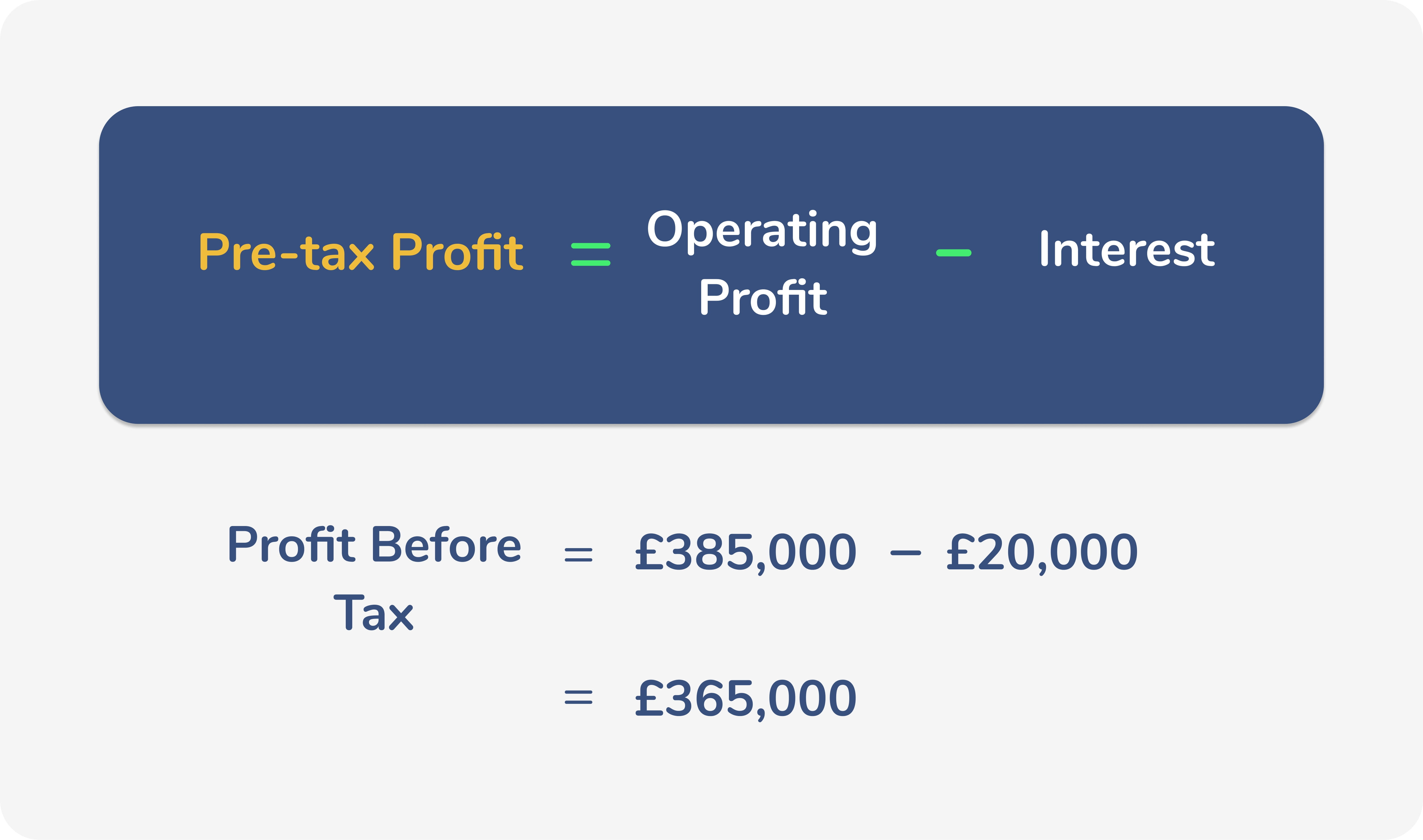

What Is The Formula For Net Profit After Tax Thus if we deduct Non operating expenses and operating expenses from revenue we would profit before tax PBT 500 150 68 282 Now calculate the Taxable amount by using PBT and the given tax rate Taxable Amount Tax 30 on PBT 30 of 282 84 6 Therefore as per formula

