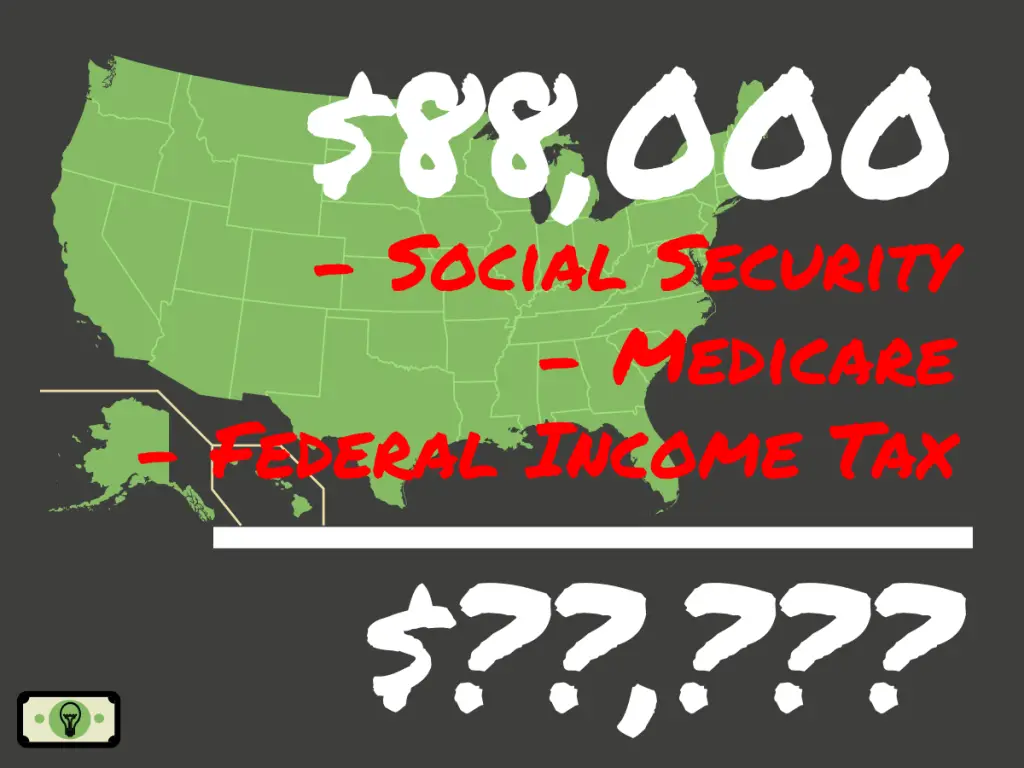

How Much Is 88000 A Month After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Before reviewing the exact calculations in the 88 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 45 43 assuming you work roughly 40 hours per week or you may want to know how much 88k a year is per month after taxes Answer The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income

How Much Is 88000 A Month After Taxes

How Much Is 88000 A Month After Taxes

https://images-cdn.9gag.com/photo/a6qoX3e_700b.jpg

Rough Country 88000 A 1 75 2022 2023 Toyota Tundra 2WD 4WD Leveling Kit Jack It

https://www.jackit.com/media/catalog/product/cache/54785edc67a0403aac2f6cf0b5ebf6bc/t/u/tundra-7.jpg

Rough Country 88000 A 1 75 2022 2023 Toyota Tundra 2WD 4WD Leveling Kit Jack It

https://www.jackit.com/media/catalog/product/cache/0e2e71d541041fc9a6055e4e4e7b5e8c/8/8/88000_a-2.jpg

In the year 2024 in the United States 88 000 a year gross salary after tax is 69 140 annual 5 201 monthly 1 196 weekly 239 22 daily and 29 9 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 88 000 a year after tax in the United States Yearly Explore the breakdown of a 88 000 a month after tax income in US find out how much is a year week day and an hour to better understand your earnings Home Tax you ll find a detailed analysis of a 88 000 after tax monthly salary for 2024 with calculations for annual weekly daily and hourly rates as of January 25th 2024 at 11

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator 88 000 00 After Tax This income tax calculation for an individual earning a 88 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance Month 2024 days in month Income Tax Deferred Student loan interest

More picture related to How Much Is 88000 A Month After Taxes

On January 1 2020 THE Company Purchased A New Machine For 136 000 The Machine Was Assigned

https://img.homeworklib.com/questions/96887050-bbe2-11eb-9042-834e74a9e427.png?x-oss-process=image/resize,w_560

2 3 Cubic Yard Trash Dumpsters Lot 824 AGRICULTURE CONSTRUCTION EQUIPMENT 9 15 2020

https://auctionresource.azureedge.net/blob/images/auction-images/2020-09-10/4772fae6-7077-4019-a87c-da58ab4378ec.jpg?preset=740x555

Solved Question 2 25 Points Your Firm Is Considering The Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/ec3/ec35d49b-4830-4c61-b246-b1d15be0be94/phpYoBijn.png

After you use the estimator Use your estimate to change your tax withholding amount on Form W 4 Or keep the same amount To change your tax withholding amount Enter your new tax withholding amount on Form W 4 Employee s Withholding Certificate Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024 Federal Tax Calculation for 8 80k Salary Annual Income 2024 8 800 00

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 So after taxes you would have approximately 68 640 left as your annual income To calculate your monthly income after taxes you can divide 68 640 by 12 since there are 12 months in a year 68 640 annual income after tax 12 months 5 720 So at a yearly salary of 88 000 your monthly income after taxes would be approximately

How Much Is 88 000 A Year After Taxes filing Single 2023 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-88000-dollars-sm-2-1024x768.png

Data For Hermann Corporation Are Shown Below Selling Price Variable Expenses Contribution

https://img.homeworklib.com/questions/938562e0-1507-11ec-8820-419dfcd47662.png?x-oss-process=image/resize,w_560

How Much Is 88000 A Month After Taxes - In the year 2024 in the United States 88 000 a year gross salary after tax is 69 140 annual 5 201 monthly 1 196 weekly 239 22 daily and 29 9 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 88 000 a year after tax in the United States Yearly