How To Calculate Gross Wages From Net Net vs gross As mentioned before net is an amount before we add the tax when the tax is added to the base amount as with VAT or sales tax or after we deduct it as with the income tax This distinction is very important Consider two examples You are a shop owner and you sell a huge chocolate bar for 40

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Use this gross pay to net pay calculator to gross up wages based on net pay For example if an employee receives 500 in take home pay it will calculate the gross amount that must be used when calculating payroll taxes It determines the amount of gross wages before taxes and deductions that are withheld given a specific take home pay amount

How To Calculate Gross Wages From Net

How To Calculate Gross Wages From Net

https://static.paystubdirect.com/uploads/2022/01/how-to-calculate-w2-wages-from-paystub.png

W2 With Full Social Security Number SocialSecurityGuide

https://www.socialsecurityguide.net/wp-content/uploads/2022/10/understanding-your-forms-w-2-wage-tax-statement.png

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

A gross wage is the amount an employee earns as compensation for services performed for an employer prior to all payroll deductions for taxes benefits or wage garnishments It s also the value that s commonly referred to when discussing compensation with new hires But what happens after pay negotiations are over Simply enter the amount of net pay you want your employee to receive along with some details about any withholding preferences from their Form W 4 and our gross up calculator will do the math To get started click the button below Start calculating now Updated June 28 2023 Why use a gross up

Self employed people pay up to 15 3 in federal self employment taxes this is because you ll need to pay your Social Security and Medicare taxes as both the employer and the employee As a traditional employee you might be used to seeing such taxes withheld from your paycheck but those should have only added up to 7 65 of your wages Gross Pay To calculate an employee s gross pay start by identifying the amount owed each pay period Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed Salary employees divide the annual salary by the number of pay periods each year This number is the gross pay

More picture related to How To Calculate Gross Wages From Net

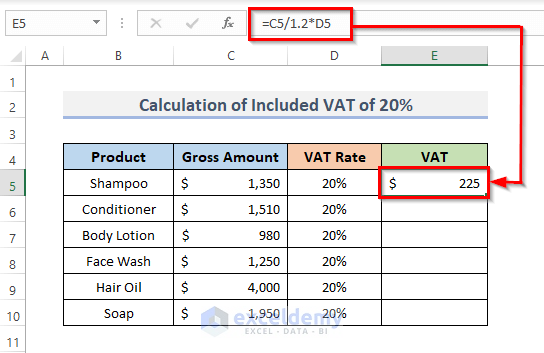

How To Calculate VAT From Gross Amount In Excel 2 Examples

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-vat-from-gross-in-excel-2.png

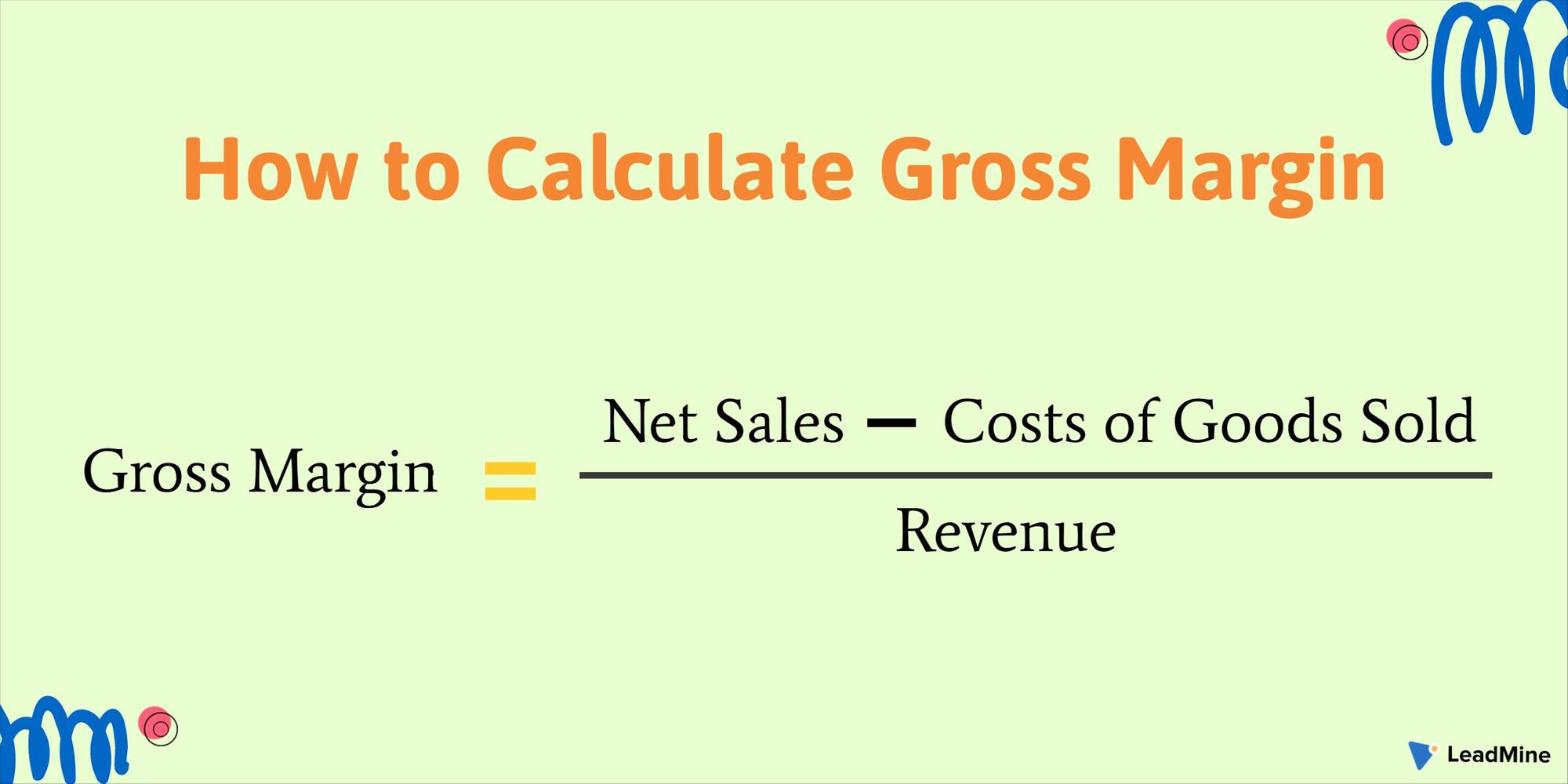

Gross Margin Definition Formula Profit Margin Vs Gross Margin

https://www.leadmine.net/glossary/content/images/2021/04/Calculate-Gross-Margin.jpeg

Top 8 How To Calculate Gross Annual Income 2022

https://www.bookkept.com.au/wp-content/uploads/2020/10/invoice-bill-paid-payment-financial-account-concept.jpg

Adjusted gross income AGI is an individual s taxable income after accounting for deductions and adjustments For companies net income is the profit after accounting for all expenses and taxes 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

Is Base Salary The Same As Gross Pay

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

![]()

Salary Wages Icon Salary Mania

https://cdn3.iconfinder.com/data/icons/sustainable-development-volume-4/500/Wages_and_Salaries-512.png

How To Calculate Gross Wages From Net - The Ascent Knowledge Payroll What Are Gross Wages A Small Business Guide Updated Aug 5 2022 First published on May 18 2022 By Ryan Lasker Many or all of the products here are from our