How To Work Out Net Income After Tax To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away It s considered your income

How To Work Out Net Income After Tax

How To Work Out Net Income After Tax

https://www.taxestalk.net/wp-content/uploads/net-income-after-taxes-niat.jpeg

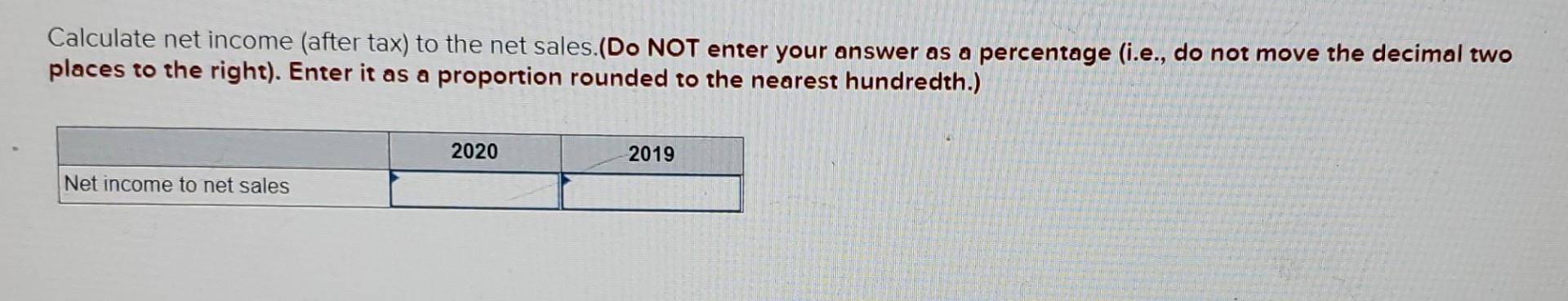

Solved Calculate Net Income after Tax To The Net Sales Chegg

https://media.cheggcdn.com/study/8ac/8acf6152-a720-45a4-a074-8de23d82dd48/image.jpg

Net Income After Tax NekishaArsha

https://i.pinimg.com/originals/44/f5/8f/44f58fbcb520f61d78173561ab0b3a3b.png

The income tax is 20 so your net income is 50 20 50 10 40 In both examples we had the same gross and net amounts but the tax percentage turned out to be different This is all down to how in the first example the net price was the base for the tax calculation while in the second one the gross amount was Gross pay vs net pay Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re an employee

Net Income After Taxes NIAT Net income after taxes NIAT is an accounting term most often found in a company s annual report that is meant to show the company s definitive bottom line for Each time you sell a stock exchange traded fund or mutual fund at a gain you ll face the NIIT s additional 3 8 charge So if you pay a 20 capital gains rate because of the NIIT your

More picture related to How To Work Out Net Income After Tax

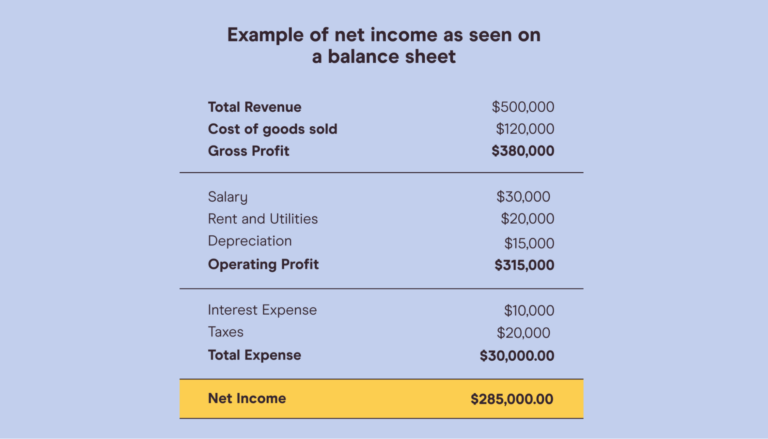

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

How To Determine Income Tax TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa-chegg-com.png

Apple IPhone 14 Foundry PEGATRON Reports Revenue Of TWD 352 867 Billion

https://static.techgoing.com/2022/10/Apple-iPhone-14-series-2.png

Multiply your net earnings by 92 35 0 9235 to get your tax base 50 000 x 92 35 46 175 Calculate your self employment tax Multiply your tax base by the self employed tax rate 46 175 x The rent a room scheme allows you to earn up to 7 500 a year tax free from letting out furnished rooms in your own home this figure is halved if you share the income with someone else

This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week To ensure our US take home pay calculator is as easy to use as possible we have to make a few assumptions about your personal circumstances such as that you have no dependents and are not married 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

Net Income After Tax NekishaArsha

https://i.pinimg.com/originals/df/3b/e4/df3be44ec64d492ca4f0270c1ceddfd3.png

How To Work Out Net Current Assets Photos Idea

https://lh3.googleusercontent.com/proxy/-ez2YzWnQf8Nf3tdSfVEfM2pzUa4Aoi7YQVJXVNw1Z-Zki8ovAMzchVMP0ObbMdQqctlMwsj1zpZhnyUpB5aO10h9tb73prBkdRfKZS8rszeMFdNxTaaPQ=w1200-h630-p-k-no-nu

How To Work Out Net Income After Tax - Each time you sell a stock exchange traded fund or mutual fund at a gain you ll face the NIIT s additional 3 8 charge So if you pay a 20 capital gains rate because of the NIIT your