How Do I Calculate My Gross Pay From Net Pay FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator

How Do I Calculate My Gross Pay From Net Pay

How Do I Calculate My Gross Pay From Net Pay

https://apspayroll.com/wp-content/uploads/2022/11/w2-last-pay-stub-difference.png

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

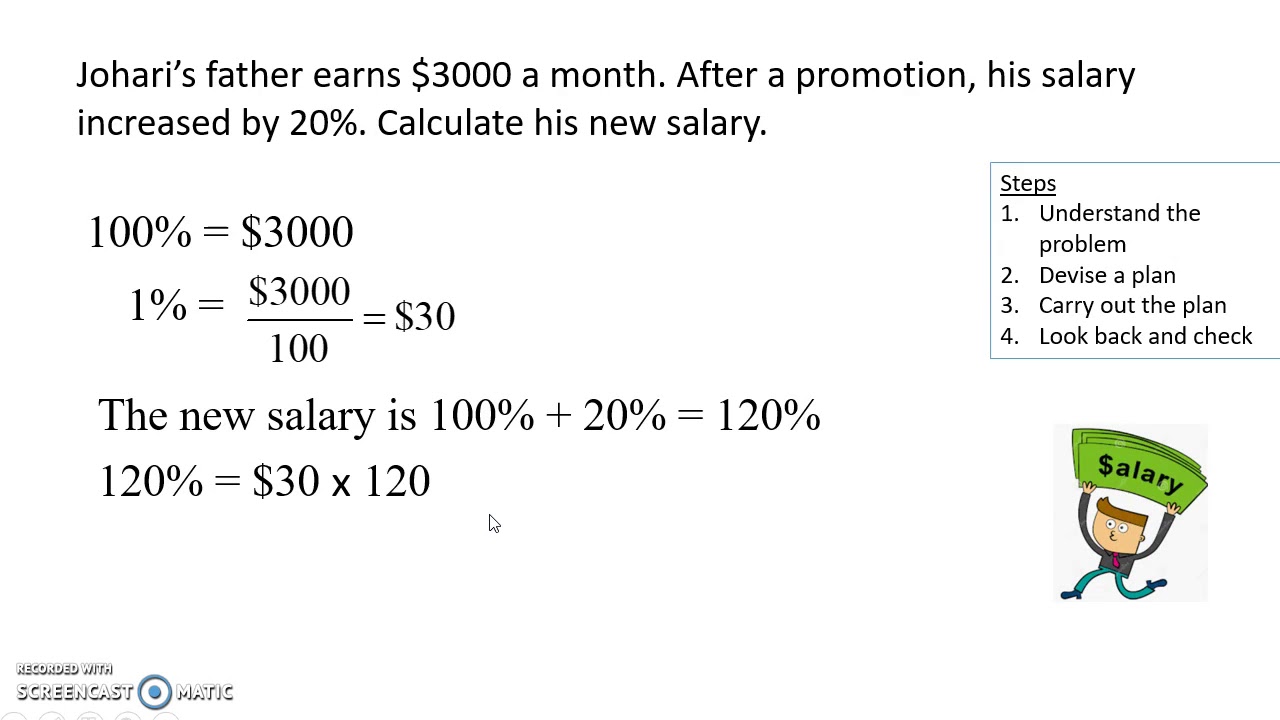

The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000 Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use this gross up calculator to determine the take home or net amount based on gross pay Perfect for any net to gross pay calculations

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

More picture related to How Do I Calculate My Gross Pay From Net Pay

How Many Biweekly Pay Periods In 2023 W2023C

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

Chapter 3 Big Book AminaLearose

https://i.ytimg.com/vi/N62rvXjNkRE/maxresdefault.jpg

How To Calculate Percentage Increase In Pay Haiper News Com

https://i.ytimg.com/vi/ABPGV3AVa6A/maxresdefault.jpg

Gross Pay or Salary Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance Some people refer to this calculation as a unit rate conversion The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

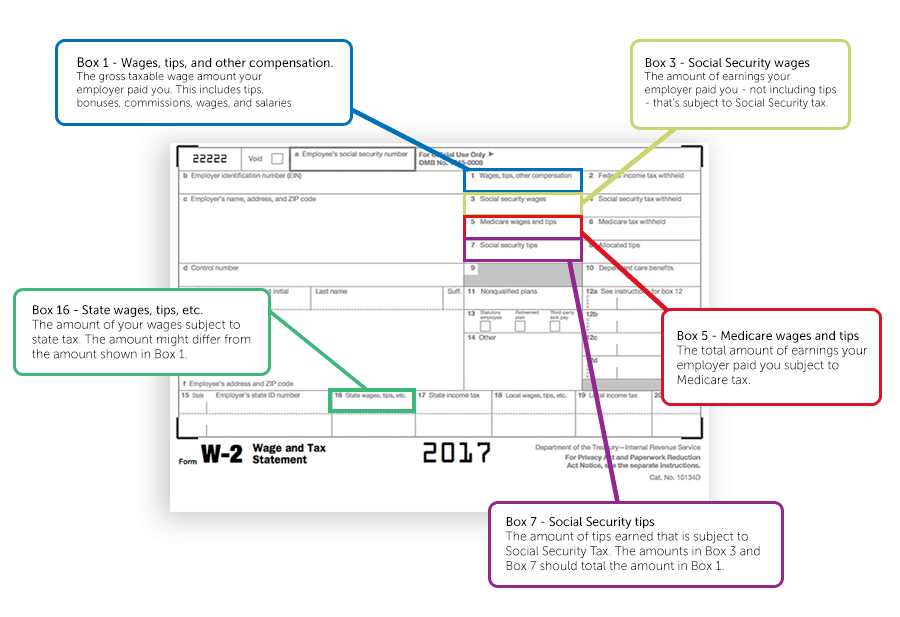

For example if an employer offers you a sales position with a base salary of 50 000 plus a bonus of 2 500 your gross income for the year would be 52 500 Related Gross Pay vs Net Pay Definitions and Examples Gross pay vs W 2 pay Gross pay represents the full amount paid to an employee while a W 2 determines taxable wages Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

Dear Santa All I Want Is My Gross Pay Pictures Photos And Images For Facebook Tumblr

https://cache.lovethispic.com/uploaded_images/436187-Dear-Santa-All-I-Want-Is-My-Gross-Pay.jpg

Completing A Financial Fellowship InvestingDoc

https://investingdoc.com/wp-content/uploads/2017/07/car-financial-fellowship-for-doctors.png

How Do I Calculate My Gross Pay From Net Pay - Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use this gross up calculator to determine the take home or net amount based on gross pay Perfect for any net to gross pay calculations