Net Operating Income Theory Formula Net Operating Income Approach NOI Approach This approach was put forth by Durand and totally differs from the Net Income Approach Also famous as the traditional approach Net Operating Income Approach suggests that the change in debt of the firm company or the change in leverage fails to affect the total value of the firm company

Net operating income NOI shows the profitability of income generating real estate investments NOI includes all revenue from the property minus necessary operating expenses Net Operating Income NOI is a crucial financial metric used in the field of real estate and business analysis Also Read Net Income Formula Calculation and Example Capital Structure Theory Modigliani and Miller MM Approach Recent Posts The Insolvency and Bankruptcy Code of India 2016 IBC 16 Financial Challenges Faced

Net Operating Income Theory Formula

Net Operating Income Theory Formula

https://i.ytimg.com/vi/kZFnooRhtMA/maxresdefault.jpg

1 12 Net Operating Income Theory Capital Structure Theories B Com

https://i.ytimg.com/vi/gOM0v4ok-0A/maxresdefault.jpg

Degree Of Operating Leverage DOL And Degree Of Financial Leverage

https://i.ytimg.com/vi/ZNJF7WEaY4k/maxresdefault.jpg

NOI vs NIBT Net Income Before Taxes It s critical to understand just how different these two figures can be even for the exact same property NIBT Net Income Before Taxes NIBT is an accounting figure whether we re talking about an operating business or an investment property It s the total revenue minus the total expenses Define NOI in Simple Terms Net Operating Income or NOI is a valuation method used by real estate owners to determine the value of their income generating properties NOI is calculated by taking the total revenue of a property and subtracting all reasonably necessary operating expenses It is a before tax figure showing up on the property s income and cash flow statements and it excludes

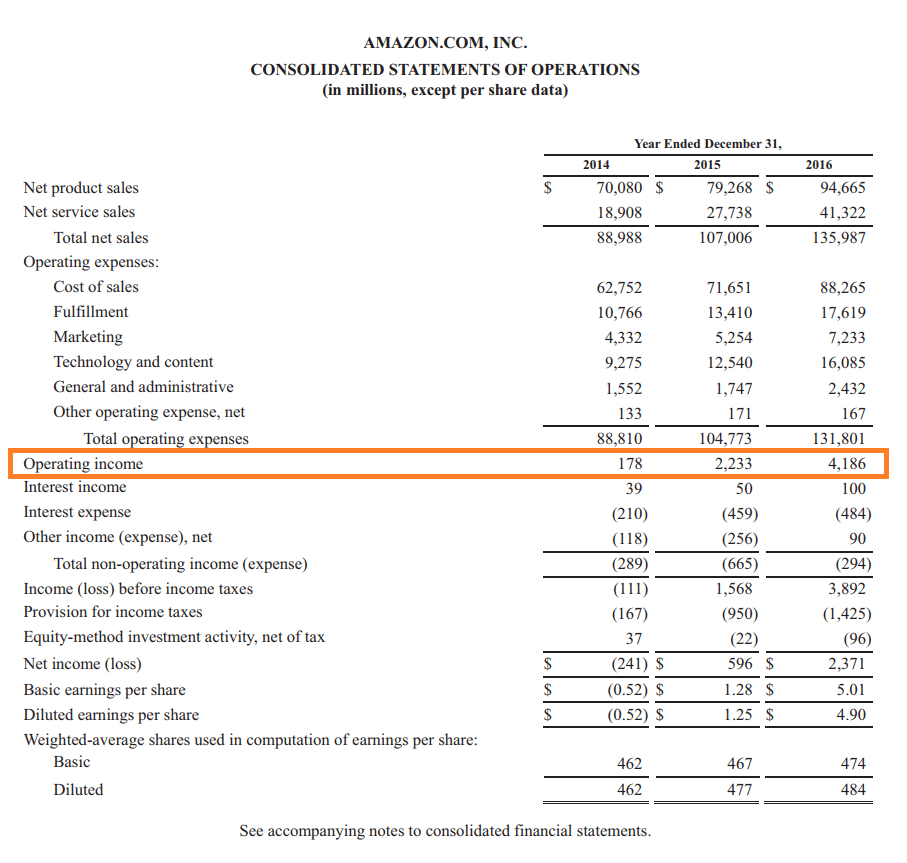

Net Operating Income Formula Total Net Sales Total Cost of Sales Operating Expenses 394 328M 223 546M 51 345M 119 437M Therefore Apple Inc generated a net operating income of 119 437M in 2022 Example 2 Consider UrbanEstates a real estate company that builds luxury homes in urban areas The company wants to Net Income Approach The net income approach suggested by David Durand brings forth the relevance of capital structure in calculating the value of a firm The WACC Weighted Average Cost of Capital which is the weighted average of debt and equity will decide the firm s value The following formula can represent the net income approach

More picture related to Net Operating Income Theory Formula

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

THEORIES OF CAPITAL STRUCTURE PART 1 NET INCOME APPROACH NET

https://i.ytimg.com/vi/xsnXRb6gIpM/maxresdefault.jpg

Archives For Rule34 paheal Ghostarchive

https://ghostarchive.org/img2/AU1La.png

Explain Net operating income theory of capital structure Capital structure of a company depends on mix or ratio of debt and equity in their mode of their financing Depending on what company prefer some may have more debt or more equity in financing their asset but final goal is to maximize their market value and their profits Net operating income NOI The strength of NOI is that it combines all the essential income and expenditures for each property into a single computation The formula for net operating income is as follows Net Operating Income Gross Operating Income Other Income Operating Expenses Net Operating Income Real Estate revenue Operating expense

[desc-10] [desc-11]

Home Goods Salary Walsh Helen

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

Operating Income Overview Formula Sample Calculation

https://cdn.corporatefinanceinstitute.com/assets/operating-income.png

Net Operating Income Theory Formula - Define NOI in Simple Terms Net Operating Income or NOI is a valuation method used by real estate owners to determine the value of their income generating properties NOI is calculated by taking the total revenue of a property and subtracting all reasonably necessary operating expenses It is a before tax figure showing up on the property s income and cash flow statements and it excludes