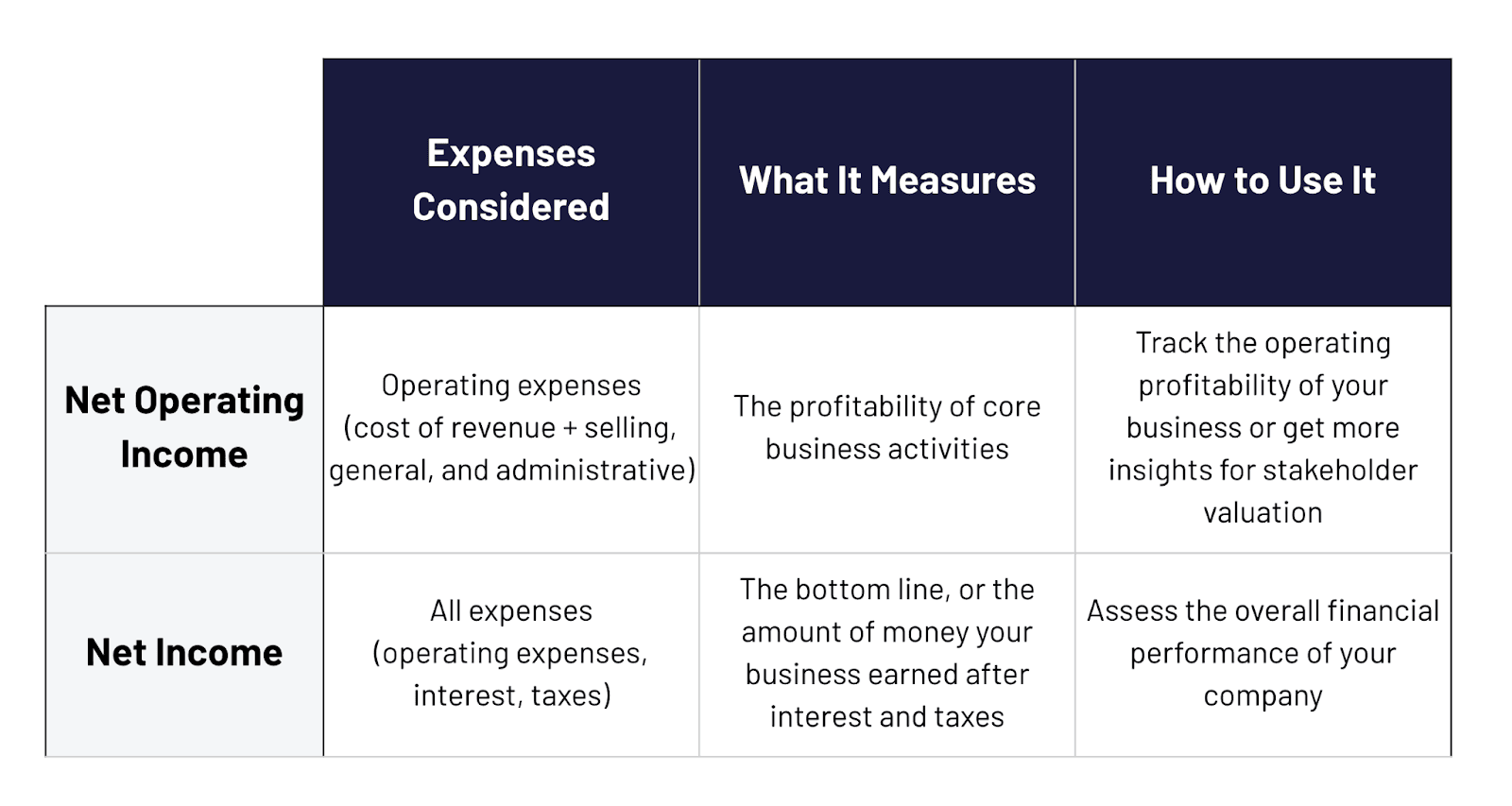

Net Operating Income Approach Assumptions The net income approach assumes that change in the degree of leverage will alter the overall cost of capital WACC and hence the firm s value Whereas the operating income approach assumes that the degree of leverage of the firm is irrelevant to the cost of capital i e the cost of capital is always constant

This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a Net Income Approach to Capital Structure Theory David Durand first suggested this approach in 1952 and he was a proponent of financial leverage He postulated that a change in financial leverage

