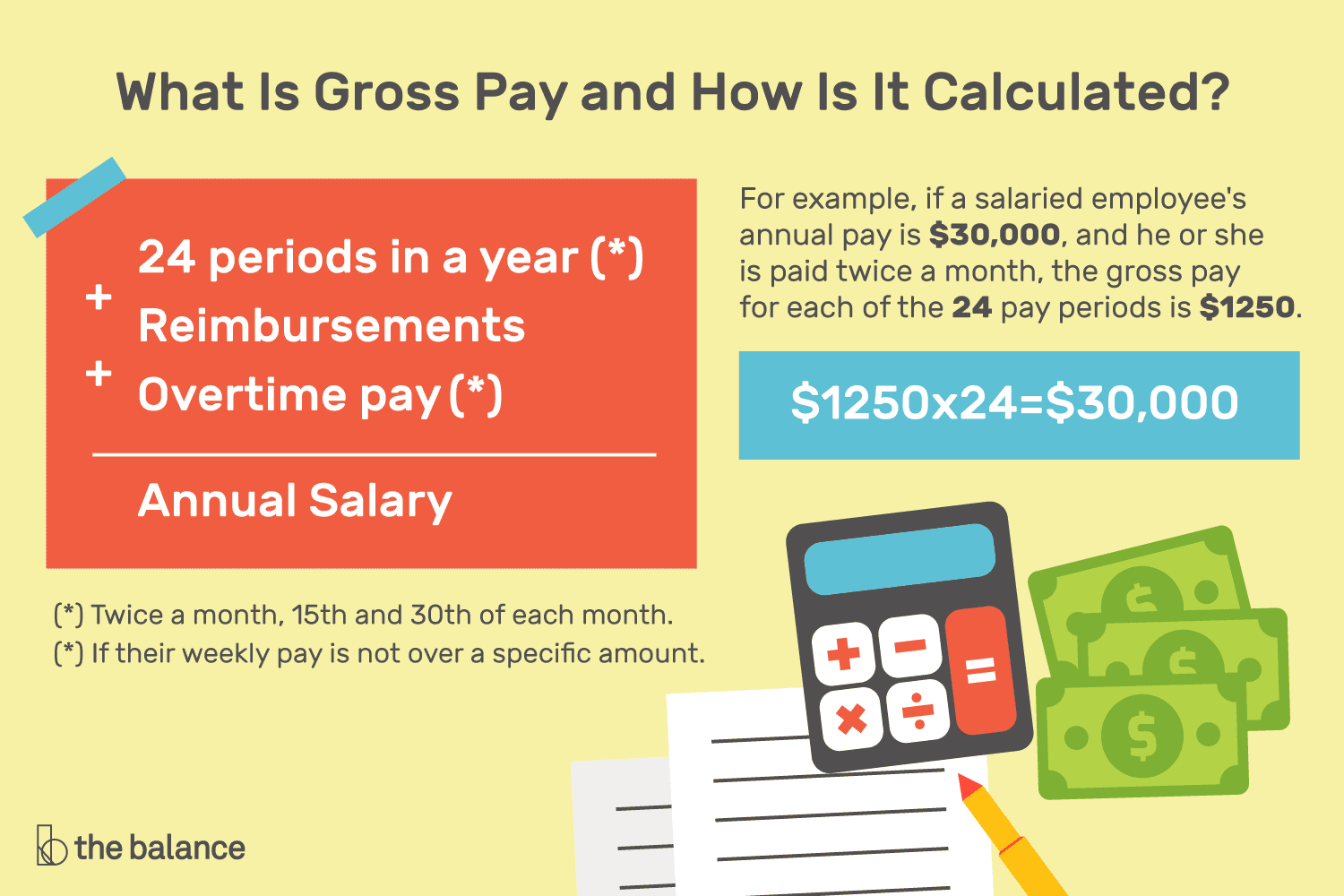

How To Calculate Gross Pay From Net To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

