How Much Is 88000 After Taxes In Florida Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

How Much Is 88000 After Taxes In Florida

How Much Is 88000 After Taxes In Florida

https://images.news18.com/ibnlive/uploads/2021/06/1624772615_maruti-suzuki-eeco-ambulance.png

UP Man Dupes Woman Of Rs 88 000 After Posing As Indian Army Soldier Arrested

https://imgeng.jagran.com/images/2022/nov/Untitled design1668050885247.jpg

2 3 Cubic Yard Trash Dumpsters Lot 824 AGRICULTURE CONSTRUCTION EQUIPMENT 9 15 2020

https://auctionresource.azureedge.net/blob/images/auction-images/2020-09-10/4772fae6-7077-4019-a87c-da58ab4378ec.jpg?preset=740x555

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

88 000 00 After Tax This income tax calculation for an individual earning a 88 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed

More picture related to How Much Is 88000 After Taxes In Florida

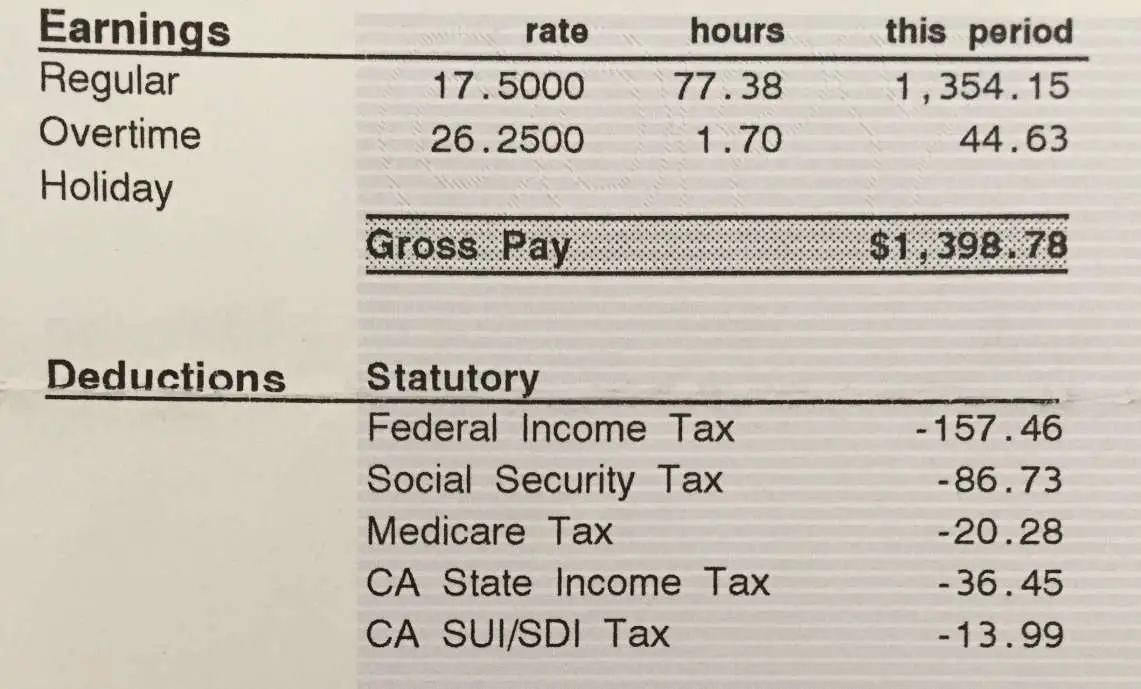

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

88 000 After Tax After Tax Calculator 2019

https://after-tax.co.uk/tpl/images/88000-after-tax-2019.png

88 000 After Tax US 2023 US Income Tax Calculator

https://incomeaftertax.com/88000-after-tax-us.jpg?20

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 After you use the estimator Use your estimate to change your tax withholding amount on Form W 4 Or keep the same amount To change your tax withholding amount Enter your new tax withholding amount on Form W 4 Employee s Withholding Certificate Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to

Summary If you make 85 000 a year living in the region of Florida USA you will be taxed 17 971 That means that your net pay will be 67 030 per year or 5 586 per month Your average tax rate is 21 1 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that you ll benefit from in your retirement years Every pay period your employer will withhold 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes

A Guide To Florida Taxes Ramsey

https://cdn.ramseysolutions.net/media/blog/taxes/tax-basics/florida-tax-guide.jpg

Hecht Group Paying Your Property Taxes In Florida What You Need To Know

https://img.hechtgroup.com/1663644109140.png

How Much Is 88000 After Taxes In Florida - Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed