How Do I Calculate Gross Pay From Net The net to gross calculator helps you see how much an amount will worth be after we add or before we deduct a tax look below for an explanation it can be a bit tricky As with all Omni calculators you can input values into the fields in any order and the calculation will still work fine

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better

How Do I Calculate Gross Pay From Net

How Do I Calculate Gross Pay From Net

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

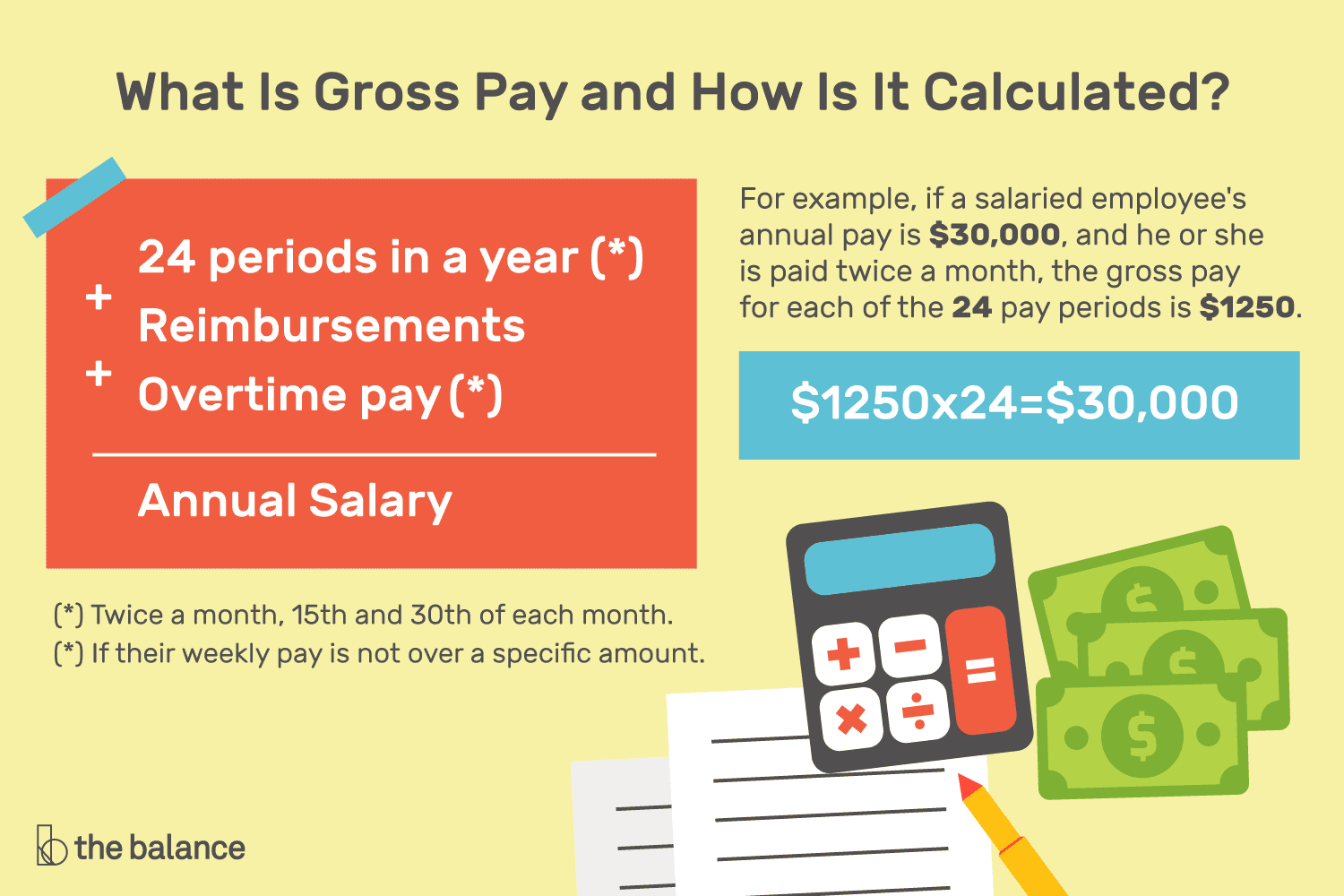

What Is Gross Pay And How Is It Calculated Db excel

https://db-excel.com/wp-content/uploads/2019/09/what-is-gross-pay-and-how-is-it-calculated.png

Gross Compensation Worksheet Turbotax

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period Gross Pay Information on W 4 Filing Status and Withholdings Pre Tax Deductions Post Tax Deductions State Gross Pay Pay Period Periods Per Year Est Gross Annual Pay Calculate Your

Simply enter the amount of net pay you want your employee to receive along with some details about any withholding preferences from their Form W 4 and our gross up calculator will do the math To get started click the button below Start calculating now Updated June 28 2023 Why use a gross up Step 1 Multiply the hourly rate by the number of hours worked up to 40 hours per week Let s say the employee makes 15 per hour If the employee works 40 hours they ve earned 600 Step 2 Add overtime tips commissions etc Remember that typically overtime is 1 5 times the employee s hourly rate

More picture related to How Do I Calculate Gross Pay From Net

Calculate Hourly Pay Based On Annual Salary ChurnjetShannan

https://i2.wp.com/www.excelstemplates.com/wp-content/uploads/2018/10/net-salary.png

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000 Tool Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

What is net pay Net pay is the money you make after deductions and expenses It s gross pay minus mandatory and voluntary deductions Your net pay is the amount of money you have in your bank account after deductions like taxes insurance and other expenses But calculating your weekly take home pay isn t a simple matter of multiplying your hourly wage by the number of hours you ll work each week or dividing your annual salary by 52 That s because your employer withholds taxes from each paycheck lowering your overall pay

Gross Annual Income Calculator Hourly JeremyAarya

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

Gross Income Vs Net Income Differences And How To Calculate MBO Partners

https://s29814.pcdn.co/wp-content/uploads/2020/06/bill-rate-calculator.jpg.optimal.jpg

How Do I Calculate Gross Pay From Net - What is gross pay Gross pay is an employee s income before taking out deductions Unless you gross up an employee s wages gross pay is usually the sticker price you offer What are deductions To calculate net from gross you must withhold deductions each pay period There are both tax and non tax deductions