How Much Is A 88000 Salary After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

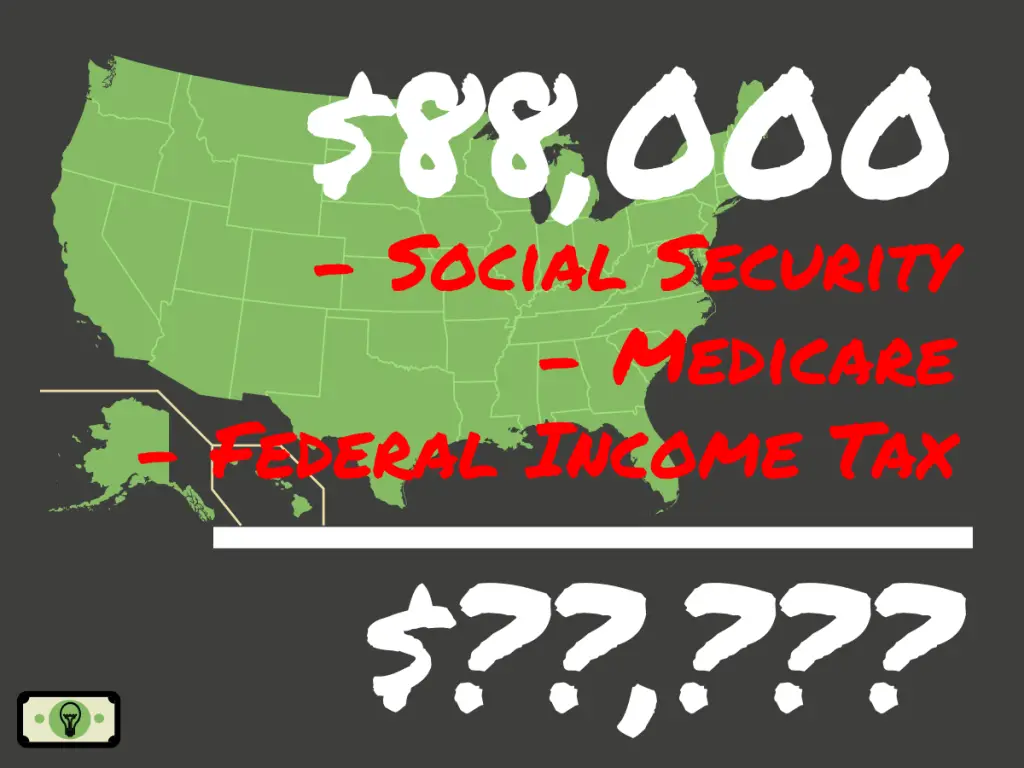

An individual who receives 64 507 05 net salary after taxes is paid 88 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 88 000 00 salary In the year 2024 in the United States 88 000 a year gross salary after tax is 69 140 annual 5 201 monthly 1 196 weekly 239 22 daily and 29 9 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 88 000 a year after tax in the United States Yearly

How Much Is A 88000 Salary After Taxes

How Much Is A 88000 Salary After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/88000-a-Year-is-How-Much-an-Hour.jpg

How Much Is 88 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-88000-dollars-sm-2-1024x768.png

Top 10 52000 A Year Is How Much A Month After Taxes That Will Change

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1658954291602-IT66OQ32WNXK3P7KU2OZ/AdobeStock_469754966.jpeg

