What Is My Net Income After Taxes To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld Information on W 4 Filing Status and Withholdings Pre Tax Deductions Post Tax Deductions State Gross Pay Pay Period Periods Per Year Est Gross Annual Pay Calculate Your estimated NET

What Is My Net Income After Taxes

What Is My Net Income After Taxes

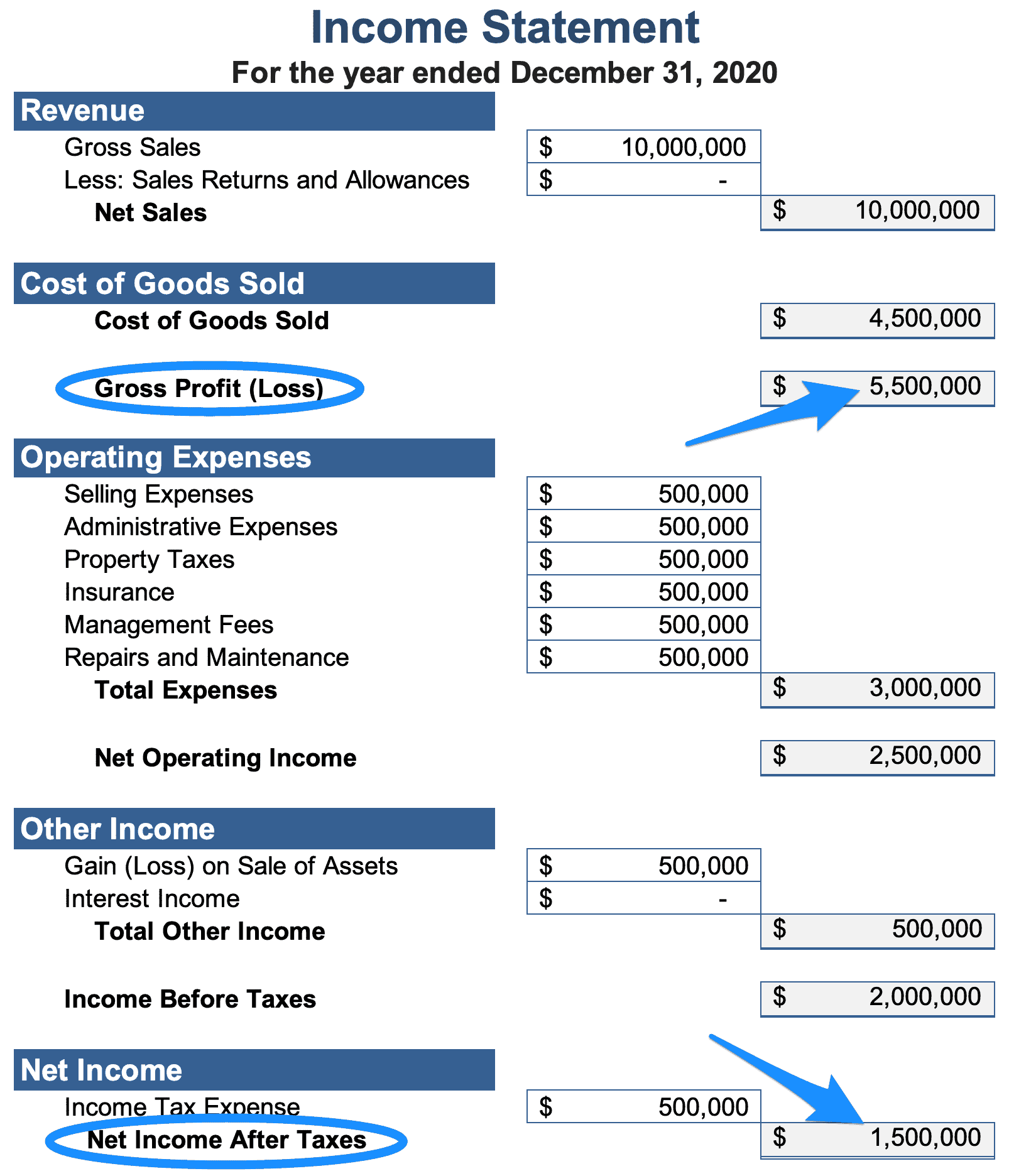

https://www.taxproadvice.com/wp-content/uploads/what-is-net-income-retipster-com.png

How To Determine Income Tax TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa-chegg-com.png

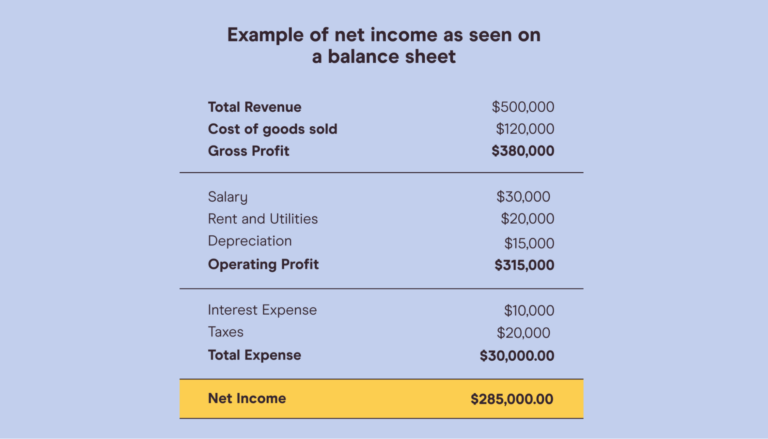

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

Calculate Your Take Home Pay Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 571 Social Security 3 410 Medicare 798 SDI State Disability Insurance 31 20 FLI Family Leave Insurance 281 Total tax

