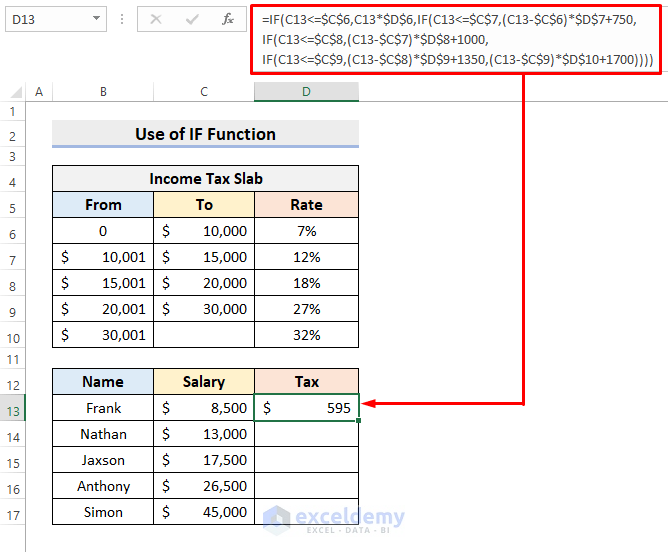

How To Calculate Income Tax Slab Rate In Excel STEP 1 Set up Income Tax Slab We need to prepare the Income tax slab first There are various Tax Rates that exist depending on the country and region To illustrate we ll use the following tax rate sample For instance a flat 7 of the total earning will be applicable for incomes 0 to 10 000

