What Happens If My Put Option Expires Out Of The Money In the money options can pose a significant risk to traders going into expiration This is unlike out of the money options which expire worthless post expiration and require no action It is almost always best to trade out of in the money options before the closing bell on the expiration day If no action is taken both long options and short

If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

What Happens If My Put Option Expires Out Of The Money

What Happens If My Put Option Expires Out Of The Money

https://i.ytimg.com/vi/USf1LPjU934/maxresdefault.jpg

Here s What Happens When Options Expire In The Money Projectfinance

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

What Happens When A Call Or Put Expires Out Of The Money In Robinhood

https://i.ytimg.com/vi/oorzMWebPSc/maxresdefault.jpg

Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying security is bought and sold at the strike price of the option Moneyness Options can either be in the money ITM at the money ATM or out of the Options can be either out of the money at the money or in the money When a put option expires in the money the contract holder s stake in the underlying security is sold at the strike price

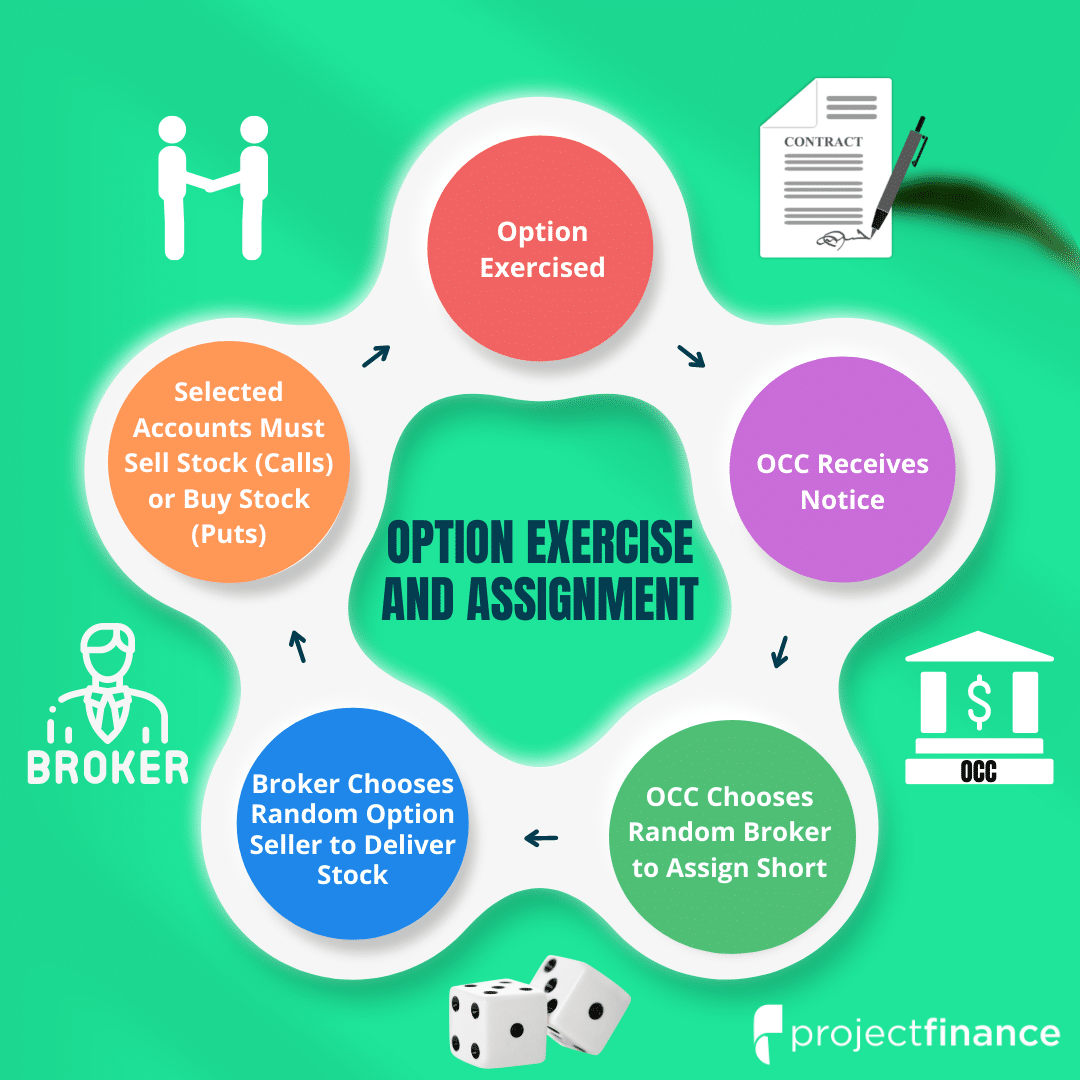

Expiration day Check your account TQE reports some unexpected bad news stock price drops to 54 75 Unfortunately John was in business meetings all day and didn t know that TQE fell so quickly Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money The buyer owner of an option has the right but not the obligation to exercise the option on or before expiration A call option 5 gives the owner the right to buy the underlying security a put option 6 gives the owner the right to sell the underlying security Conversely when you sell an option you may be assigned at any time regardless of the ITM amount if the option owner

More picture related to What Happens If My Put Option Expires Out Of The Money

What Happens When An Option Expires In The Money

https://financhill.com/blog/wp-content/uploads/2021/09/Untitled-design-94.jpg

What Happens When An Option Expires In The Money On Robinhood YouTube

https://i.ytimg.com/vi/HqqxRiuf6mY/maxresdefault.jpg

Welcome To The Stonk Market The Verge

https://cdn.vox-cdn.com/thumbor/FVXl3IWd2A0mHCzUGj_aatxWFMs=/0x73:1875x1128/1600x900/cdn.vox-cdn.com/uploads/chorus_image/image/70073805/VRG_ILLO_4825_Future_of_Money_Lede.0.gif

For both types of options this deadline is the third Friday of the expiration month An investor normally has until 4 30 p m CT on the third Friday of the month to instruct their broker to A put option put is a contract that gives the owner the right to sell an underlying security at a set price strike price before a certain date expiration The seller sets the

Options expiration is the date at which an option s contract expires The expiration date is usually set by a market maker who acts as a middleman between buyers and sellers of options In most cases this happens automatically when you buy or sell an option contract An option s expiration date can be different than the exercise date Option Expiration Expiration Day typically occurs Friday or Thursday if that is the last trading day of the week However certain securities may also have Monday Wednesday or Quarterly expiration days Automatic Exercise on Expiration Day If you hold an expiring long option through expiration day that is a 0 01 or more in the money the OCC Options Clearing Corporation will

Put Option Example And Problems Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2022/09/put-option.png

_121721.png)

The Ultimate Guide To Option Moneyness ITM OTM ATM

https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/61bd0a563a1dc20dd09b508d_1257975_OptionMoneyness_03_LongCall(OTM)_121721.png

What Happens If My Put Option Expires Out Of The Money - After a week the stock drops in value down to 19 share Your contract is in the money and you can exercise the option to sell that stock at a premium of 1 share Obviously this is the ideal outcome And it s something you can enjoy at a high rate of consistency when you leverage the VectorVest system more on that later