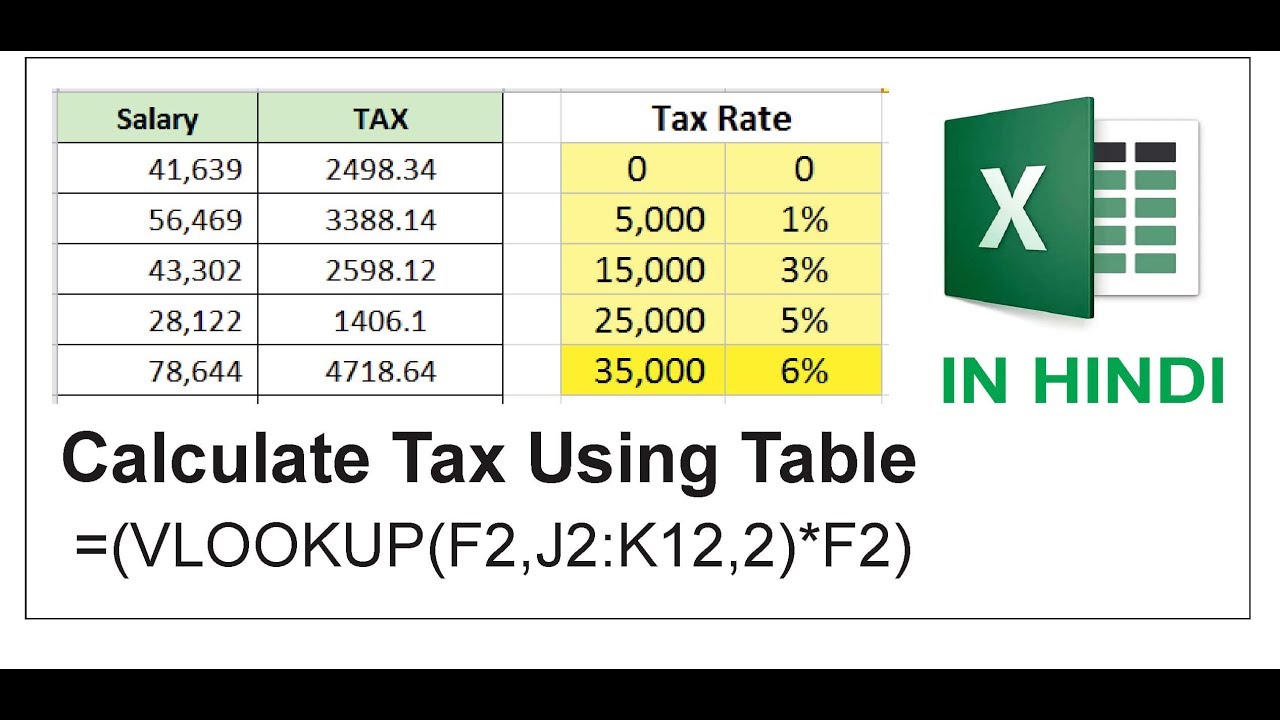

How To Calculate Progressive Tax Rate In Excel This article shows you how to build a formula to calculate a progressive tax rate in Excel Watch Video Formula to calculate a progressive tax rate Set up a table in ascending order with the amounts from your income tax card You will do three Approximate Match VLOOKUPS to get the base tax the percentage and the start of the level

To calculate the total income tax owed in a progressive tax system with multiple tax brackets you can use a simple elegant approach that leverages Excel s new dynamic array engine In the worksheet shown the main challenge is to split the income in cell I6 into the correct tax brackets This is done with a single formula like this in cell E7 LET income I6 upper C7 C13 lower DROP VSTACK In the following picture we have a dataset of four columns The first column is Bracket This column has two sub columns Lower Bound and Upper Bound We have put some sample tax brackets ranging from 0 to 60 001 and above The next column is Tax Rate which has all the marginal tax rates ranging from 0 to 50 The next two columns are Taxable Income and Tax Payable

