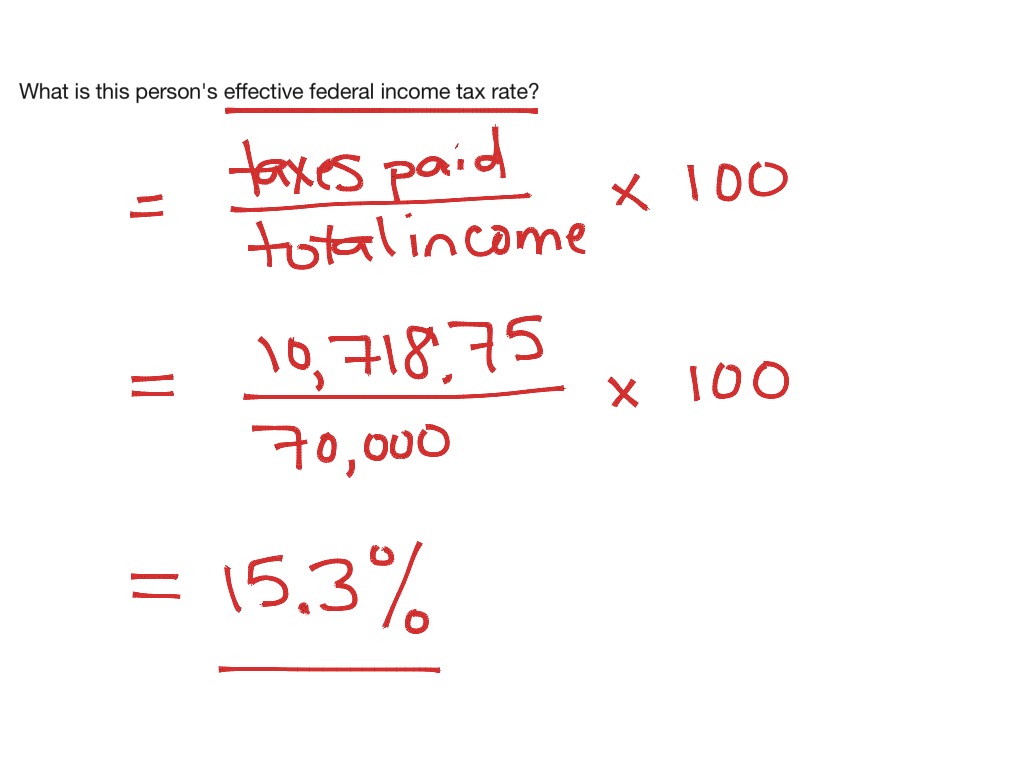

How Do You Calculate Tax On Net Income Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

Gross Income Expenses Net Income Or if you really want to simplify things you can express the net income formula as Total Revenues Total Expenses Net Income Net income can be positive or negative When your company has more revenues than expenses you have a positive net income Subtract the total taxes from your income to get your net annual income Sticking with the previous example if your gross income was 50 000 you had 5 000 in deductions and you deducted another 2 000 for retirement your taxable income is 43 000 Then if you owe 10 000 in taxes that makes your net income 33 000

How Do You Calculate Tax On Net Income

How Do You Calculate Tax On Net Income

https://showme0-9071.kxcdn.com/files/1000093366/pictures/thumbs/2302829/last_thumb1456332448.jpg

