Net Operating Income Approach Definition The income approach is a real estate appraisal method that allows investors to estimate the value of a property based on the income it generates a property with a net operating income NOI

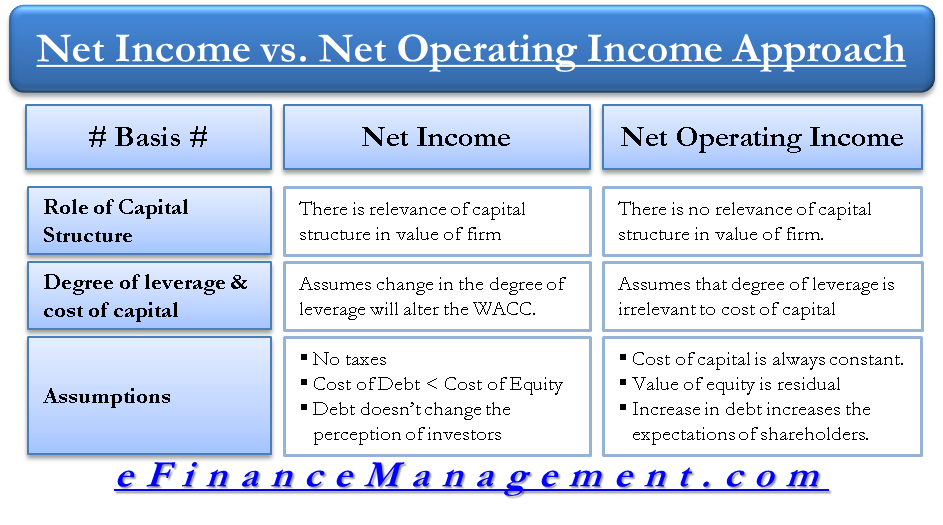

NOI vs NIBT Net Income Before Taxes It s critical to understand just how different these two figures can be even for the exact same property NIBT Net Income Before Taxes NIBT is an accounting figure whether we re talking about an operating business or an investment property It s the total revenue minus the total expenses Also famous as the traditional approach Net Operating Income Approach suggests that the change in debt of the firm company or the change in leverage fails to affect the total value of the firm company As per this approach the WACC and the total value of a company are independent of the company s capital structure decision or financial

Net Operating Income Approach Definition

Net Operating Income Approach Definition

https://navi.com/blog/wp-content/uploads/2022/10/net-operating-income.jpg

3 NI Net Income Approach NOI Net Operating Income Approach

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

How To Calculate Net Income Formula Examples

https://www.profitwell.com/hubfs/Net Income-01.jpg#keepProtocol

Net Operating Income As shown in the net operating income formula above net operating income is the final result which is simply effective gross income minus operating expenses Although these are the high level line items used to calculate NOI the format of a real estate proforma can vary widely depending on the property type intended Define NOI in Simple Terms Net Operating Income or NOI is a valuation method used by real estate owners to determine the value of their income generating properties NOI is calculated by taking the total revenue of a property and subtracting all reasonably necessary operating expenses It is a before tax figure showing up on the property s income and cash flow statements and it excludes

The higher the company s net operating income the higher the chances of the company surviving in the future and paying debts and returns to the lenders and investors respectively The increasing trend in this number of operating income indicates that there is more scope for the company to grow in the future and vice versa Advantages of Net Operating Income Net Operating Income NOI offers several advantages in real estate and business analysis Here are some of the key benefits Focus on Core Operations NOI concentrates solely on the income generating activities and operational performance of a property or business

More picture related to Net Operating Income Approach Definition

THEORIES OF CAPITAL STRUCTURE PART 1 NET INCOME APPROACH NET

https://i.ytimg.com/vi/xsnXRb6gIpM/maxresdefault.jpg

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Net Operating Income How To Interpret Net Operating Income

https://cdn.educba.com/academy/wp-content/uploads/2021/07/Net-Operating-Income.jpg

What Is Net Operating Income NOI Net operating income NOI is a calculation used to analyze the profitability of real estate investments It considers the overall revenue after deducting necessary operating expenses NOI doesn t include taxes interest depreciation amortization or capital expenditures So it won t provide all the information about an investment s financial outlook Tip If the calculation of NOI results in a negative number this is known as a net operating loss rather than net operating income So if a property has gross income of 20 000 with 21 000 in

[desc-10] [desc-11]

Net Income Appraoch And Net Operating Income Approach PDF Equity

https://imgv2-2-f.scribdassets.com/img/document/680824103/original/eafa3a4525/1704004918?v=1

Difference Between Net Income Vs Net Operating Income Approach

https://efinancemanagement.com/wp-content/uploads/2014/07/Net-income-approach-NI-and-Net-Operating-income-approach-NOI.png?x62448

Net Operating Income Approach Definition - Advantages of Net Operating Income Net Operating Income NOI offers several advantages in real estate and business analysis Here are some of the key benefits Focus on Core Operations NOI concentrates solely on the income generating activities and operational performance of a property or business