Net Operating Income Approach Assumptions

Net Operating Income Approach Assumptions

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

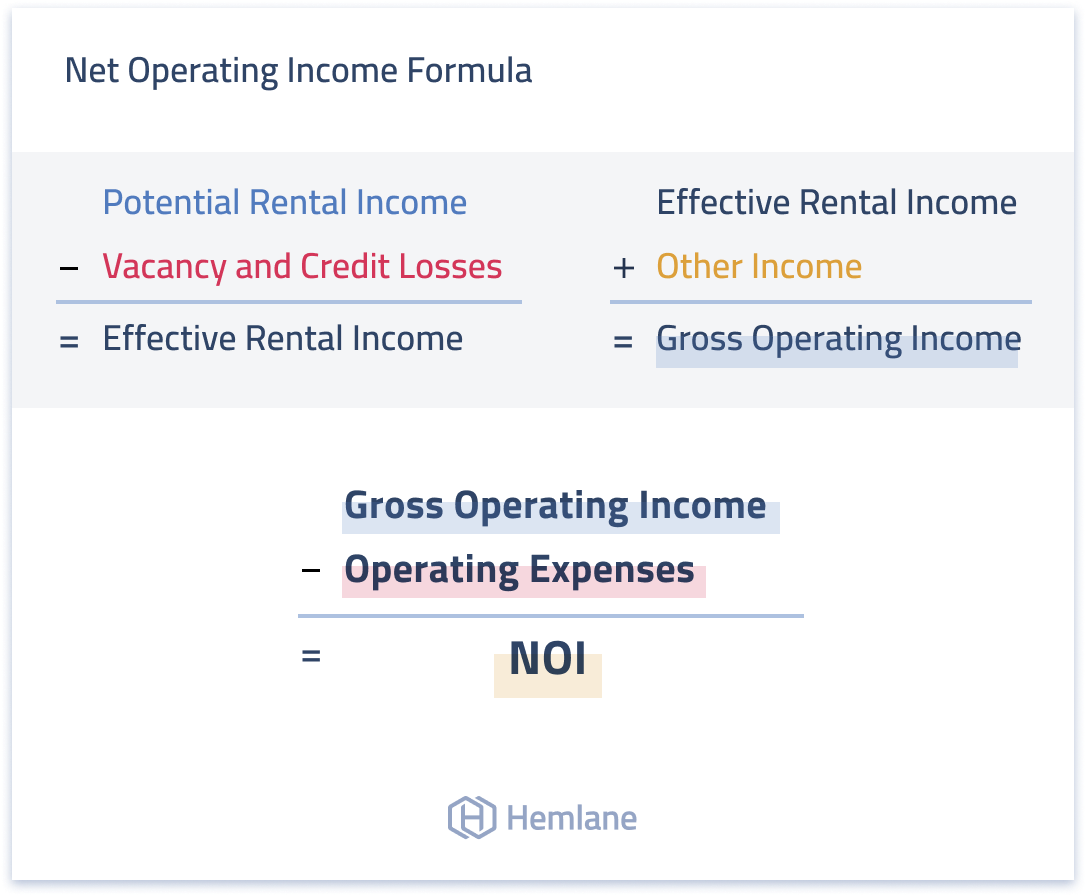

Net Operating Income NOI Net operating income NOI is a calculation used to analyze real estate investments that generate income Net operating income equals all revenue from the property NIBT Net Income Before Taxes NIBT is an accounting figure whether we re talking about an operating business or an investment property It s the total revenue minus the total expenses For real estate revenue is largely rental income Total Rental Income Total Expenses NIBT Because passive income tax rates tend to be high in

Assumptions The net operating income approach works best if the following assumptions are met The weighted average cost of capital is constant and irrelevant to capital structure The valuation of a firm is determined by operating income and WACC The cost of debt k d is constant at any level of financial leverage According to net operating income approach firm value is not affected by change in company or firm s debt components Net operating income approach says that value of a firm depends on operating income and associated business risk Value of firm will not be affected by change in debt components Assumptions are as follows

More picture related to Net Operating Income Approach Assumptions

Net Operating Income Approach Of Capital Structure Assumptions

http://financialmanagementpro.com/wp-content/uploads/2023/02/net-operating-income-main.webp

Analyzing Underwritten Versus Actual Net Operating Incomes NOI

https://www.trepp.com/hubfs/GettyImages-508184291-compressor.jpg

Net Income NI Approach

https://i0.wp.com/theintactone.com/wp-content/uploads/2019/02/topic-8.1-2.jpg?fit=624%2C735&ssl=1

After viewing this video students will learn to complete of Net Operating Income Approach with Assumptions Examples Comparison Conclusion capital structu Join telegram for all resources https t me skillicsCapital structure lecture 1https youtu be EGprl kj6l0Capital lecture Lecture 2https youtu be X0iRd

The Net Operating Income Approach is based on the following assumptions The overall cost of capital Ko of the firm is known and constant It depends upon the business risk which is assumed to be unchanged Capital Structure Theory Net Income Approach The Net Income Approach suggests that the value of the firm can be increased by decreasing the overall cost of capital WACC through a higher debt proportion There are various theories that propagate the ideal capital mix capital structure for a firm Capital structure is the proportion

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

Net Operating Income In SaaS Definition Formula More

https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F08%2FNet-Operating-Income-vs.-Net-Income-Chart.png&w=3840&q=75

Net Operating Income Approach Assumptions - Net Income Approach NI Approach Suggested By David Durand in 1959 The earning of the firm after the payment of all other expenses except interest on debt is called Net Operating Income NOI and the earning available for equity shareholders after the payment of interest is called as Net Income NI