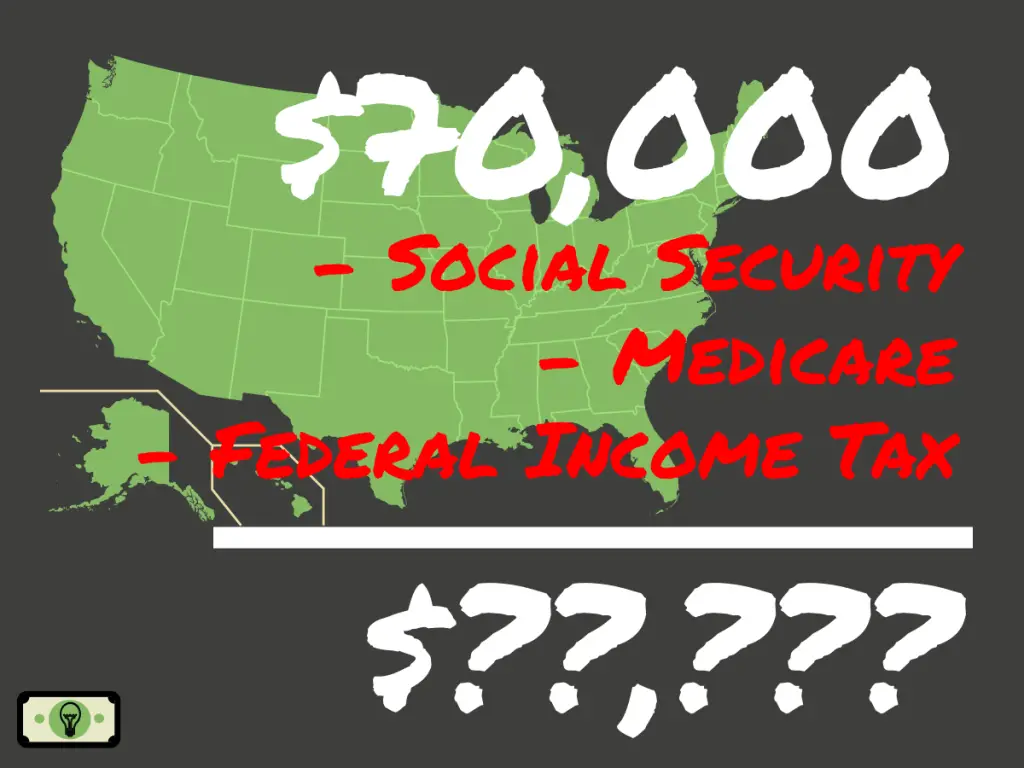

How Much Is 88000 A Year After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Before reviewing the exact calculations in the 88 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 45 43 assuming you work roughly 40 hours per week or you may want to know how much 88k a year is per month after taxes Answer In the year 2024 in the United States 88 000 a year gross salary after tax is 69 140 annual 5 201 monthly 1 196 weekly 239 22 daily and 29 9 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 88 000 a year after tax in the United States Yearly

How Much Is 88000 A Year After Taxes

How Much Is 88000 A Year After Taxes

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

44 000 A Year Is How Much An Hour

https://savvybudgetboss.com/wp-content/uploads/2022/04/40000-a-year-after-taxes.png

60 An Hour Is How Much A Year Before After Taxes

https://www.financiallunatic.com/wp-content/uploads/2022/04/Income-Tax.jpg

Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The IRS uses many factors to calculate the actual tax you may owe in any given year Note that if you are If you make 88 000 a year you will make 6 769 23 a month before taxes assuming you are working full time Each month after taxes you will make approximately 5 076 92 A full time worker or employee works at least 40 hours a week If you work either more or fewer hours this amount will vary slightly

88 000 00 After Tax This income tax calculation for an individual earning a 88 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024 Federal Tax Calculation for 8 80k Salary Annual Income 2024 8 800 00

More picture related to How Much Is 88000 A Year After Taxes

What Is 5 Off 88000 Calculatio

https://calculat.io/en/number/percent-off/5--88000/generated-og.png

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Top 10 16 An Hour Is How Much A Year After Taxes That Will Change Your

https://www.investopedia.com/thmb/CZmdffwGUlSMqlDUrD6ye6BNS60=/1731x1098/filters:no_upscale():max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg

Appartement pinal 3 Pi ces De 68m Avec D pendances Et JARDIN De 34m

https://media.immo-facile.com/office7/ladresseAc3-375/catalog/images/pr_web/1/2/2/7/3/4/5/8/12273458f.jpg?DATEMAJ=28/12/2020-11:02:22

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 Summary If you make 88 000 a year living in the region of California USA you will be taxed 25 042 That means that your net pay will be 62 958 per year or 5 247 per month Your average tax rate is 28 5 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

Roughly if you make a yearly salary of 88 000 you will need to pay between 14 08k to 21 12k in taxes Let s be conservative and estimate based on the higher taxes of 21 12k We are also going to assume that you get two weeks of paid vacation per year 88 000 21120 2080 32 an hour That means that after taxes you will have an 2014 53 875 2013 51 406 2012 51 926 Payroll taxes in Texas are relatively simple because there are no state or local income taxes Texas is a good place to be self employed or own a business because the tax withholding won t as much of a headache And if you live in a state with an income tax but you work in Texas you ll be sitting

Solved You ve Collected The Following Information About Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/39d/39d99b9d-242a-49c1-ad40-d109b1d8021c/phpXwuzIt.png

62000 A Year Is How Much A Month After Taxes New Update Abettes

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Is 88000 A Year After Taxes - Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The IRS uses many factors to calculate the actual tax you may owe in any given year Note that if you are