What Is My Net Income Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

So if you elect to save 10 of your income in your company s 401 k plan 10 of your pay will come out of each paycheck If you increase your contributions your paychecks will get smaller However making pre tax contributions will also decrease the amount of your pay that is subject to income tax The money also grows tax free so that you Calculating your net income might look like this 3 350 272 51 102 48 46 61 193 31 125 2 610 09 Your net income which is sometimes called take home pay is 2 610 09 Knowing your take home pay each pay period can help you create a budget for living expenses and any financial goals you may have

What Is My Net Income

What Is My Net Income

https://moneybliss.org/wp-content/uploads/2022/11/annual-net-income.jpg

What Is The Difference Between Net Income And Free Cash Flow Richard

https://richardjwright.com/wp-content/uploads/2022/03/Net-income-vs-FCF.png

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

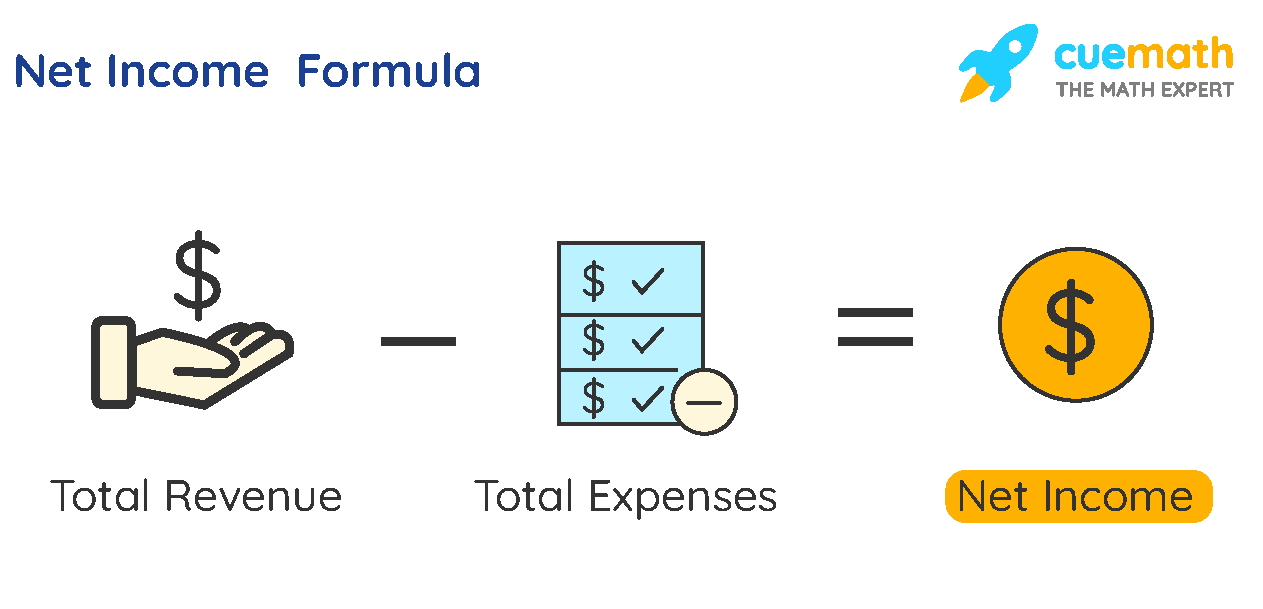

Net income is the money after taxation To know more about calculating net income check out our gross to net calculator There are two ways to determine your yearly net income Set the net hourly rate in the net salary section or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field Net income is a measure of how much money a person or business makes after accounting for all costs Here s everything you need to know Net income is a measure of how much money a person or

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Salary Calculators Europe Belgium Denmark France Net Income 4 715 56 585 2 176 1 088 217 63 27 20 22 tax due Your Take Home Pay in Other States To calculate an individual s net income use the following formula based on a recent pay stub Types of Net Income and Examples Net income shows an individual s or company s financial position When examining a company s or your own finances you can use net income in a variety of ways Two common types of net income examples

More picture related to What Is My Net Income

Net Income Formulas What Is Net Income Formula Examples En

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/net-income-formula-1623236027.png

How To Find Net Income Calculations For Business

https://www.patriotsoftware.com/wp-content/uploads/2019/12/net-income-visual.jpg

What Is Net Income Definition How To Calculate It

https://www.bankrate.com/2021/06/29183324/what-is-net-income.jpeg

This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and deductions Calculate your net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator This usually happens because your income is lower than the tax threshold also known as the standard deduction For 2024 you need to make less than

[desc-10] [desc-11]

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Cogs Margin Haiper

https://www.investopedia.com/thmb/zEEqAuvgWlum5qEaY9GZkQGR4t0=/3884x3884/smart/filters:no_upscale()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

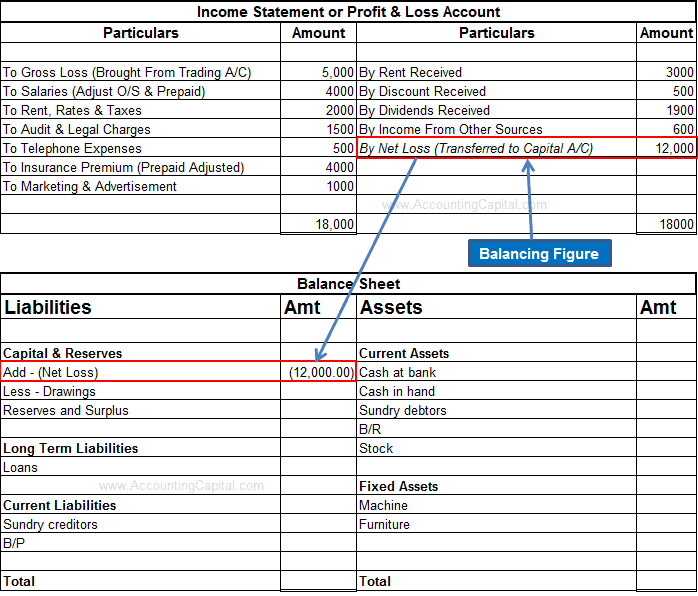

How To Calculate Net Income And Loss Haiper

https://2.bp.blogspot.com/-OFAsGcbv6RE/XCRmFAchd_I/AAAAAAAAEUc/nGJ4CNrMboQ1VimHa7nLFPlEGhsObJvhQCLcBGAs/s1600/Net-Loss-in-Income-Statement-and-Balance-Sheet.png

What Is My Net Income - Net income is the money after taxation To know more about calculating net income check out our gross to net calculator There are two ways to determine your yearly net income Set the net hourly rate in the net salary section or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field