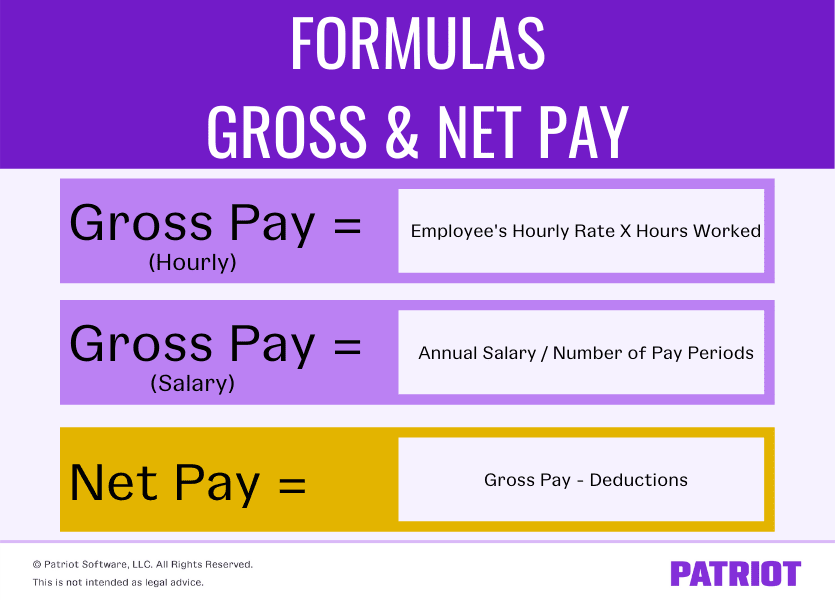

To get started click the button below Start calculating now Updated June 28 2023 Why use a gross up Grossing up also known as a net to gross calculation is generally used to ensure a staffer receives a specific amount of money for special one time payments like bonuses or moving costs The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period

How To Calculate Gross Pay From Net

How To Calculate Gross Pay From Net

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Net Salary Calculator Templates 13 Free Docs Xlsx PDF Salary

https://i.pinimg.com/originals/df/90/44/df90442f476464d96326329685c05adb.jpg

Gross Pay Vs Net Pay What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1.png

Use this gross pay to net pay calculator to gross up wages based on net pay For example if an employee receives 500 in take home pay it will calculate the gross amount that must be used when calculating payroll taxes It determines the amount of gross wages before taxes and deductions that are withheld given a specific take home pay amount If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

More picture related to How To Calculate Gross Pay From Net

How To Calculate Net Pay For Accurate Payroll

https://www.patriotsoftware.com/wp-content/uploads/2018/05/calc-net-pay-gross-pay-1.jpg

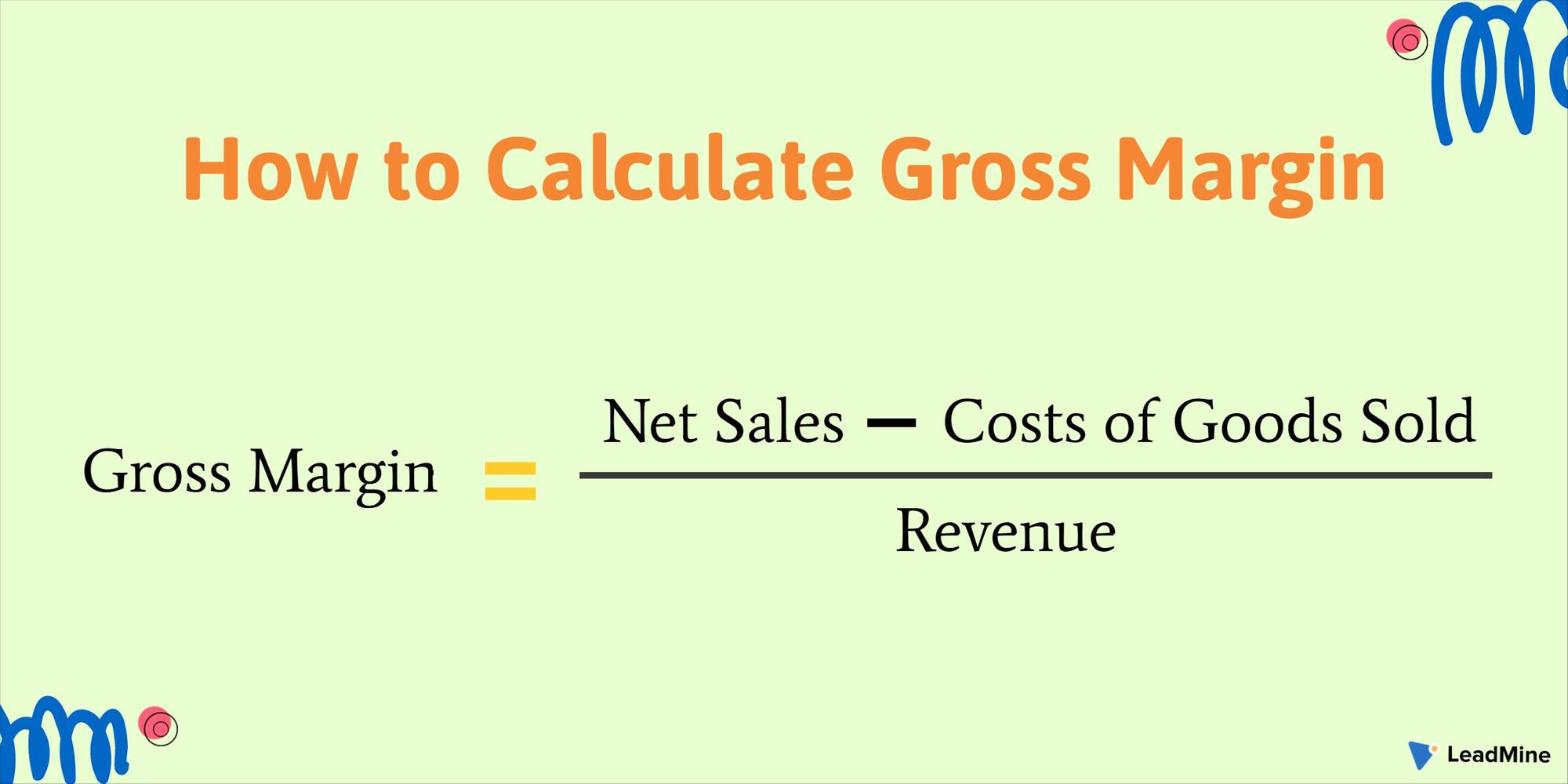

Gross Margin Definition Formula Profit Margin Vs Gross Margin

https://www.leadmine.net/glossary/content/images/2021/04/Calculate-Gross-Margin.jpeg

