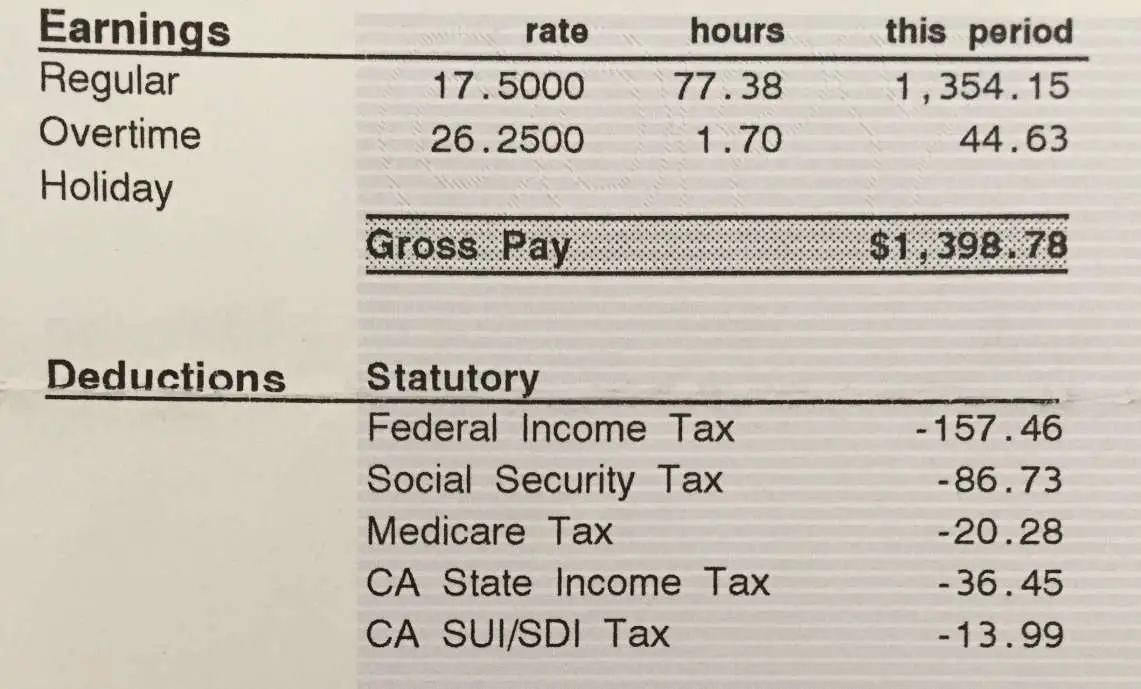

How Much Is 88000 After Taxes In California Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Take note Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax

The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 88 000 00 per annum when living and paying your taxes in California The 88 000 00 California tax example uses standard assumptions for the tax calculation California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average tax rate is 10 94 and your

How Much Is 88000 After Taxes In California

How Much Is 88000 After Taxes In California

https://images.news18.com/ibnlive/uploads/2021/06/1624772615_maruti-suzuki-eeco-ambulance.png

UP Man Dupes Woman Of Rs 88 000 After Posing As Indian Army Soldier Arrested

https://imgeng.jagran.com/images/2022/nov/Untitled design1668050885247.jpg

Property Taxes By State County Median Property Tax Bills Tax Foundation Sulite Sui

https://files.taxfoundation.org/20220912155938/Property-taxes-by-state-compare-state-property-tax-rankings-1200x1033.png

State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

What is 64 507 05 as a gross salary An individual who receives 64 507 05 net salary after taxes is paid 88 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 88 000 00 salary California s base sales tax is 6 00 This means that regardless of where you are in the state you will pay an additional 6 00 of the purchase price of any taxable good Many cities and counties also enact their own sales taxes ranging from 1 25 to 4 75 So the maximum combined rate is 10 75

More picture related to How Much Is 88000 After Taxes In California

2 3 Cubic Yard Trash Dumpsters Lot 824 AGRICULTURE CONSTRUCTION EQUIPMENT 9 15 2020

https://auctionresource.azureedge.net/blob/images/auction-images/2020-09-10/4772fae6-7077-4019-a87c-da58ab4378ec.jpg?preset=740x555

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

88 000 After Tax After Tax Calculator 2019

https://after-tax.co.uk/tpl/images/88000-after-tax-2019.png

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Find out how much your salary is after tax 88 000 88 500 89 000 89 500 90 000 90 500 91 000 91 500 92 000 NOTE Withholding is calculated based on the California tables of USA income tax For simplification purposes some variables such as marital status and others have been assumed Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

88 000 After Tax US 2023 US Income Tax Calculator

https://incomeaftertax.com/88000-after-tax-us.jpg?20

How Much Is 88 000 A Year After Taxes filing Single 2023 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-88000-dollars-sm-2-1024x768.png

How Much Is 88000 After Taxes In California - State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024