How To Calculate Gross Income From Net Ontario Self employed people pay up to 15 3 in federal self employment taxes this is because you ll need to pay your Social Security and Medicare taxes as both the employer and the employee As a traditional employee you might be used to seeing such taxes withheld from your paycheck but those should have only added up to 7 65 of your wages

This is the Net to Gross Calculator Start by entering some numbers Tip You don t need to go from the top to the bottom You can calculate anything in any order Net to Gross Calculator Created by Mateusz Mucha and Tibor P l PhD candidate Reviewed by Bogna Szyk and Jack Bowater Based on research by The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How To Calculate Gross Income From Net Ontario

How To Calculate Gross Income From Net Ontario

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

Gross Salary Calculator Start with your employee s net pay and easily work your way back to gross pay We re hard at work on our 2023 year end resources Stay tuned for updates 2024 Gross Salary Calculator coming soon Year Net Salary Per Province Gross Salary is 0 00 This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and

If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions may vary significantly based on your location If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

More picture related to How To Calculate Gross Income From Net Ontario

How To Calculate Adjusted Gross Income On W 2 In 2023 Simple Guide To

https://i.ytimg.com/vi/GxkBOBVE54E/maxresdefault.jpg

How To Calculate Gross Income Biweekly Haiper

http://cdn.ilovefreesoftware.com/wp-content/uploads/2017/06/calculatordotnet-home.jpg

How To Calculate Net Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

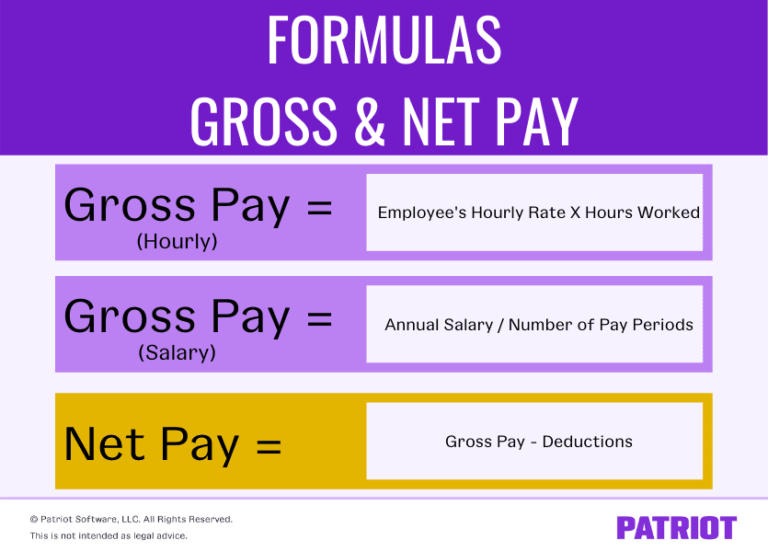

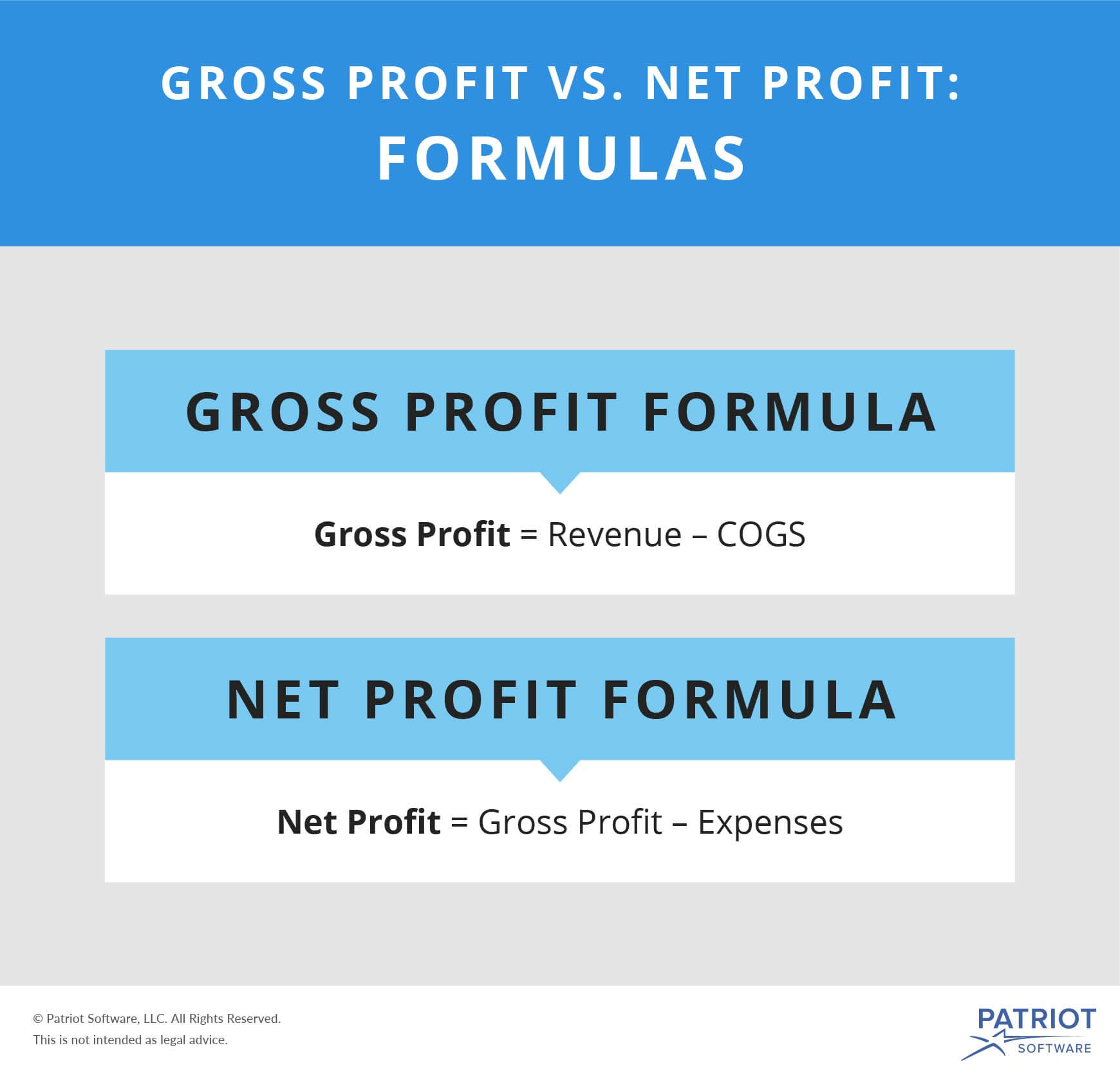

Follow these steps to determine gross pay 1 Add up W 2 wages for the month Tally up the gross pay or income listed on each of your paystubs for a given month 2 Sum additional sources of income Add in additional sources of income in your gross monthly income calculation factor in additional payments Gross income or gross pay is an individual s total pay before accounting for taxes or other deductions At the company level it s the company s revenue minus the cost of good sold In this

Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

How To Calculate Gross Profit Vs Net Profit Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-profit-vs.-net-profit-formulas-visual.jpg

Dec t Detaliat Venituri How To Calculate Gross Annual Income nvins

https://i.ytimg.com/vi/PaD6N4iwQtU/maxresdefault.jpg

How To Calculate Gross Income From Net Ontario - If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions may vary significantly based on your location