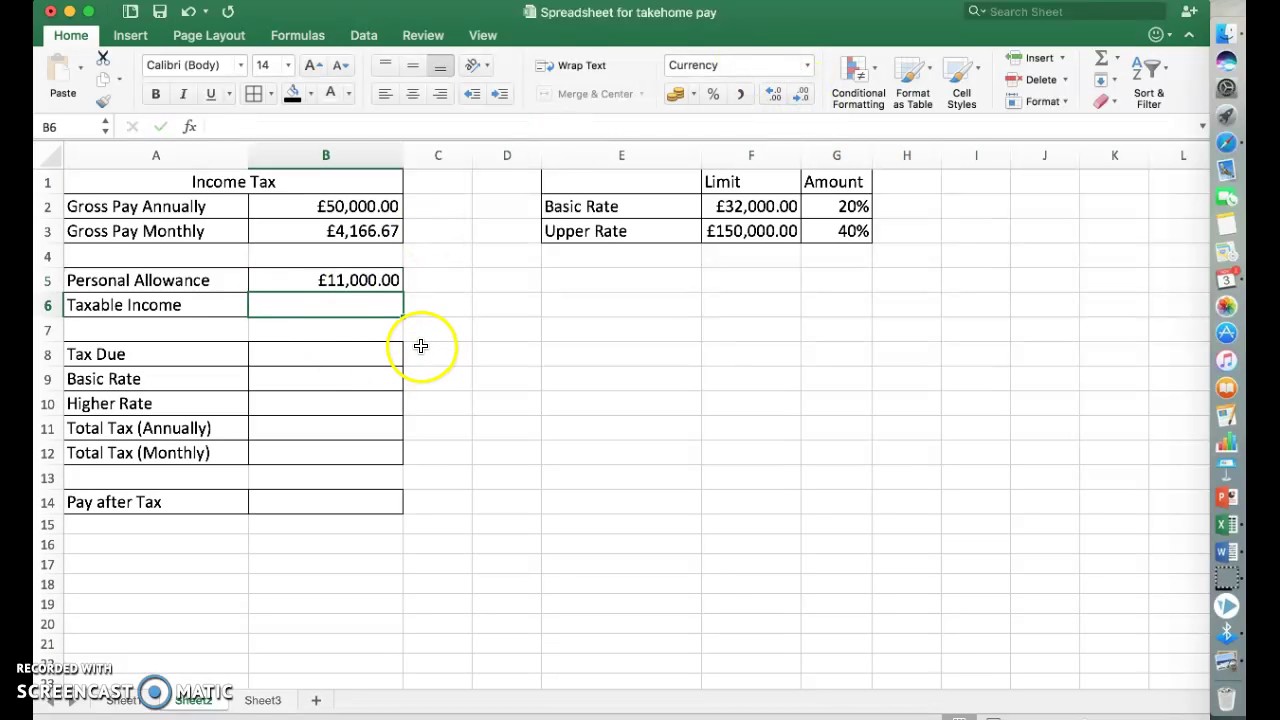

This calculator will work for both old and new tax slab rate which were released in 2023 You can calculate your tax liability and decide on tax efficient investment options and the suitable tax regime for FY 2023 24 The calculator is created using Microsoft excel Simple excel based formulas and functions are used in creating this calculator Steps In this example at first you have to calculate taxable income from gross salary and total deduction To begin with select the cell in which you want to calculate your taxable income here I selected cell E5 Next in cell E5 write the following formula C5 D5 Here I subtracted the Total Deductions from the Gross Salary

How To Calculate Income Tax Slab Rate In Excel

How To Calculate Income Tax Slab Rate In Excel

https://www.exceldemy.com/wp-content/uploads/2022/06/calculate-income-tax-in-excel-using-if-function-3.png

How To Calculate Tax Rate TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-income-tax-rate-in-excel.jpeg

2022 Income Tax Brackets Australia

https://www.taxmann.com/post/wp-content/uploads/2022/02/Slab-Rate-1.jpg

5081 25 50000 36900 25 We can use VLOOKUP to obtain all of the related values from the tax table based on the taxable income The basic syntax of the VLOOKUP function follows VLOOKUP lookup value table array col index num range lookup Where lookup value is the value we are seeking table array is where we are looking How to Apply Slab Rates to a Value in Excel Calculate Income Tax MITutorials 15 2K subscribers Subscribe Subscribed 116 Share 25K views 5 years ago In this excel Tutorial I m teaching

Enter your tax year filing status and taxable income to calculate your estimated tax rate What Is My Tax Rate 2021 Filing status Annual taxable income Your 2023 marginal tax rate 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 What are Tax Brackets How Many Tax Brackets Are There Income tax calculator if excel formula IF AND A4 0 A4 250000 not tax IF AND A4 250001 A4 500000 A4 250000 10 100 IF AND A4 500001 A4 1000000 A4 500000 20 100 25000 IF AND A4 1000000 A4 1000000 30 100 125000

More picture related to How To Calculate Income Tax Slab Rate In Excel

Apna Plan Income Tax Calculator Fy 2023 24 Excel Download Pay Period

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2021/02/New-Tax-Regime-Income-Tax-Slab-FY-2021-22-AY-2022-23-ArthikDisha.png

Income Tax Calculation How To Calculate Income Tax Income Tax Slab

https://i.ytimg.com/vi/5OJO4NegfqE/maxresdefault.jpg

How To Calculate Income Tax In Excel My XXX Hot Girl

https://fasrbeer849.weebly.com/uploads/1/2/5/3/125316631/338096476.jpg

Subject Multi slab Income Tax Calculation in MS Excel If annual Income is up to 4000000 sic Tax is exempted if between 400000 to 750000 tax is 5 if between 750000 to 1400000 tax is 10 plus 17500 if between 1400000 to 1500000 tax is 12 50 plus 38000 if between 150000 to 1800000 tax is 15 plus 60000 Example if income is 39000 tax equals 3572 0 325 39000 37000 3572 650 4222 To automatically calculate the tax on an income execute the following steps 1 On the second sheet create the named range Rates 2

The Income tax calculator is an easy to use online tool that helps you estimate your taxes based on your income after the Union Budget is presented We have updated our tool in line with the income tax changes proposed in the Union Budget 2023 24 Read the highlights here How to use the Income tax calculator for FY 2023 24 AY 2024 25 Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime you may add your exact income details on this simplified income tax calculator to find out the exact tax payable If you are calculating for FY2022 23 make sure to select the

How To Calculate Income Tax FY 2018 19 Age BELOW 60 Years

https://i.ytimg.com/vi/P_DkAtA1Ajg/maxresdefault.jpg

2022 Tax Brackets Irs Calculator

https://i1.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

How To Calculate Income Tax Slab Rate In Excel - Income tax calculator if excel formula IF AND A4 0 A4 250000 not tax IF AND A4 250001 A4 500000 A4 250000 10 100 IF AND A4 500001 A4 1000000 A4 500000 20 100 25000 IF AND A4 1000000 A4 1000000 30 100 125000