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

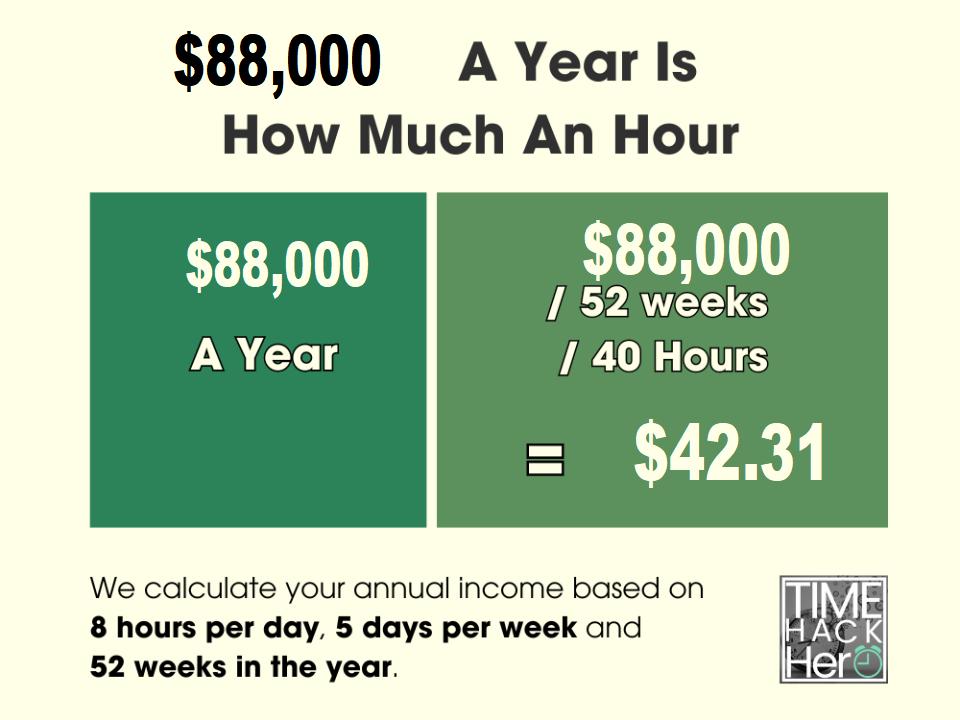

The table below details how Federal Income Tax is calculated in 2023 The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2023 Federal Tax Calculation for 88k Salary Annual Income 2023 88 000 00 How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

More picture related to How Much Is A 88000 Salary After Taxes

88000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/Convert-88000-a-Year-to-Hourly-Daily-Biweekly-Weekly-and-Monthly-Salary.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

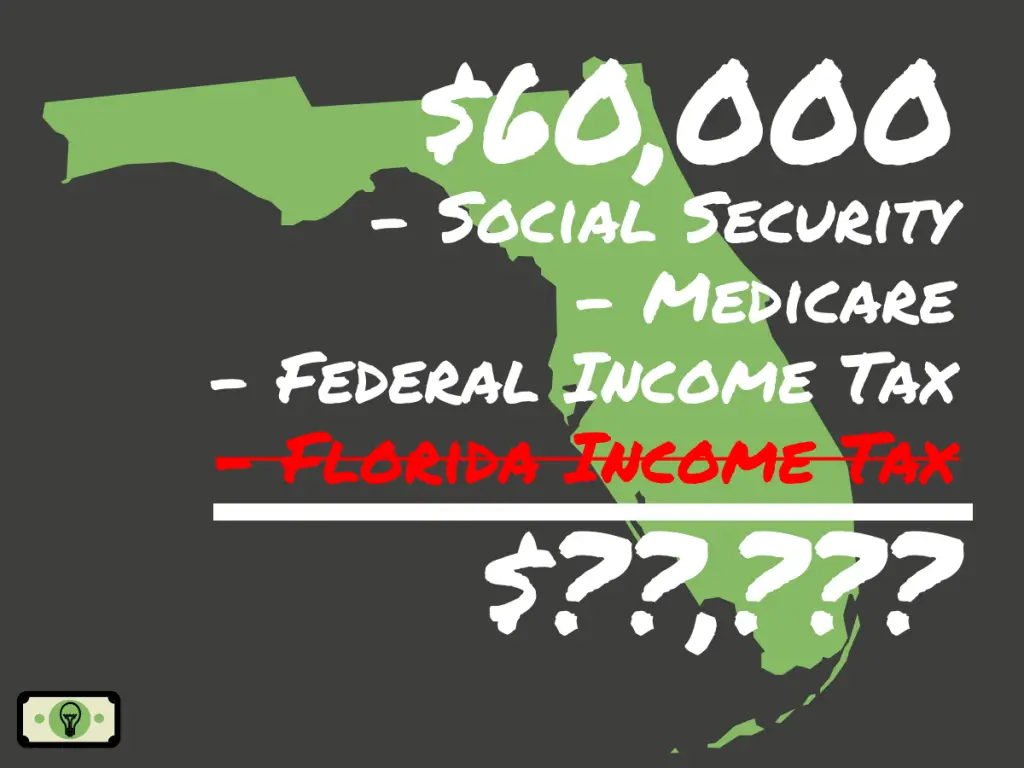

60 000 Dollars Salary After Taxes In Florida single 2023 SPFi

https://smartpersonalfinance.info/wp-content/uploads/2022/09/fl-60000-after-taxes-sm-1024x768.png

88 000 00 After Tax This income tax calculation for an individual earning a 88 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance Here s a step by step guide on how our calculator works and how it can help you understand your paycheck better 1 State Our calculator is designed to cater to the specific tax rules of each state Simply select your state to ensure the calculations take into account state specific tax rates and regulations 2

2014 53 875 2013 51 406 2012 51 926 Payroll taxes in Texas are relatively simple because there are no state or local income taxes Texas is a good place to be self employed or own a business because the tax withholding won t as much of a headache And if you live in a state with an income tax but you work in Texas you ll be sitting The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

88 000 A Year Is How Much An Hour Is It A Good Salary

https://www.pineapplemoney.com/img/88000-a-year-is-how-much-an-hour.jpg#header-image

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

How Much Is A 88000 Salary After Taxes - The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator