How Do I Calculate Gross Salary From Net The gross price would be 40 25 40 40 10 50 Net price is 40 gross price is 50 and the tax is 25 You perform a job and your gross pay is 50 The income tax is 20 so your net income is 50 20 50 10 40 In both examples we had the same gross and net amounts but the tax percentage turned out to be different

Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use this gross up calculator to determine the take home or net amount based on gross pay Perfect for any net to gross pay calculations The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How Do I Calculate Gross Salary From Net

How Do I Calculate Gross Salary From Net

https://www.theskimm.com/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F2I9f42uTt5CFoE6lL1hkaK%2Fe29c898e1d4d77cb69dbe3cbdc1f8184%2F07.11.22_Gross_Pay_vs._Net_Pay_web.png&w=3840&q=75

:max_bytes(150000):strip_icc()/grossincome-ea78c4765b7b48999138d5512646f591.jpg)

What is Gross Income? Definition, Formula, Calculation, and Example

https://www.investopedia.com/thmb/ZUxFGX4_4C2GxrLojCa7j7O_57s=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/grossincome-ea78c4765b7b48999138d5512646f591.jpg

How To Calculate Gross Monthly Income (With Examples) - Zippia

https://www.zippia.com/wp-content/uploads/2021/07/how-to-calculate-gross-monthly-income-with-examples.png

