What Happens When Puts Expire Out Of The Money If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option

For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying A put option is OTM if its strike price is below the price of the underlying stock 3 An options contract gives the owner the right but not the obligation to buy in the case of a call or sell in the case of a put the underlying security at the strike price on or before the option s expiration date When the owner claims the right i e

What Happens When Puts Expire Out Of The Money

What Happens When Puts Expire Out Of The Money

https://www.tastingtable.com/img/gallery/what-really-happens-when-you-eat-these-expired-foods/l-intro-1663695601.jpg

Welcome To The Stonk Market The Verge

https://cdn.vox-cdn.com/thumbor/FVXl3IWd2A0mHCzUGj_aatxWFMs=/0x73:1875x1128/1600x900/cdn.vox-cdn.com/uploads/chorus_image/image/70073805/VRG_ILLO_4825_Future_of_Money_Lede.0.gif

What Does Out Of The Money In Options Mean YouTube

https://i.ytimg.com/vi/tdsqyFhjO8k/maxresdefault.jpg

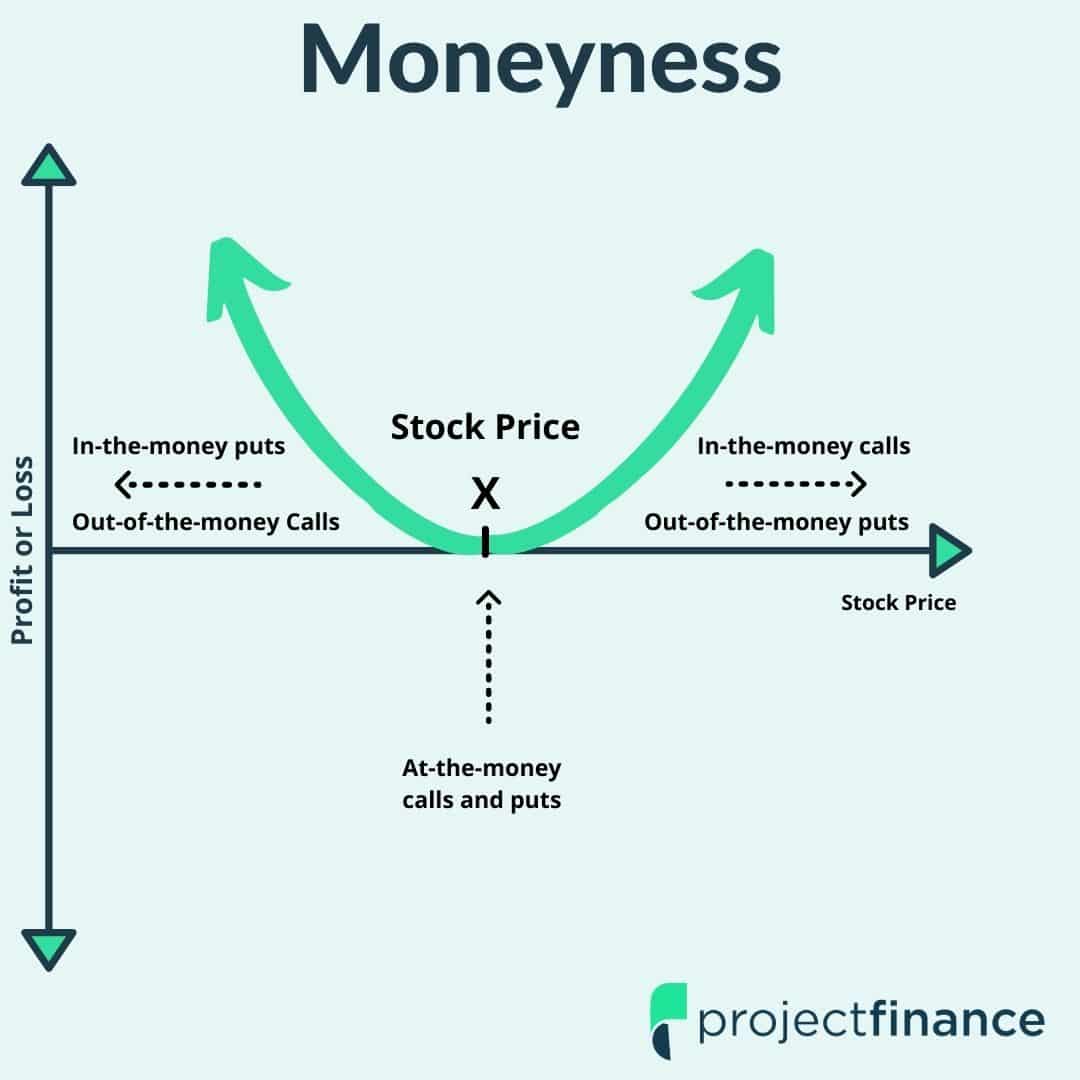

If the option expires unprofitable or out of the money nothing happens and the money paid for the option is lost A put option increases in value meaning the premium rises as the price of the In the Money and Out of the Money It Makes a Difference The first thing you need to understand about what happens when options expire is whether they re in the money ITM or out of the money OTM Simply put if executing the option could make a profit it s ITM If it wouldn t be profitable it s OTM

Out Of The Money OTM Out of the money OTM is term used to describe a call option with a strike price that is higher than the market price of the underlying asset or a put option with a In the case of a short equity put the writer pays cash and in return receives the stock Please Note Deliverables are subject to change Out of The Money Short Options The 100 call will be in the money and the 110 call will expire out of the money Your defined risk trade of 10 000 00 has now changed to you assuming a potentially a

More picture related to What Happens When Puts Expire Out Of The Money

What Does In The Money And Out Of The Money Mean YouTube

https://i.ytimg.com/vi/72NliHqgQ7c/maxresdefault.jpg

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

Expired Pharmaceuticals Tips For Getting More Money For Your Outdated

https://www.alliantrx.com/wp-content/uploads/2020/05/Medicine-expired-date.jpg

Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would A put option put is a contract that gives the owner the right to sell an underlying security at a set price strike price before a certain date expiration The seller sets the

Generally options are auto exercised assigned if the option is ITM by 0 01 or more Assuming your spread expires ITM completely your short leg will be assigned and your long leg will be exercised For short credit spreads this will result in your max loss which is calculated by taking the Credit Received MINUS the Spread Width multiplied Consider what happens when the stock closes at 49 99 on a Friday The option is out of the money by one penny because the price to purchase was dropping and this market maker MM did not get the stock price they wanted Puts that expire out of the money will be worthless but OTM puts can still create profitable trades if the price of

Side Effects Of Eating Expired Foods Eat This Not That

https://www.eatthis.com/wp-content/uploads/sites/4/2020/05/moldy-food.jpg

Selling An Out Of The Money Put For Earnings YouTube

https://i.ytimg.com/vi/Y5HTlyd44k8/maxresdefault.jpg

What Happens When Puts Expire Out Of The Money - Out Of The Money OTM Out of the money OTM is term used to describe a call option with a strike price that is higher than the market price of the underlying asset or a put option with a