Net income also called take home income is the money that actually goes into your bank account Most people receive their income from either an hourly wage or a salary We ll assume for now The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to What Is My Net Income After Taxes

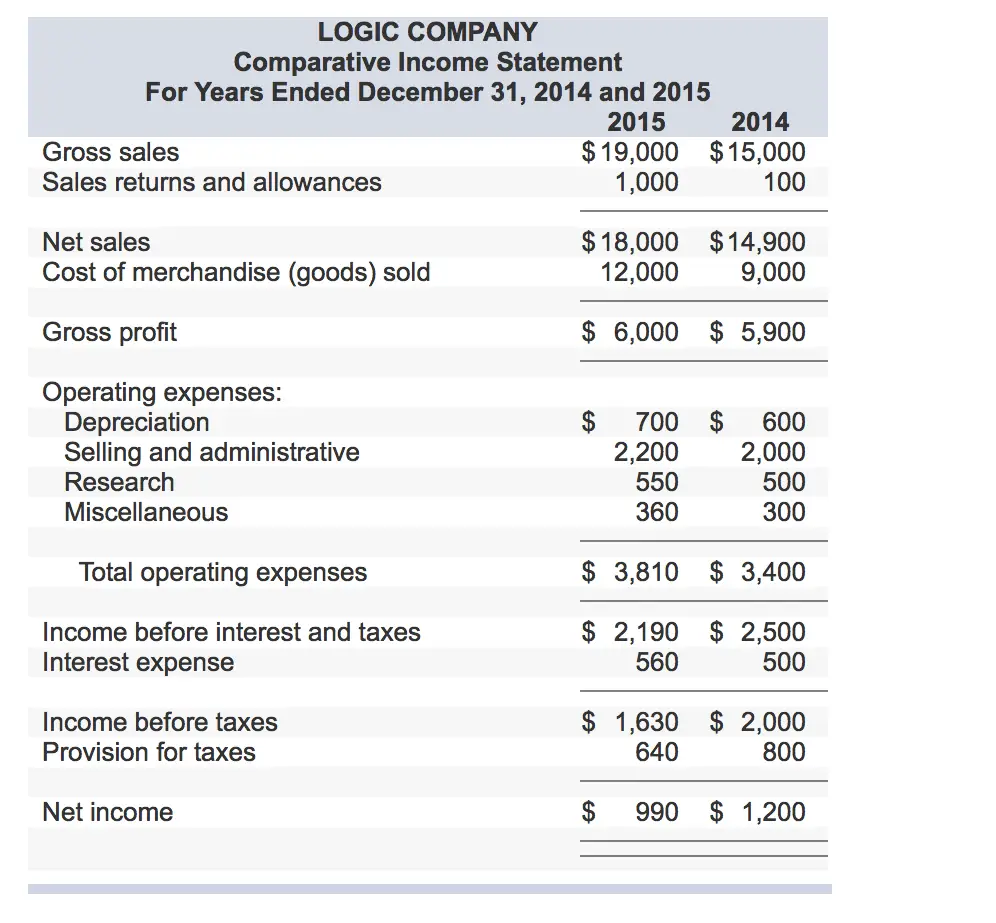

How To Calculate Net Income After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa.png

How To Calculate Net Income After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/net-income-after-taxes-niat.jpeg

62000 A Year Is How Much A Month After Taxes New Update Abettes

https://i.ytimg.com/vi/V9X30VkLRtY/maxresdefault.jpg

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and

What Is Net Income How Do You Calculate It Capital One Net income is the amount of money you take home after taxes and other deductions Learn more about how to calculate it here Your take home pay is the difference between your gross pay and what you get paid after taxes are taken out How much you re actually taxed depends on various factors such as your marital status

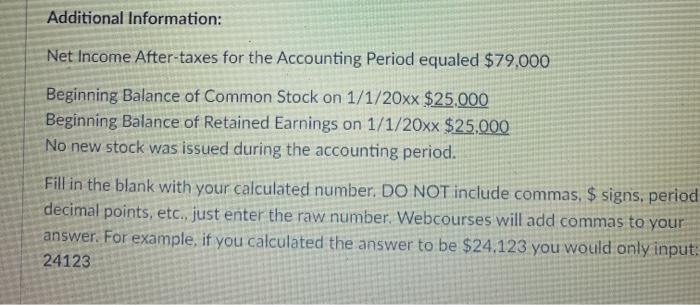

Solved Question Based On The Partial Trial Balance And Chegg

https://media.cheggcdn.com/study/563/5636f2ca-6782-486f-a815-acaf248512dd/image

Net Income After Taxes For A Two earner Married Couple With Two

https://figure.nz/chart/JuJ61POrBwtF98lK-eRv6Fe2E4zRVjwSm/download

What Is My Net Income After Taxes - Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 571 Social Security 3 410 Medicare 798 SDI State Disability Insurance 31 20 FLI Family Leave Insurance 281 Total tax