Net Operating Income Approach Formula In Financial Management Net Income Approach The net income approach suggested by David Durand brings forth the relevance of capital structure in calculating the value of a firm The WACC Weighted Average Cost of Capital which is the weighted average of debt and equity will decide the firm s value The following formula can represent the net income approach

Net income approach and net operating income approach were proposed by David Durand The market value of the firm is determined by the following formula Management 304 Marketing Management 305 Company Accounts 306 Company Law 360 Degree Appraisals 401 Consumer Behavior 402 Financial Management 403 Production Management 404 Sales This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a

Net Operating Income Approach Formula In Financial Management

Net Operating Income Approach Formula In Financial Management

https://i.ytimg.com/vi/WvnonMCUGtA/maxresdefault.jpg

Net Income Approach Capital Structure With Assumptions Examples

https://i.ytimg.com/vi/kZFnooRhtMA/maxresdefault.jpg

Net Operating Income Approach Problems Explained In English Tamil

https://i.ytimg.com/vi/dSkvi3nKdzg/maxresdefault.jpg

The parties related to the business like creditors investors and the management use the net operating income calculator measure to analyze and evaluate the profitability and efficiency of operations prospects and overall health of the business The higher the company s net operating income the higher the chances of the company surviving in Capital Structure Theories net income net operating income traditional M M deal the question if change in capital structure influence value of a firm In financial management it is an important term and it is a crucial decision in business vs Net Operating Income NOI Approach Financial Structure Meaning Importance and

Net Operating Income Formula Total Net Sales Total Cost of Sales Operating Expenses 394 328M 223 546M 51 345M 119 437M Therefore Apple Inc generated a net operating income of 119 437M in 2022 The Net Operating Income NOI approach is a financial theory that argues that a company s value and its cost of capital are not influenced by its capital structure This means that whether a firm finances its operations through debt equity or a mix of both its overall market value and cost of capital will remain the same

More picture related to Net Operating Income Approach Formula In Financial Management

Net Operating Income Approach Introduction Formulas Format

https://i.ytimg.com/vi/NYQAnknsTvs/maxresdefault.jpg

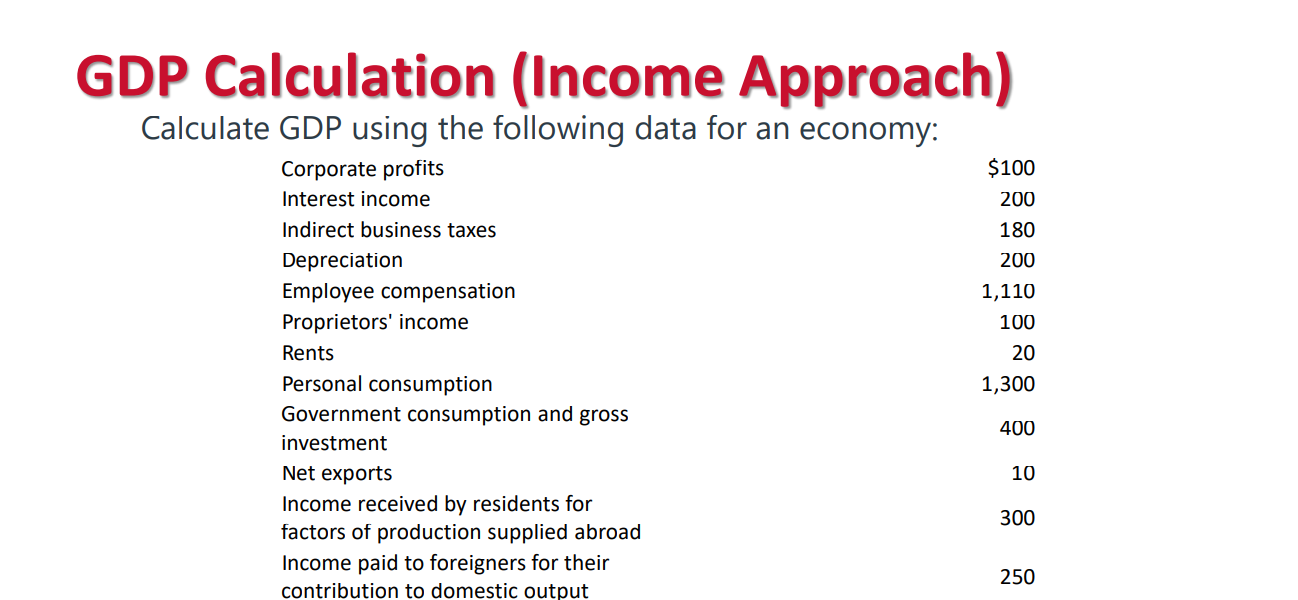

Measuring GDP Using The Income Approach And The Expenditure Approach

https://i.ytimg.com/vi/ZdGnhusKnRU/maxresdefault.jpg

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Net operating income approach says that value of a firm depends on operating income and associated business risk Value of firm will not be affected by change in debt components Formulas Market value of a firm V is ratio of earnings before income taxes EBIT and weighted average cost of capital WACC then financial leverage also Net Income Approach NI Approach Suggested By David Durand in 1959 The earning of the firm after the payment of all other expenses except interest on debt is called Net Operating Income NOI and the earning available for equity shareholders after the payment of interest is called as Net Income NI

[desc-10] [desc-11]

Net Operating Income Approach Theories Of Capital Structure YouTube

https://i.ytimg.com/vi/WsZq-X0VUhc/maxresdefault.jpg

GDP Formula Calculation Of GDP Using Formulas 50 OFF

https://media.cheggcdn.com/media/11d/11d9fba3-c72e-40ab-a2d4-441fec00951d/phpP09Obk

Net Operating Income Approach Formula In Financial Management - [desc-13]