What To Do When Options Expire Out Of The Money In the money options can pose a significant risk to traders going into expiration This is unlike out of the money options which expire worthless post expiration and require no action It is almost always best to trade out of in the money options before the closing bell on the expiration day If no action is taken both long options and short

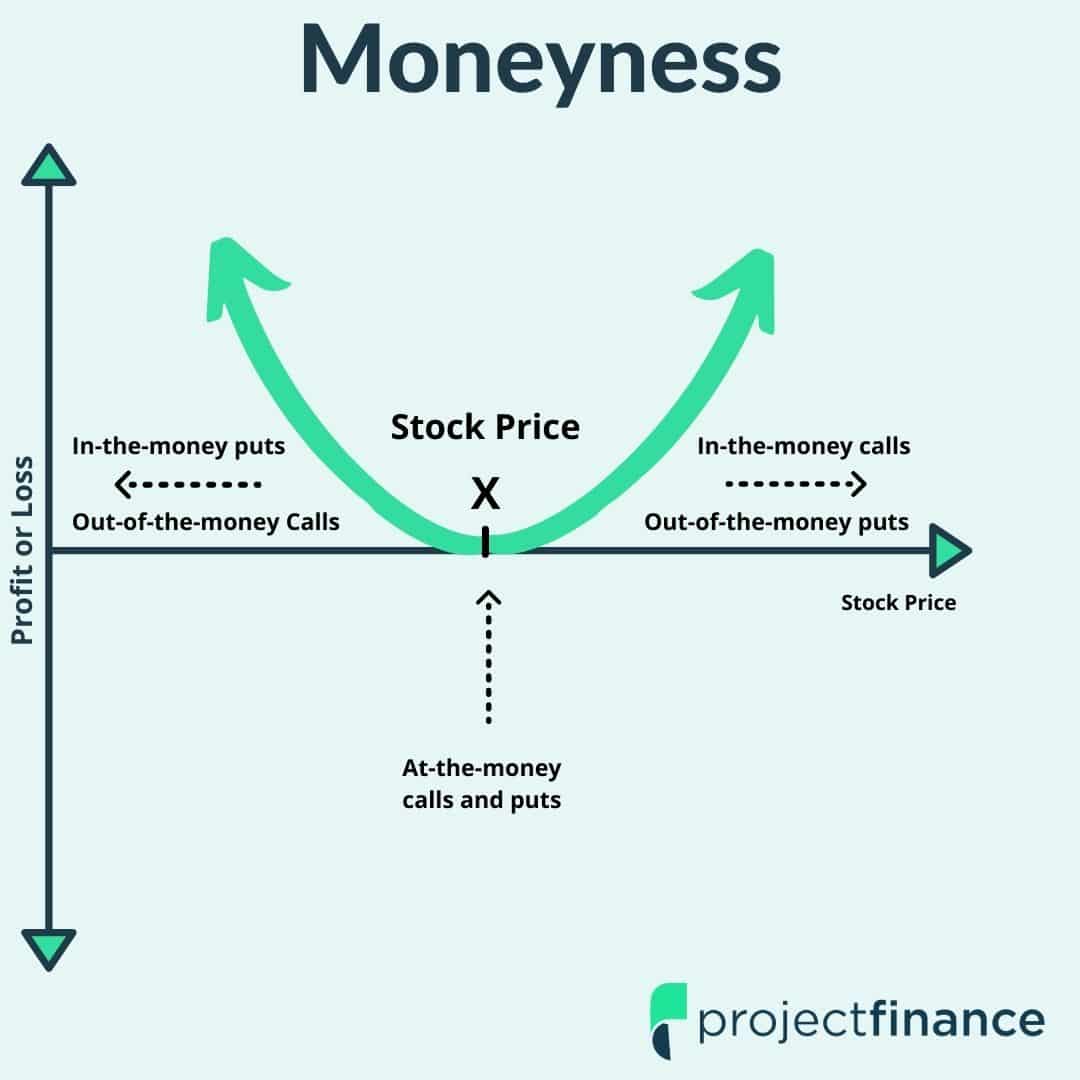

Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying security is bought and sold at the strike price of the option Moneyness Options can either be in the money ITM at the money ATM or out of the This guide can help you navigate the dynamics of options expiration So your trading account has gotten options approval and you recently made that first trade say a long call in XYZ with a strike price of 105 Then expiration day approaches and at the time XYZ is trading at 105 30 Wait The stock s above the strike

What To Do When Options Expire Out Of The Money

What To Do When Options Expire Out Of The Money

https://cdn.vox-cdn.com/thumbor/FVXl3IWd2A0mHCzUGj_aatxWFMs=/0x73:1875x1128/1600x900/cdn.vox-cdn.com/uploads/chorus_image/image/70073805/VRG_ILLO_4825_Future_of_Money_Lede.0.gif

What Does Out Of The Money In Options Mean YouTube

https://i.ytimg.com/vi/tdsqyFhjO8k/maxresdefault.jpg

5 Tips On What To Do When You Want To Get A Divorce

https://www.reverbtimemag.com/reverb_images/blog_images/5-tips-on-what-to-do-when-you-want-to-get-a-divorce16649483511.jpg

Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would Fair enough Solution 1 Never get down to options expiration with in the money options Be proactive with your trades Solution 2 Close out the in the money option completely This may be difficult into options expiration as the liquidity will dry up and you will be forced to take a worse price

1 You can buy or sell to close the position prior to expiration 2 The options expire out of the money and worthless so you do nothing 3 The options expire in the money usually resulting in a trade of the underlying stock if the option is exercised There s a common misconception that 2 is the most frequent outcome Expiration Time A specified time after which the options contract is no longer valid The expiration time gives a more specific deadline to an options contract on top of the expiration date by

More picture related to What To Do When Options Expire Out Of The Money

What Does In The Money And Out Of The Money Mean YouTube

https://i.ytimg.com/vi/72NliHqgQ7c/maxresdefault.jpg

How Out Of The Money Option Trading Can Benefit You Option Buying

https://i.ytimg.com/vi/IWZXCm40Awg/maxresdefault.jpg

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

Option Expiration Expiration Day typically occurs Friday or Thursday if that is the last trading day of the week However certain securities may also have Monday Wednesday or Quarterly expiration days Automatic Exercise on Expiration Day If you hold an expiring long option through expiration day that is a 0 01 or more in the money the OCC Options Clearing Corporation will All options have an expiration date It is part of the creation and listing of all new series of calls and puts on the various underlying stocks ETFs indexes and futures on which options are made available to buy and sell The expiration date is the end of the contract the last day the owner of the option has the right to buy or sell the underlying asset at the strike price

Expiration Date Derivatives An expiration date in derivatives is the last day that an options or futures contract is valid When investors buy options the contracts gives them the right but The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14

:no_upscale():format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/22967610/VRG_ILLO_4825_Future_of_Money_Lede.gif)

Welcome To The Stonk Market The Verge

https://duet-cdn.vox-cdn.com/thumbor/0x0:1875x1200/1200x1200/filters:focal(938x600:939x601):no_upscale():format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/22967610/VRG_ILLO_4825_Future_of_Money_Lede.gif

Stock Options Expiration Date Explained How Do They Work

https://investingfuse.com/wp-content/uploads/2022/01/stock-options-expiration-date.png

What To Do When Options Expire Out Of The Money - Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would