How To Work Out Tax Payable On Taxable Income Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

Keep in mind your income is part of what determines how much you owe in federal and state income taxes As you prepare your tax return it helps to understand how the tax law views your income and how to determine taxable income How to determine taxable income Step by step Step 1 Determine Your Filing Status First determine your filing This form also includes any applicable deductions to your taxable income such as income tax Social Security Medicare and 401 k contributions among others

How To Work Out Tax Payable On Taxable Income

How To Work Out Tax Payable On Taxable Income

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

Solved C Calculation Questions 1 What Is The Federal Tax Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/107/107b05ab-878a-4761-8cb2-e1a829f4f029/image

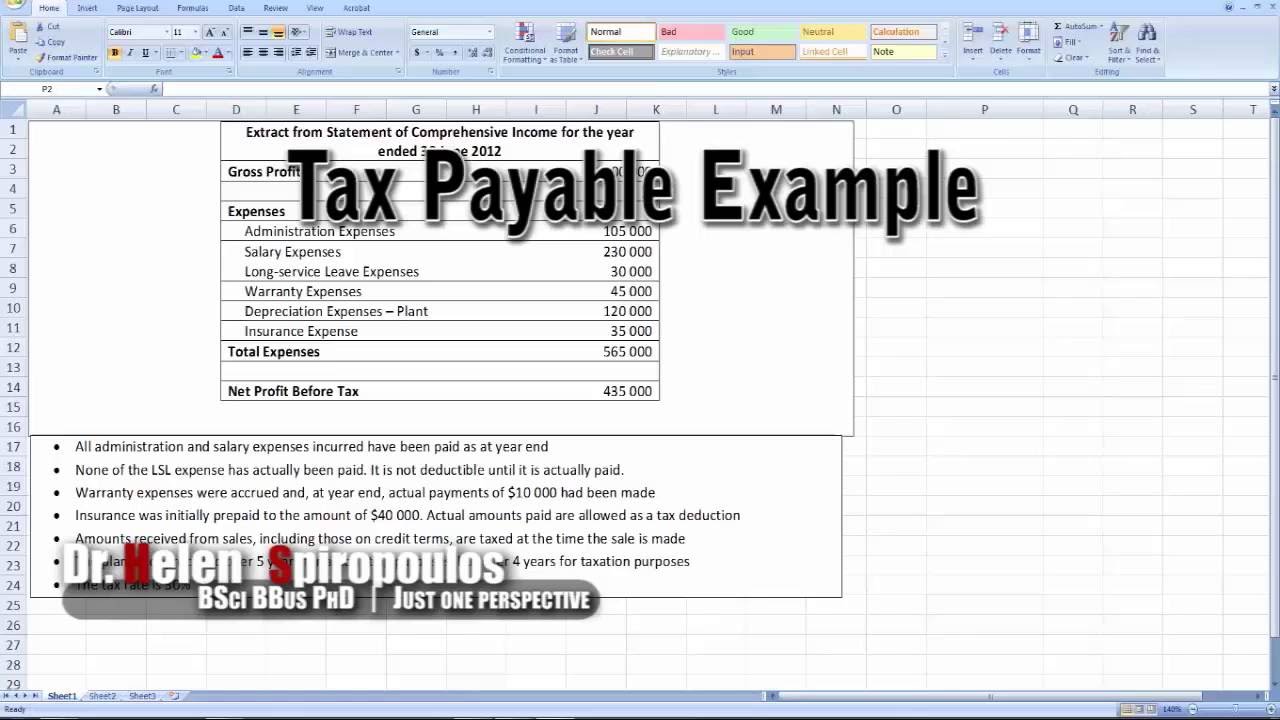

Tax Example Part 1 Tax Payable YouTube

https://i.ytimg.com/vi/ya_uCYKigJ4/maxresdefault.jpg

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck This is tax withholding See how your withholding affects your refund take home pay or tax due How it works Use this tool to Estimate your federal income tax withholding New job or other paid work Major income change Marriage Child This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800

Taxes can really put a dent in your paycheck But with a Savings or CD account you can let your money work for you Check out these deals below most people pay taxes throughout the year in the form of payroll taxes that are if you calculate that you have tax liability of 1 000 based on your taxable income and your tax bracket and Step 2 2 Federal taxable income Now you need to figure out your federal taxable income The formula is Gross income adjusted Federal standard itemized deductions Federal taxable income You can either take the standard deduction amount or itemize your deductions