How To Calculate Progressive Tax Rate In Excel

How To Calculate Progressive Tax Rate In Excel

https://i.ytimg.com/vi/m6HtEY-UDac/maxresdefault.jpg

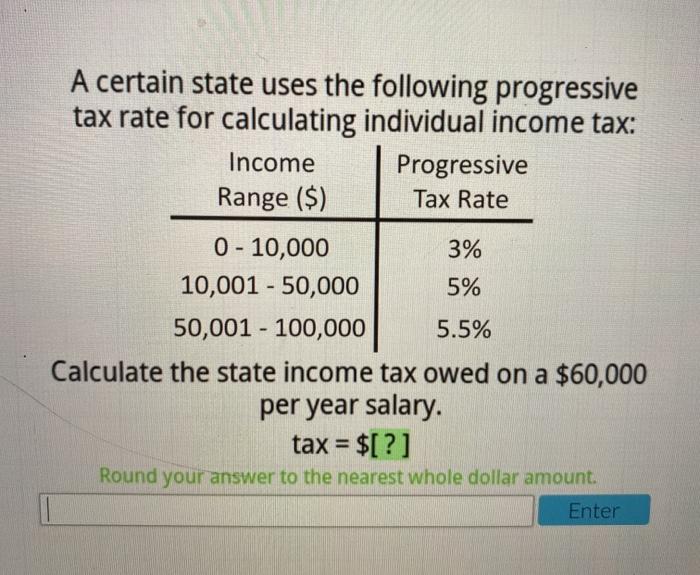

A Certain State Uses The Following Progressive Tax Rate For Course

https://www.coursehero.com/qa/attachment/23669958/

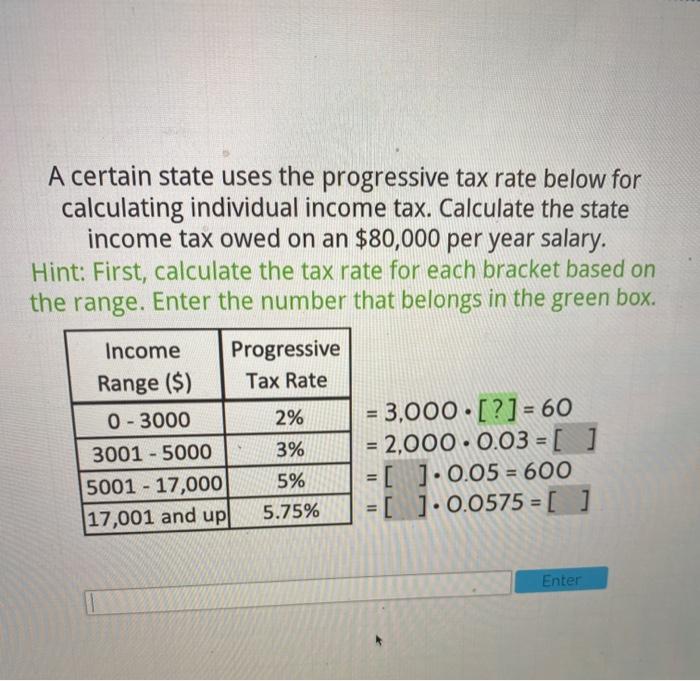

Solved A Certain State Uses The Following Progressive Tax Chegg

https://media.cheggcdn.com/study/04a/04ab3a8d-cb2f-4dcf-a871-0abb2e96ec06/image

You re going to set up a progressive field with multiple helper columns Say you have total I come in C C dedicate D D through F F for the provincial levels income level 131200 C C tax rate 0 1 and tax applied D D E E respectively Microsoft Excel Tutorial Excel Formula to Calculate a Progressive Income Tax Rate Welcome to another episode of the MrExcel Podcast where we teach you all

Method 1 Apply Excel VLOOKUP Function to Calculate Income Tax In this method we ll apply the VLOOKUP function This function looks for a value in a range and returns a value from the specified column The tax rate here is not like the earlier sample So follow the steps below to perform the task Steps Select cell D13 Type the formula This video shows you how to calculate income tax from a progressive schedule in Excel and how to turn that calculation into an easy custom function It also

More picture related to How To Calculate Progressive Tax Rate In Excel

Progressive Tax Examples Pros Cons How To Calculate

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhsgC17DRs86Wt67RR0aVyMHXfgva8MuuwIxDubgh3h4TSAPK0FvLSaDQpnqZcDwO9ZsAzryWIDlxe5dzChsYCWv309IFg9O2hvKcrf-f6wbRZpi4EbG5rLlbUmd-PL002D293OErsiisWCF9vBdvWyZjz4JMHHyNmVqGBlTTUpb4TUVbE-h48G3XMY/s888/PT.jpg

Solved A Certain State Uses The Progressive Tax Rate Below Chegg

https://media.cheggcdn.com/study/092/092a56d6-d051-4249-ad30-b7d319c38bd5/image

Effective Tax Rate Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Effective-Tax-Rate-Formula.jpg

Next we considered the amount that exceeds what we accounted for in the first step which is 10 000 The difference amounts to 26 000 36 000 10 000 For this segment we applied a tax rate of 3 representing the difference between the tax rate in the second bracket 10 and the rate applied in the first step 7 Asad asks for a formula to calculate a progressive income tax rate Set up a table in ascending order with the amounts from your income tax card You will do three Approximate Match VLOOKUPS to get the base tax the percentage and the start of the level Subtract the Start Level from the income for the period Multiply by the percentage

[desc-10] [desc-11]

Learn Excel Progressive Tax Rate Podcast 2065 YouTube

https://i.ytimg.com/vi/wZSOXAr2smA/maxresdefault.jpg

Progressive Tax Calculation YouTube

https://i.ytimg.com/vi/46lZGmIt1lM/maxresdefault.jpg

How To Calculate Progressive Tax Rate In Excel - This video shows you how to calculate income tax from a progressive schedule in Excel and how to turn that calculation into an easy custom function It also