Salary Tax Rate In Philippines Tax rates for income subject to final tax For resident and non resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to final tax usually passive investment income is 20 For non resident aliens not engaged in trade or business in the Philippines the rate is a flat 25

Find out how much income tax you need to pay in 2024 with this easy to use tax calculator for the Philippines Compare different scenarios and plan your budget The tax reform law introduced a new tax structure resulting in higher take home pay for employees in the Philippines Income taxes are expected to go down further with the new graduated rates starting January 1 2023

Salary Tax Rate In Philippines

Salary Tax Rate In Philippines

https://live.staticflickr.com/65535/52575587835_9656887d20_o.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

https://www.fitsnews.com/wp-content/uploads/2020/12/income-tax-rates.jpeg

Learn how to compute income tax from the manual method using the tax table to the most straightforward option of using online tax calculators Discover the Philippines tax tables for 2022 including tax rates and income thresholds Stay informed about tax regulations and calculations in Philippines in 2022

Use this income tax in the Philippines calculator to help you quickly determine your income tax as a Filipino citizen your benefits contributions and your net pay after tax and deductions On this page you will find links to current and historical tax tables for Philippines which provide detailed information on different tax rates and how they may affect you Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax when factoring in social security

More picture related to Salary Tax Rate In Philippines

Philippine Personal Income Tax Rates 2018 Ines Gopez Amarante And Co

https://4.bp.blogspot.com/-VJPwpwy2J6c/Wk2p9iYTF6I/AAAAAAAAAIA/l4oNgQLl4tkv5PnjDSy-tOfFemMbiH2XgCLcBGAs/s1600/Personal%2BIncome%2BTax%2B-%2BTRAIN%2B2018.jpg

Salary Tax Rate Hong Kong For Expats Learn More

https://premiatnc.com/hk/wp-content/uploads/2023/03/Salary-tax-rate-Hong-Kong-min.jpg

What Is The Tax Rate In America

https://www.usaexpattaxes.com/wp-content/uploads/2022/04/US-tax-rate.png

Under the TRAIN tax table in the Philippines taxpayers earning below 250 000 per year are still exempted from paying personal income tax in 2023 and onwards Those who have an annual income of more than 250 000 but less than 8 million pay a tax rate of 15 to 30 starting in 2023 For context the previous rate used to be 20 to 32 Welcome to the 2022 Income Tax Calculator for Philippines which allows you to calculate Income Tax Due the Effective Tax Rate and the Marginal Tax Rate based on your taxable income in Philippines in 2022 On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income

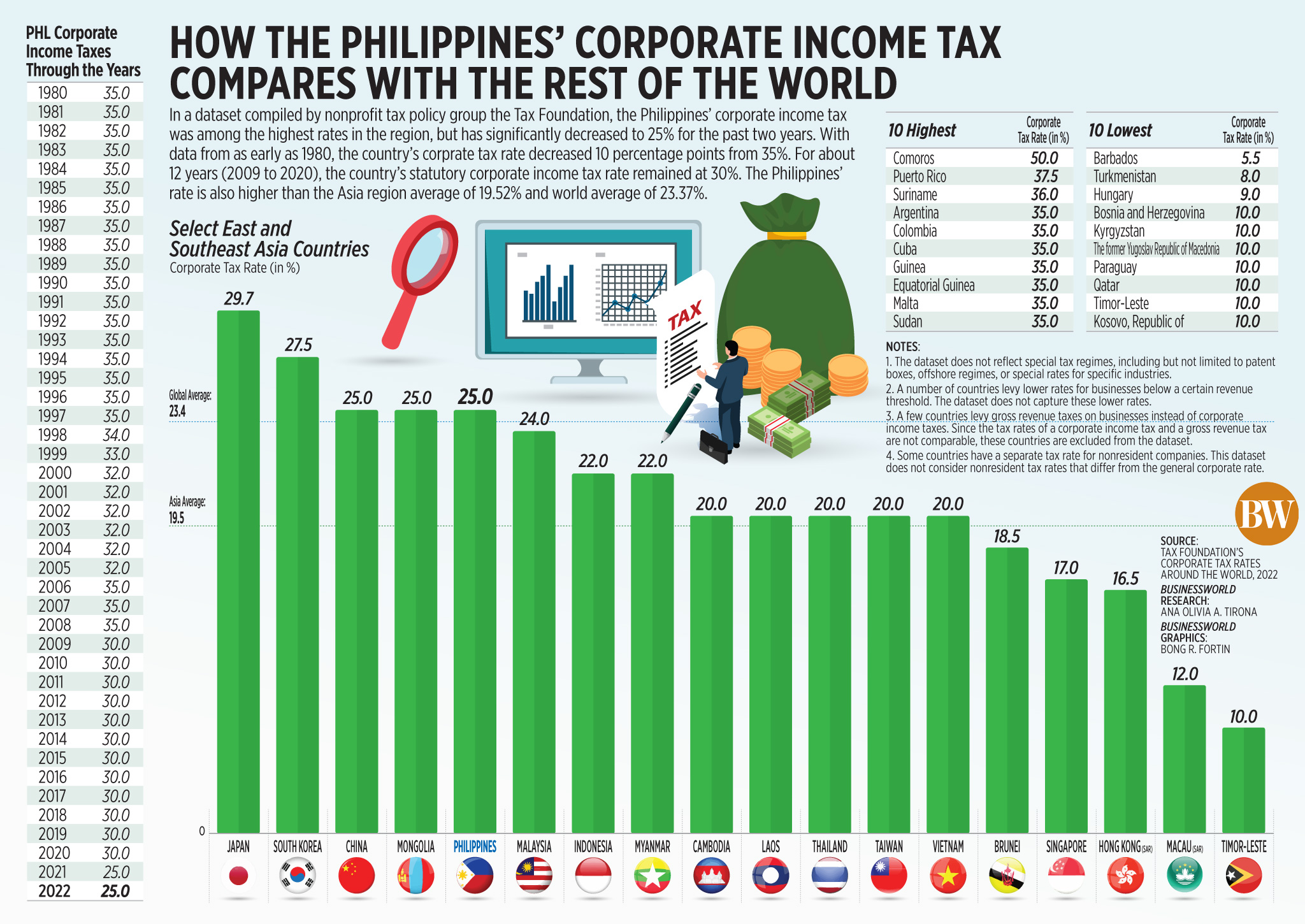

This tax guide discusses everything you need to know about taxes from the TIN and its role in taxation to different tax forms and how to pay taxes Meanwhile a foreign corporation with a branch in the Philippines is subject to taxation on the income generated in the country Branch taxable income is calculated in the same way as subsidiary taxable income Effective from July 1 2020 Philippine corporations are taxed at a rate of 25 from 30

2019 Income Tax Philippines Table Carfare me 2019 2020

http://business.inquirer.net/files/2016/08/tax-rates.jpg

BIR Implements New Tax Rates For 2023 CloudCfo

https://cloudcfo.ph/wp-content/uploads/2023/01/Taxable-Income-Table-1.png

Salary Tax Rate In Philippines - Learn how to compute income tax in the Philippines in 2024 Follow these steps to calculate your income tax return tax due and tax payable