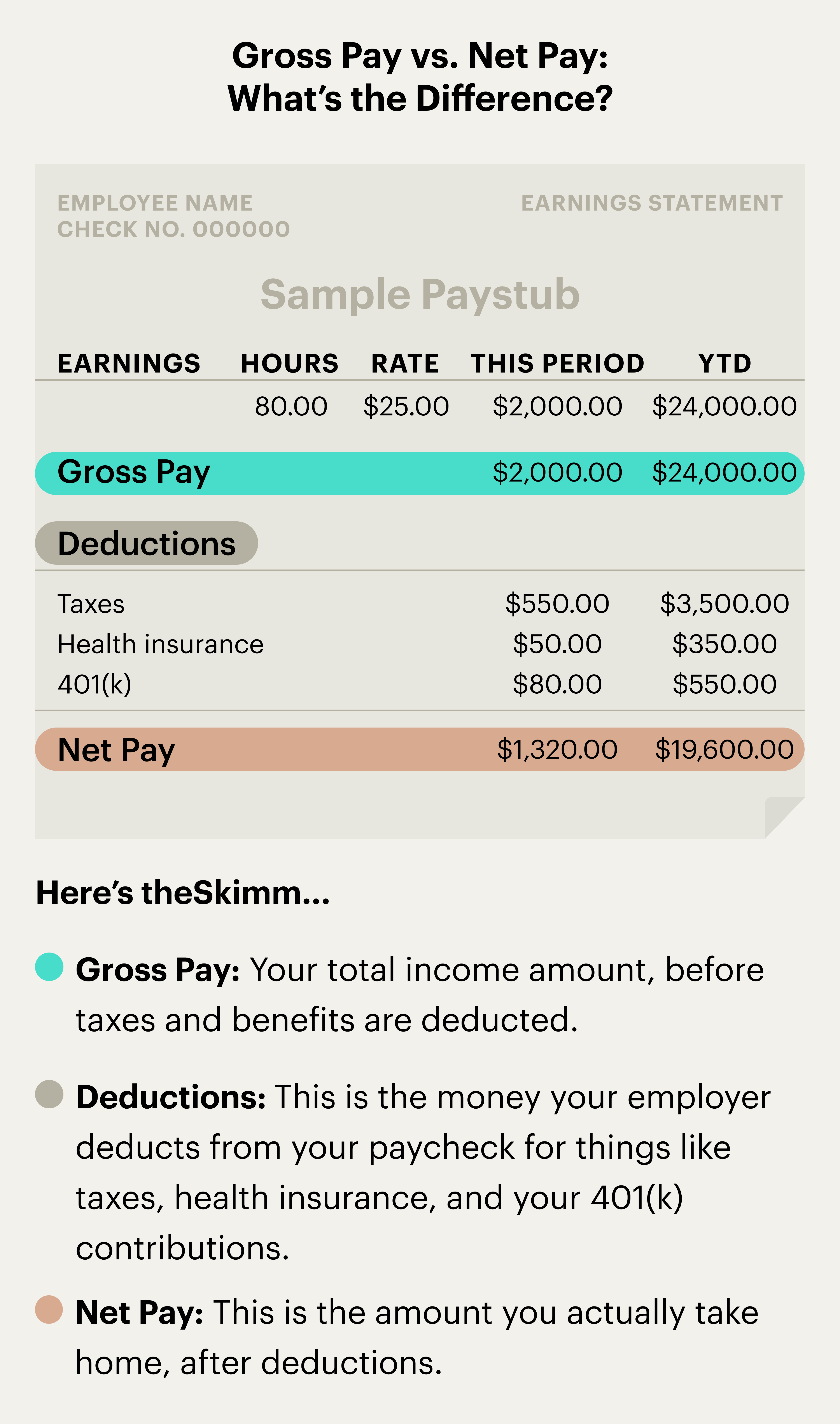

For SA residents Gross income means the total amount of worldwide income that you earned during the tax year excluding income that is of a capital nature Note that income is also money that is owed to you for work you performed even if not paid to you yet for example payment for a service that you performed Net pay is take home pay The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck Bi weekly Your net pay 26 Your bi weekly paycheck Semi monthly Your net pay 24 Your semi monthly paycheck

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would be as follows 40 regular hours x 20 per hour regular pay 800 10 overtime hours x 30 per hour regular pay x 1 5 300 800 regular pay 300 overtime pay 1 100 gross pay for the pay period

More picture related to How Do I Calculate Gross Salary From Net

Gross pay definition | What it is & how to calculate it | Sage Advice US

https://www.sage.com/en-us/-/media/images/sagedotcom/master/products/sage-50-refresh/us/sage50_payroll_ui_960x500.png?h=1000&la=en-US&w=1920&hash=2672963C11ED5976494381DF8D57EFD7

3 Ways to Read a Pay Check Stub - wikiHow

https://www.wikihow.com/images/thumb/0/0a/Read-a-Pay-Check-Stub-Step-10-Version-2.jpg/aid1069189-v4-1200px-Read-a-Pay-Check-Stub-Step-10-Version-2.jpg

Gross vs. Net Revenue | Formula + Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/04/07230848/Net-Revenue-Formula.jpg

To calculate your salary after taxes Determine the gross salary Express the tax rate as a fraction dividing it by 100 for example 10 10 100 0 1 Use the formula for the salary after taxes Net salary Gross salary 1 Tax rate Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates 1 minus 2965 0 7035 Then we ll divide the net pay 700 by the rate 0 7035 700 divided by 0 7035 is 995 00 this number totals the gross payment 995 x 2965 is 295 00 this number equals the total tax withheld 995 295 700 this is the net bonus the employee should receive So the gross up or extra pay the employer

Annual Income Calculator

https://i.ytimg.com/vi/QbX6kuk4gAk/maxresdefault.jpg

:max_bytes(150000):strip_icc()/netincome-ad82b5ea402c4da3afcb362685f2710b.jpg)

Net Income (NI) Definition: Uses, and How to Calculate It

https://www.investopedia.com/thmb/Y78b33L8Zfja9d-3e51GBvbWvR4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/netincome-ad82b5ea402c4da3afcb362685f2710b.jpg

How Do I Calculate Gross Salary From Net - If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would be as follows 40 regular hours x 20 per hour regular pay 800 10 overtime hours x 30 per hour regular pay x 1 5 300 800 regular pay 300 overtime pay 1 100 gross pay for the pay period