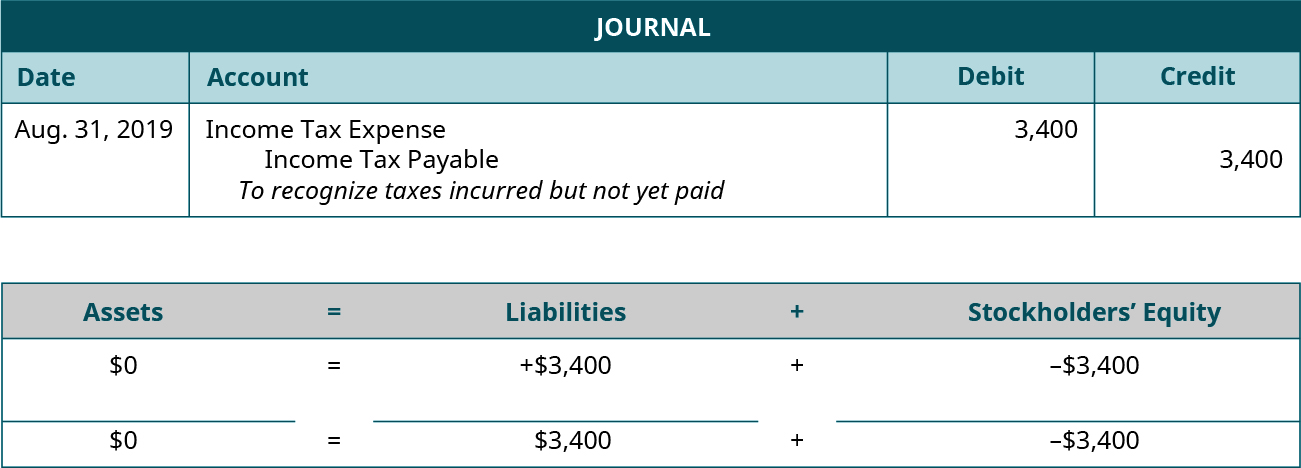

Casual Journal Entry For Income Tax Payable Financial Statement

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/1.18.20.jpeg

Federal Tax Estimator 2022 FinbarAtharv

https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&w=2560&ssl=1

To calculate the net income of an individual you need to know their tax rate based on filing status federal tax rate and state tax rate and any deductions taken out of their paycheck such as But you pay 272 51 in federal taxes 102 48 in state taxes 46 61 in Medicare taxes 193 31 in Social Security taxes and 125 for insurance And these are all deducted from your paycheck before you get it Yes you can find a net income calculator online that can help you find your monthly net income or annual net income Key takeaways

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

More picture related to How Do You Calculate Tax On Net Income

Here s How To Find How What Tax Bracket You re In For 2020 Business

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

https://i0.wp.com/nairametrics.com/wp-content/uploads/2016/07/Tax-payable.jpg?ssl=1

Income Tax Relief 2019

https://www.thetaxadviser.com/content/tta-home/issues/2019/aug/effective-tax-rate-reconciliation-income-tax-provision-disclosure/_jcr_content/contentSectionArticlePage/article/articleparsys/image_1005546862.img.jpg/1564068666913.jpg

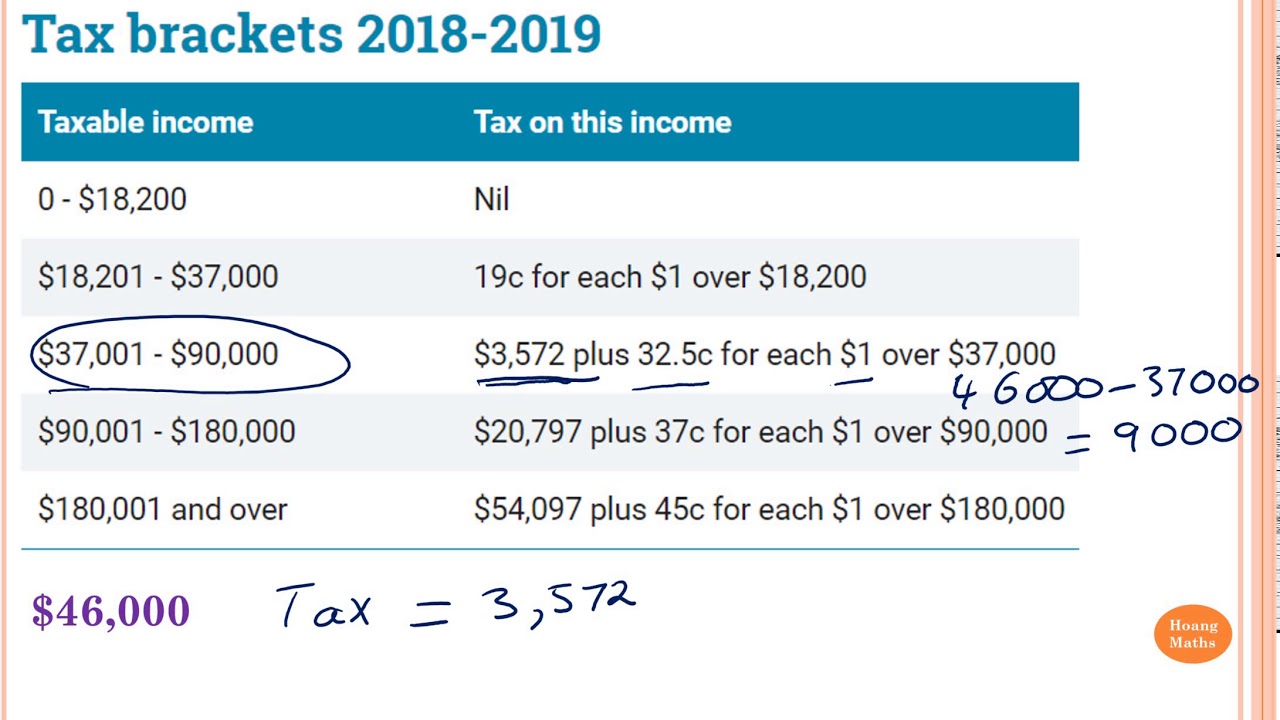

Finally Jim and Jane can calculate net income by taking the gross income and then subtracting the expenses Net income 40 000 14 000 26 000 So Jim and Jane can calculate their net income for the quarter which ends up being 26 000 Including Net Income on Your Tax Returns There are a few things to be aware of when including your Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

[desc-10] [desc-11]

Tax On Taxable Income Calculator RebeccaLochie

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

HOW TO CALCULATE INCOME TAX Example 1 YouTube

https://i.ytimg.com/vi/jxNo7WZyLfE/maxresdefault.jpg

How Do You Calculate Tax On Net Income - [desc-13]