How To Calculate Net Salary Lupon gov ph

https://i.ytimg.com/vi/eowCuwKkybY/maxresdefault.jpg

Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better What is net pay Net pay is the money you make after deductions and expenses It s gross pay minus mandatory and voluntary deductions Your net pay is the amount of money you have in your bank account after deductions like taxes insurance and other expenses

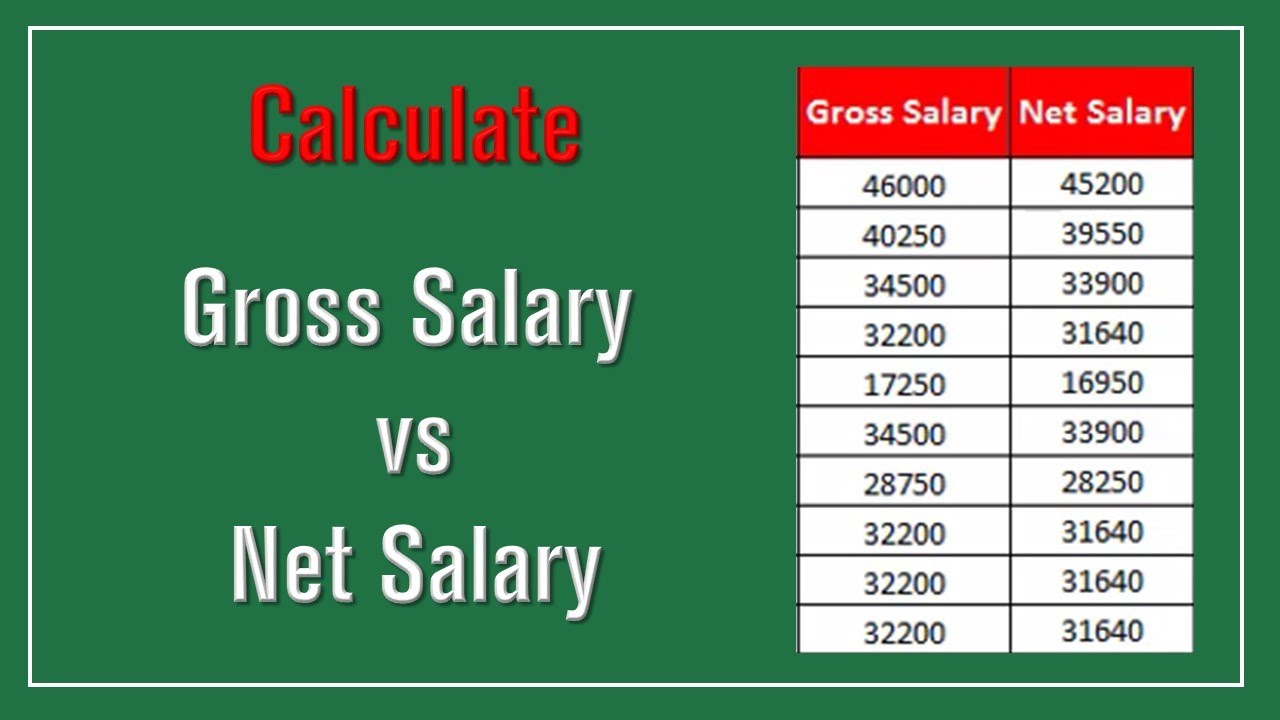

The net pay formula is Gross pay deductions Net pay Some common deductions include income taxes Social Security taxes health insurance and retirement contributions Calculating the difference between gross pay and net pay is crucial for employers and employees Here s a quick guide to doing so Gross pay is an employee s total earned wages before payroll deductions What is net income Net income also known as net earnings is the total revenue of a company minus operating

What Is Gross Pay And How Is It Calculated Db excel

https://db-excel.com/wp-content/uploads/2019/09/what-is-gross-pay-and-how-is-it-calculated.png

Gross To Net Salary Calculator CALCULATORUK HJW

https://i2.wp.com/www.excelstemplates.com/wp-content/uploads/2018/10/net-salary.png

How To Calculate Gross Pay From Net - Find out what you owe by multiplying gross pay by 7 65 For example an employee who earns 3 000 per month will owe 229 50 in FICA tax Fourth add up any additional deductions such as health premiums charity deductions etc Once you ve added up all of the deductions above subtract the sum from the gross pay to reach your total net pay