Net Income After Taxes NIAT Net income after taxes NIAT is an accounting term most often found in a company s annual report that is meant to show the company s definitive bottom line for Net Income is a measure of accounting profitability or the residual after tax profit of a company once all operating and non operating costs are deducted The net income or net profit is recorded at the bottom of the income statement and represents the after tax profit remaining upon deducting all costs and expenses

What Is The Formula For Net Profit After Tax

What Is The Formula For Net Profit After Tax

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

.png)

How To Calculate Gross Profit Formula And Examples Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63646b209859532b69040e08_Net Profit Calculation (1).png

Gross Profit Vs Net Profit Definition Formula Key Differences

https://learn.financestrategists.com/wp-content/uploads/Net_Profit_Formula-1-1024x642.png

Net income after tax NIAT is an entity s profits after deducting all expenses and taxes It is also referred to as bottom line profitability NIAT is frequently used in ratio analysis to identify the company s profitability Net income after tax is either reinvested back into the company paid out in dividends or is used to acquire Net profit is the amount of money that a company has after all its expenses are paid You can think of net profit like your paycheck It s the money left after all taxes and benefits are subtracted Found on the last line of the income statement net profit impacts the take home profit of a company Net profit is also referred to as

After tax profit margin is a financial performance ratio calculated by dividing net profit after taxes by revenue A company s after tax profit margin is important because it tells investors the Local taxes as discussed above can also be included These taxes are further subtracted from the net income to get the net income after tax How to Calculate Net Income After Tax The formula for calculating net income after tax is After Tax Income Pre Tax Income Taxes Let s say the net income was 100 000 We will also assume the

More picture related to What Is The Formula For Net Profit After Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

Net Income Formulas What Is Net Income Formula Examples

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/net-income-formula-1623236027.png