More picture related to How To Work Out Tax Payable On Taxable Income

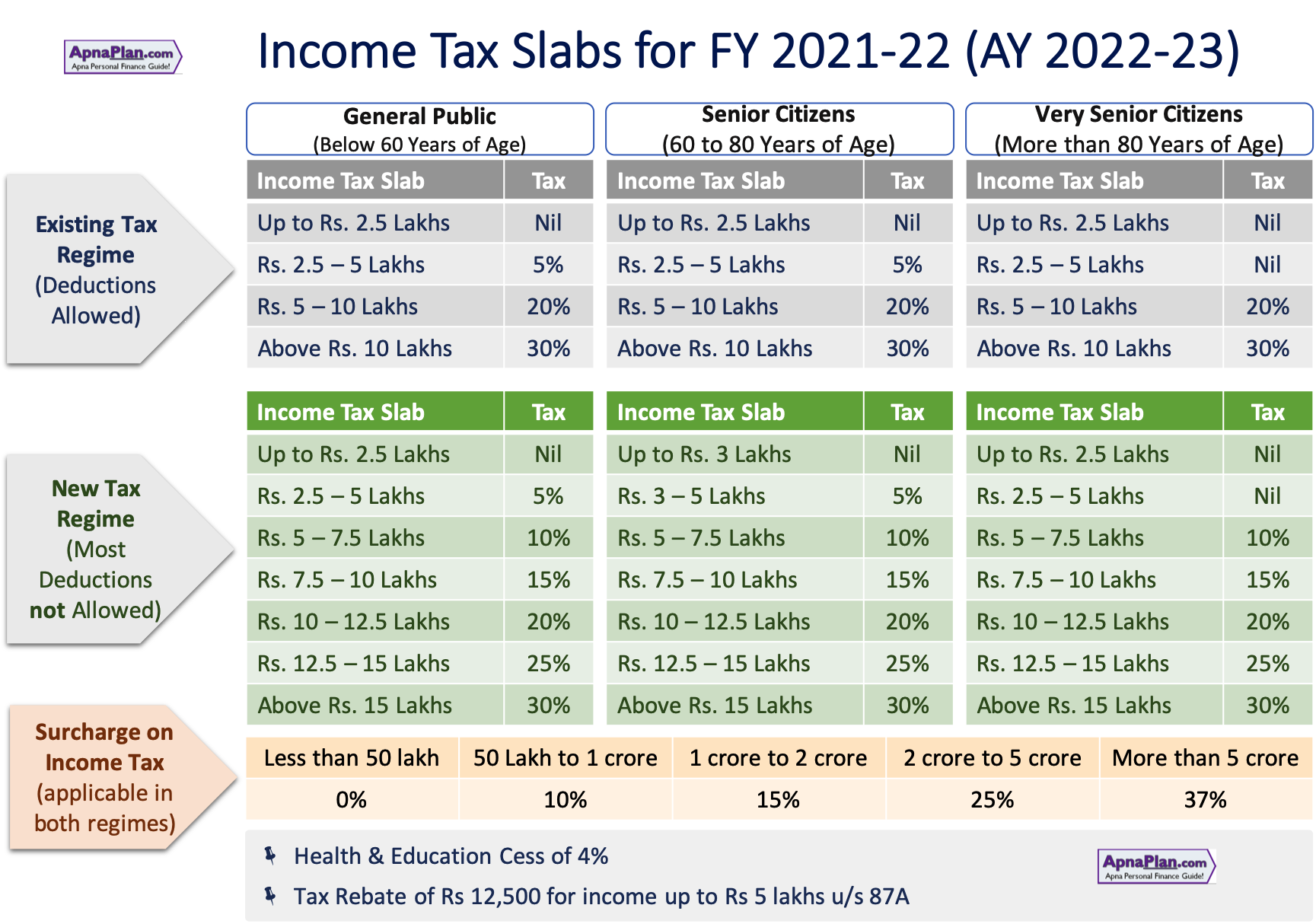

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23.png

Tax On A Second Job How Much Do I Pay

https://www.simplybusiness.co.uk/static/07e56b63aa727960afe96af4fd4ab39d/b6518/guide-to-second-job-tax.jpg

The Power Of Your Subconsious Mind

http://www.clone2go.com/images/convert-wma-to-mp3.jpg

The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied This calculator will only work out your tax for income years 2013 14 to 2023 24 income tax rates will depend on the income year you select and your residency status for income tax purposes during that income year Foreign residents pay tax at a higher rate and can t claim the tax free threshold Part year residents can usually claim

[desc-10] [desc-11]

Sales Taxes Payable Meaning Journal Entries Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/08/Sales-Taxes-Payable.jpg

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

https://i0.wp.com/nairametrics.com/wp-content/uploads/2016/07/Tax-payable.jpg?ssl=1

How To Work Out Tax Payable On Taxable Income - This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800