How To Work Out Tax On Net Income Federal income tax withholding Employers withhold federal income tax from their workers pay based on current tax rates and Form W 4 Employee Withholding Certificates When completing this form employees typically need to provide their filing status and note if they are claiming any dependents work multiple jobs or have a spouse who also

Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage Like federal tax liability there are a few substeps to work out your state tax liability Step 3 1 State taxable income You can use the federal AGI you calculated earlier The formula is Local income tax rate Local income tax liability Step 5 Your net pay

How To Work Out Tax On Net Income

How To Work Out Tax On Net Income

https://i.pinimg.com/originals/ca/75/43/ca7543a9a524c85eb63ae3beb83877fc.png

How To Work Out Tax On Directors Loans How To Avoid Paying 32 5 Tax

https://aidhangroupholdings.com/wp-content/uploads/2021/01/3.-tax-on-Director-Loan--1024x536.png

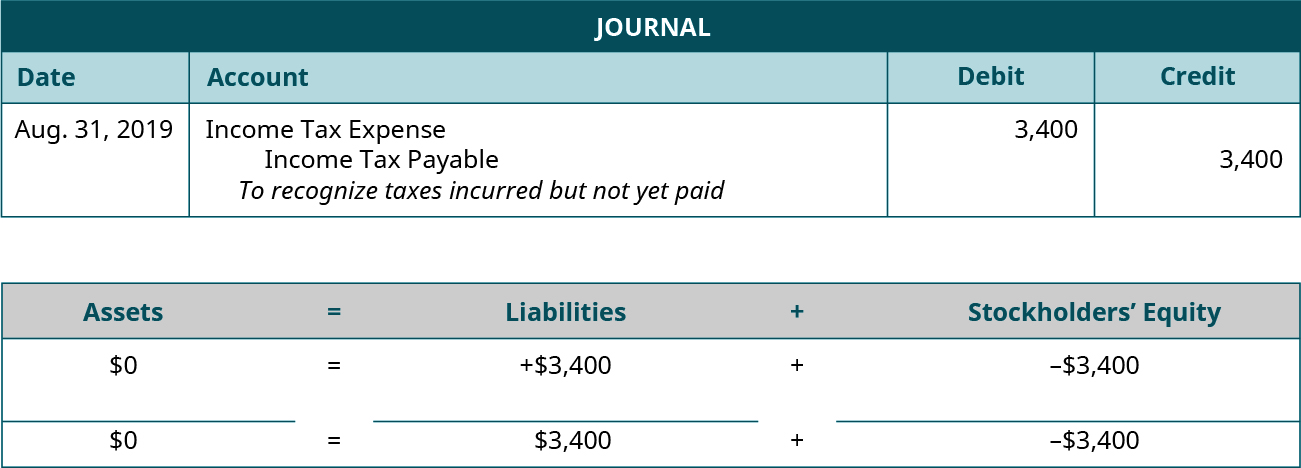

Casual Journal Entry For Income Tax Payable Financial Statement

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/1.18.20.jpeg

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Salary Calculators Net Income 4 715 56 585 2 176 1 088 217 63 27 20 22 tax Federal Income Tax is collected by the federal government and must be paid no matter where you live in the It s important to know what the base is for the tax For example when talking about gross income vs net income the tax is based on the gross value If we earn 100 and the tax rate is 20 we d earn 80 net The situation is different when we re dealing with VAT and sales tax Then the tax amount is based on the net price

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to How To Work Out Tax On Net Income

