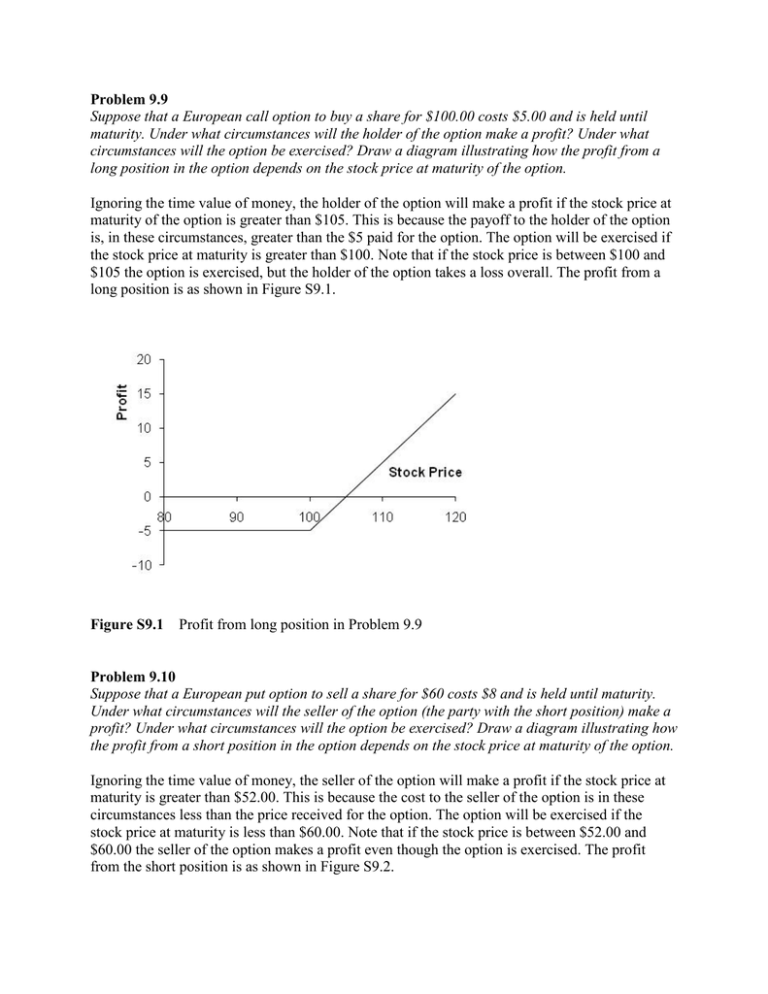

What Happens When A Put Credit Spread Expires Out Of The Money This would result in a 2 00 loss per contract but you keep the 0 40 initial net credit You would have the full loss of 1 60 on the spread AAPL closes on 20 MAY at 95 00 or anywhere between 94 and 96 Your 96 00 call is out of the money and would expire worthless You have an obligation to deliver shares of stock at 94 00

A put credit spread is a neutral to bullish options strategy with defined risk and reward This means that you will have a max profit and a max loss that is known before you execute the trade Put That will take two ticks off for the bid ask spread We would then buy the 1000 strike for about 1 60 again this is adjusted for the bid ask spread This would give us a credit of 1 50 3 10 1

What Happens When A Put Credit Spread Expires Out Of The Money

What Happens When A Put Credit Spread Expires Out Of The Money

https://i.ytimg.com/vi/oorzMWebPSc/maxresdefault.jpg

How To Sell A Put Credit Spread In Small Accounts Make Money Selling

https://i.ytimg.com/vi/_k1A7YXdCpU/maxresdefault.jpg

Option Strategies Put Credit Spread

https://fractalerts.com/templates/yootheme/cache/option-strategies-put-credit-spread-5a247f54.jpeg

The difference between your buy and sell price is 5 000 However because you brought in 1 500 when the spread was established your net loss is only 3 500 This will be the case at any price below 65 Therefore this spread is only advantageous over uncovered puts if XYZ drops below 64 50 For example by selling a 10 000 cash secured put with a 30 day expiration targeting a 1 5 yield you can generate 150 For put credit spreads even if you risk 5 000 half the amount you could sell ten 5 width bull put credit spreads earning 50 per contract resulting in a total premiums of 500

The put spread will likely expire worthless and you ll keep the 100 credit minus transaction costs By selling the 90 strike put and buying the 80 strike put for example your credit would be 1 45 2 0 55 1 45 which is 145 per spread in exchange for a maximum risk of 8 55 or 855 per spread the difference between the The bull put spread strategy has other names It is also known as a credit put spread and as a short put spread The term bull refers to the fact that the strategy profits with bullish or rising stock prices The term credit refers to the fact that the strategy is created for a net credit or net amount received

More picture related to What Happens When A Put Credit Spread Expires Out Of The Money

Are Debit Spreads Safer Than Credit Spreads Leia Aqui Is Debit Spread

https://www.projectfinance.com/wp-content/uploads/2022/01/credit-spread-pros.png

How To Trade Credit Spreads Simpler Trading

https://cdn.simplertrading.com/2022/04/01135107/1.jpg

Payoff Vs Profit Diagram Short Beerlasopa

https://s2.studylib.net/store/data/018109939_1-c0c129f8f8b2900c73811311ced56bce-768x994.png

A bull put spread involves being short a put option and long another put option with the same expiration but with a lower strike The short put generates income whereas the long put s main purpose is to offset assignment risk and protect the investor in case of a sharp move downward Because of the relationship between the two strike prices the investor will always receive a premium credit A Put Credit Spread which we will refer to as a PCS is a Options Spread that utilizes both short and long puts to minimize risk and earn credit When you open a PCS you are writing

Generally options are auto exercised assigned if the option is ITM by 0 01 or more Assuming your spread expires ITM completely your short leg will be assigned and your long leg will be exercised For short credit spreads this will result in your max loss which is calculated by taking the Credit Received MINUS the Spread Width multiplied Bull Put Spread A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset This strategy is constructed by purchasing

:no_upscale():format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/22967610/VRG_ILLO_4825_Future_of_Money_Lede.gif)

Welcome To The Stonk Market The Verge

https://duet-cdn.vox-cdn.com/thumbor/0x0:1875x1200/1200x1200/filters:focal(938x600:939x601):no_upscale():format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/22967610/VRG_ILLO_4825_Future_of_Money_Lede.gif

Selling An Out Of The Money Put For Earnings YouTube

https://i.ytimg.com/vi/Y5HTlyd44k8/maxresdefault.jpg

What Happens When A Put Credit Spread Expires Out Of The Money - For example by selling a 10 000 cash secured put with a 30 day expiration targeting a 1 5 yield you can generate 150 For put credit spreads even if you risk 5 000 half the amount you could sell ten 5 width bull put credit spreads earning 50 per contract resulting in a total premiums of 500