How To Calculate Net Profit Before Tax And Interest Earnings before interest and taxes EBIT help measure a company s profitability and is calculated as revenue minus expenses excluding tax and interest EBIT is also called operating profit

Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2 000 000 1 750 000 250 000 PBT vs EBIT Profit before taxes and earnings before interest and tax EBIT are both effective measures of a company s profitability However they provide slightly different perspectives on financial results Apple s Earnings Before Taxes 53 394 million 1 26 1 Another method Another way to calculate pre tax profit You can also calculate a company s pre tax profit by subtracting a company s

How To Calculate Net Profit Before Tax And Interest

How To Calculate Net Profit Before Tax And Interest

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/net-income-summary-image-2x-us-en.png

Return On Assets Net Sales Gross Profit Margin Cost Of Goods Operating Net Profit Before Tax

https://img.homeworklib.com/questions/5a213060-7285-11ea-9dd0-e5e9a2b40a04.png?x-oss-process=image/resize,w_560

Adjusted Net Profit Cash At Par Premium Discount And Bonus

https://learn.financestrategists.com/wp-content/uploads/Adjusted-Net-Profit-Example-1.jpg

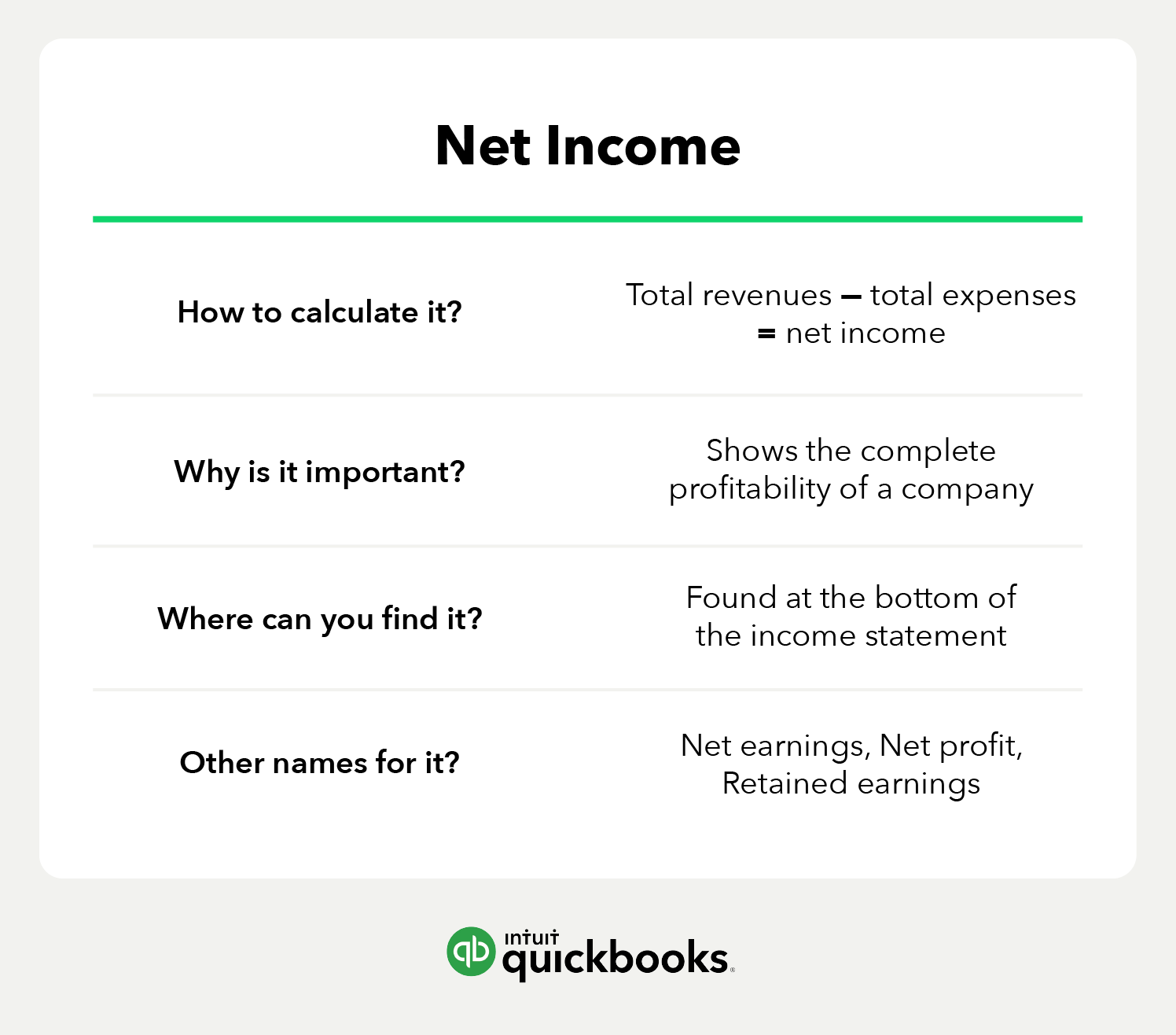

To calculate net profit before tax subtract all expenses except for income taxes from a company s revenue including Cost of goods sold 50 000 in COGS 20 000 in operating expenses and 5 000 in interest expenses its net profit before tax would be 100 000 Total Revenue 50 000 COGS 20 000 Operating Expenses 5 000 Interest To calculate EBIT using the indirect method we add income tax expense and interest expense to the net income EBIT 5 727 934 262 6 923 From both examples we had above we can see non operating items proceeds from sale of asset lawsuit expenses and other expenses that need to be accounted for

After EBIT only interest and taxes remain for deduction before arriving at net income How Is PBT Calculated Understanding the income statement can help an analyst have a better understanding of 2 Calculate EBIT from Net Income Alternatively you can calculate EBIT by starting with net income and adding back interest and taxes If a company has Net Income 100 000 Interest Expense 20 000 Taxes 30 000 The EBIT calculation would be EBIT Net Income Interest Taxes EBIT 100 000 20 000 30 000 150 000

More picture related to How To Calculate Net Profit Before Tax And Interest

D nsky Pou Stato n Company Net Worth Calculator Atrakt vne Oslepuj ci Tmel

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo Pros m Nie

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

How To Calculate Net Profit Before Tax Extraordinary Items In Cash Flow Statement Class 12

https://i.ytimg.com/vi/EAoKze6rbg4/maxresdefault.jpg

For a single step income statement you add up all your income and gains then add your expenses and losses together Subtract the negative items from the positive and you get your net income The last line above the entry for your tax expense gives you your income before taxes A multiple step income statement is more complex EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

[desc-10] [desc-11]

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo Pros m Nie

https://cdn.corporatefinanceinstitute.com/assets/Net-Profit-Margin-Ratio.png

Net Profit Margin How To Calculate Net Profit Margin

https://1.bp.blogspot.com/--wQXtI_9PTs/YB5K1_J8wOI/AAAAAAAAHAA/ldOyaUXybZs50lSTCGvjlkqpAY7Z1Ki8ACLcBGAsYHQ/s768/Net-profit-margin.jpg

How To Calculate Net Profit Before Tax And Interest - To calculate net profit before tax subtract all expenses except for income taxes from a company s revenue including Cost of goods sold 50 000 in COGS 20 000 in operating expenses and 5 000 in interest expenses its net profit before tax would be 100 000 Total Revenue 50 000 COGS 20 000 Operating Expenses 5 000 Interest