What Is My Net Salary After Tax Verkko You ll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases This is based on Income Tax National Insurance and Student Loan information from April 2023 More information on tax rates here

Verkko Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the U S Verkko Take home salary is the amount of money an employee receives after all deductions including taxes and other withholdings have been subtracted from their gross salary It s the actual income that an employee can use for their personal expenses Take Home Salary Gross Salary Deductions Income Tax Employees PF Contribution PF

What Is My Net Salary After Tax

What Is My Net Salary After Tax

https://4.bp.blogspot.com/-8n2-LuAs4Zs/TfnxkARsKKI/AAAAAAAABBw/-4f4wGPt2sE/s1600/Salary+After+Tax.jpg

Pay Slips Of Speaker Yakubu Dogara s Salary Released To Public P M News

https://cdn.pmnewsnigeria.com/2017/04/DecemberDogara-e1491953192351.jpg

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Revenu Net Apr s Imp ts NIAT

https://www.investopedia.com/thmb/Q5ir-NHCLUsmqJvAAh9FImZ64CU=/1247x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

Verkko To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Verkko Your net pay is essentially your gross income minus the taxes and other deductions that are withheld from your earnings by your employer Your net pay each pay period is the final

Verkko In 2023 the median gross salary in the Netherlands sits at 40 000 based on the latest macroeconomic report from CPB Centraal Planbureau This equates to an after tax pay of about 2 583 per month as determined by our take home pay calculator If your salary is higher than this amount then you are among the top 50 of all Dutch earners Verkko Some deductions are post tax like Roth 401 k and are deducted after being taxed In our calculators you can add deductions under Benefits and Deductions and select if it s a fixed amount a percentage of the gross pay or a percentage of the net pay For hourly calculators you can also select a fixed amount per hour

More picture related to What Is My Net Salary After Tax

C Program To Calculate Net Salary Of An Employee Also Calculate Net

https://1.bp.blogspot.com/-m6Xxjs5hR5I/YIvxYSBTqRI/AAAAAAAABaQ/BP480NTYRbAqHg6wMksMWc3cEQTeFBTxwCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210430-131423%257E2.png

What Is Meant By Basic Salary

https://decoalert.com/wp-content/uploads/2021/06/What-is-meant-by-basic-salary.jpg

What s The Average Cost Of Living In Japan All About Japan

https://imgcp.aacdn.jp/img-a/1200/auto/global-aaj-front/article/2017/12/5a2e54bd1caa0_5a2e526971bc7_293036927.jpg

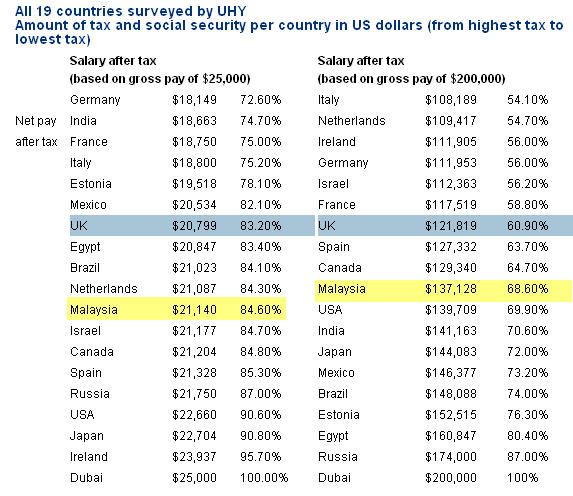

Verkko Calculate Your Salary After Tax Blog Explore the financial landscape of countries around the world with our in depth blog posts on personal finance salaries taxes and the cost of living Get the knowledge you need to make smart financial decisions Check Our Latest Articles Verkko The formula for after tax income is quite simple as given below To calculate the after tax income simply subtract total taxes from the gross income For example let s assume an individual makes an annual salary of 50 000 and is taxed at a rate of 12 It would result in taxes of 6 000 per year Therefore this individual s after tax

Verkko 29 kes 228 k 2023 nbsp 0183 32 Your gross income is the total amount of money you receive annually It is the sum of your monthly gross pay Your gross annual income will always be larger than your net income because it does not include any deductions Some deductions are mandatory and others are voluntary choices you have made about savings or benefits Verkko Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more

PRC Individual Income Tax Implementation Rules Related Circulars

https://www.forvis.com/sites/default/files/inline-images/new-tax-rates-on-comprehensive-income.JPG

Im pertin ncias ARTIGO DEFUNTO A Pobreza Das Crian as Dos Pa ses

https://3.bp.blogspot.com/-HXE46xo7srY/WULNHLpyLFI/AAAAAAAAH9o/JZS-scmMndAPPgt3lQ49olOZmcNCCGAMACK4BGAYYCw/s1600/AverageMonthlyNetSalary.jpg

What Is My Net Salary After Tax - Verkko There are two main components that are taken off your gross pay income tax and national insurance contributions made by your employer In your case when you earn 163 49 000 yearly Income tax breakdown You pay no income tax on first 163 12 570 that you make You pay 163 7 286 at basic income tax rate 20 on the next 163 36 430