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

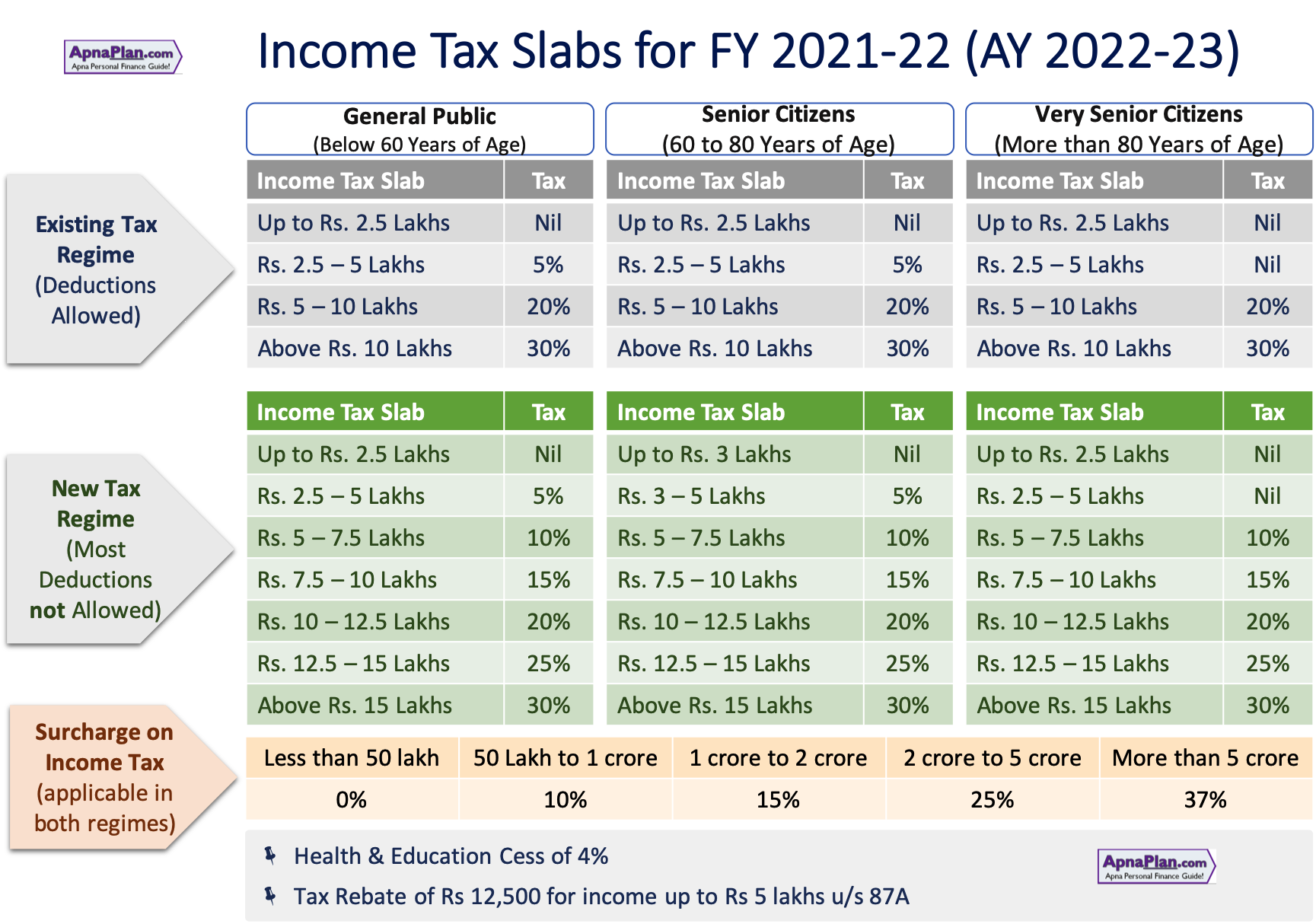

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23.png

Tax On A Second Job How Much Do I Pay

https://www.simplybusiness.co.uk/static/07e56b63aa727960afe96af4fd4ab39d/b6518/guide-to-second-job-tax.jpg

Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800 After taking 12 tax from that 13 800 we are left with 1 656 of tax Foreign Tax Credit This is a non refundable credit that reduces the double tax burden for taxpayers earning income outside the U S Children Child Tax Credit It is possible to claim up to 2 000 per child 1 400 of which is refundable The child tax credit starts to phase out once the income reaches 200 000 400 000 for joint filers

[desc-10] [desc-11]

The Power Of Your Subconsious Mind

http://www.clone2go.com/images/convert-wma-to-mp3.jpg

Solved Calculations Need To Be Done Based On This Scenario Shelby

https://www.coursehero.com/qa/attachment/39846814/

How To Work Out Tax On Net Income - [desc-12]