Profit Margin The 4 Types Formula And Definition Wise

https://wise.com/imaginary/251e126aeedb4b6609f03c68975428c2.jpg

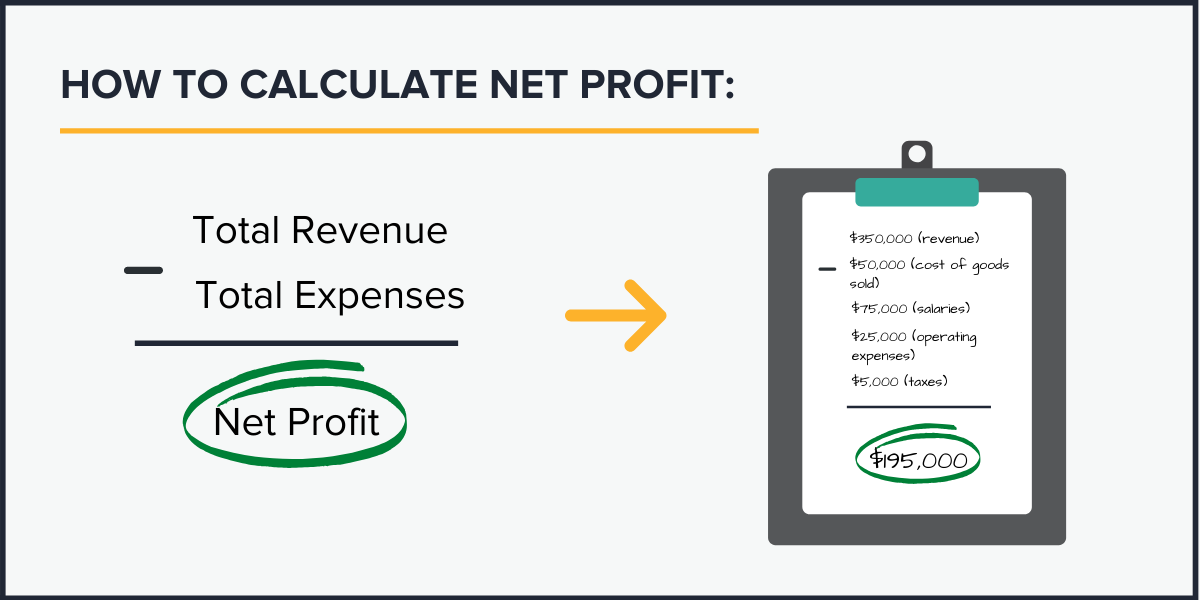

The total expenses were 25 000 They also sold an old van for 3000 while spending 2000 on settling a lawsuit Following our net profit formula we have total expenses equal to 25000 2000 27 000 Total revenue 60000 3000 63 000 Hence the net profit is 63 000 27 000 36 000 Net income after taxes is found on the last line of the income statement which is why it s often referred to as the bottom line Let s look at a hypothetical income statement for Company XYZ Total Revenue 100 000 Interest Expense 10 000 Taxes 10 000 NIAT 30 000 By using the formula we can see that NIAT 100 000 20 000

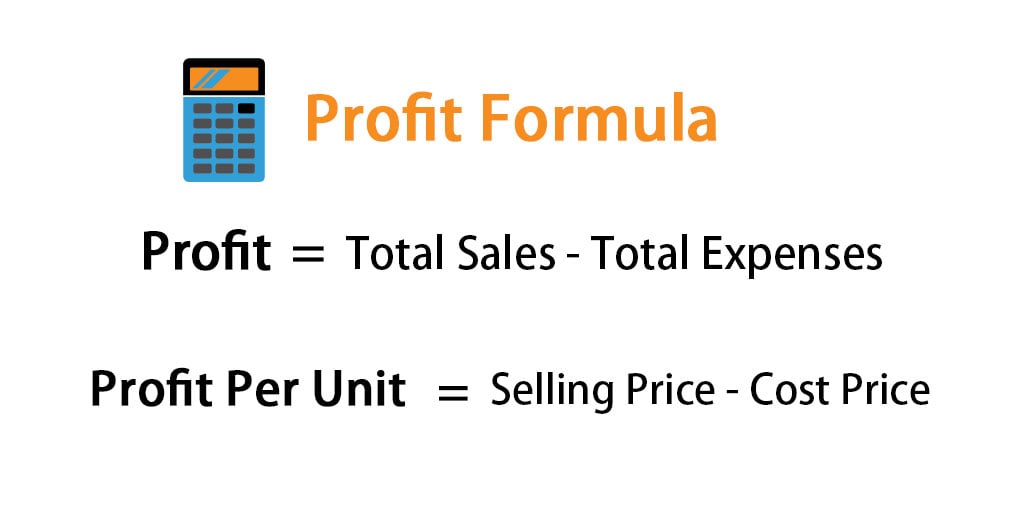

Net Income Formula If you need to calculate net income for a business use the following formula To calculate an individual s net income use the following formula based on a recent pay stub Since net income isn t a tax term you won t find it on your Form 1040 Instead the Individual Income Tax Return determines an individual s The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is

How To Calculate Net Profit In Business Haiper

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Profit-Formula.jpg

Mengetahui Cara Menghitung Rumus Profit Margin Hubster Blog

https://assets.website-files.com/6277e4df50fd58d2359b4f00/62a898dfb3413e361abbdcab_62559fc1bdaefc8ccad461f7_profit%2520margin%2520bersih.jpeg

What Is The Formula For Net Profit After Tax - Taxes This includes federal state and local income taxes as well as other taxes such as sales tax Once you have calculated the total expenses you can subtract them from the company s revenue to determine its net profit Let s say a company has the following financial information Revenue 100 000 Cost of Goods Sold COGS 40 000