Income Tax Rate In The Philippines 2016 Capital Gain Tax Rate in Philippines For real property capital gain tax rate is 6 Deadline is Within 30 days after each sale exchange transfer or other disposition of real property Withholding Tax Rate in Philippines Types of taxable income Tax rate For non resident

The new income tax rates from year 2023 onwards as per the TRAIN law are as follows Taxable Income per Year Income Tax Rate Year 2023 onwards P250 000 and below 0 Above P250 000 to P400 000 15 of the excess over P250 000 Above P400 000 to P800 000 P22 500 20 of the excess over P400 000 Estimated Income Tax Brackets and Rates In 2016 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 The top marginal income tax rate of 39 6 percent will hit taxpayers with taxable income of 415 050 and higher for single filers and 466 950 and higher for married filers

Income Tax Rate In The Philippines 2016

Income Tax Rate In The Philippines 2016

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

BIR Implements New Tax Rates For 2023 CloudCfo

https://cloudcfo.ph/wp-content/uploads/2023/01/Taxable-Income-Table-1.png

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

https://www.fitsnews.com/wp-content/uploads/2020/12/income-tax-rates.jpeg

Based on the revised withholding tax table of BIR since this taxable income is above 20 833 and below 33 332 we subtract 20 833 from 28 175 to get 7 342 Finally we calculate 20 of the taxable income for this compensation range to arrive at a tax value of 7 342 0 2 1 468 40 KPMG s individual income tax rates table provides a view of individual income tax rates around the world a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited a private English company limited by guarantee

1 Determine the standard deduction by multiplying the gross income by 40 Php 840 000 x 0 40 Php 336 000 2 To get the taxable income subtract the OSD from the gross income Php 840 000 Php 336 000 Php 504 000 3 Refer to the BIR s graduated tax table for the applicable tax rate In depth view into Philippines Taxes on Income Profits and Capital Gains including historical data from 1990 to 2021 charts and stats 2016 41 95 December 31 2015 41 34 Average Growth Rate 0 79 Value from 1 Year Ago 35 18 Change from 1 Year Ago 0 78 Frequency Yearly Unit Percent of Revenue Adjustment

More picture related to Income Tax Rate In The Philippines 2016

State Taxes Can Add Up Wealth Management

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

Cukai Pendapatan How To File Income Tax In Malaysia Jobstreet Malaysia

https://media.graphassets.com/j9n1ArmpRreKvI9fooEq

Tax at 71 2 percent These rates may be reduced if a relevant tax treaty applies The withholding tax on dividends paid to a non resident foreign corporation may be reduced to a lower rate if the country in which the corporation is domiciled allows a credit for taxes deemed paid in the Philippines tax sparing 2016 2015 2014 2013 2017 Philippine Capital Income and Financial Intermediation Statistics Philippine Public Finance and Related Statistics 2020 Tax Information Income Tax Calculator FAQs Sitemap Find Us 8th Floor EDPC Building BSP Complex Roxas Boulevard cor Pablo Ocampo St Manila

The taxable income of Php 225 600 falls under the first bracket which means the tax rate is 0 Since the taxable income is below the Php 250 000 tax exemption the employee should not pay tax on compensation income 2 Computation of income tax due on business income Using the 8 tax rate Get the annual gross income Php 15 000 x 12 months Income business tax computed as follows Annual gross sales receipts not exceeding the VAT threshold P3 Million 8 of gross sales receipts and other income in excess of P250 000 in lieu of the graduated income tax rates and percentage tax no option to register for VAT OR graduated income tax rates of 0 to 35 on net taxable income 3

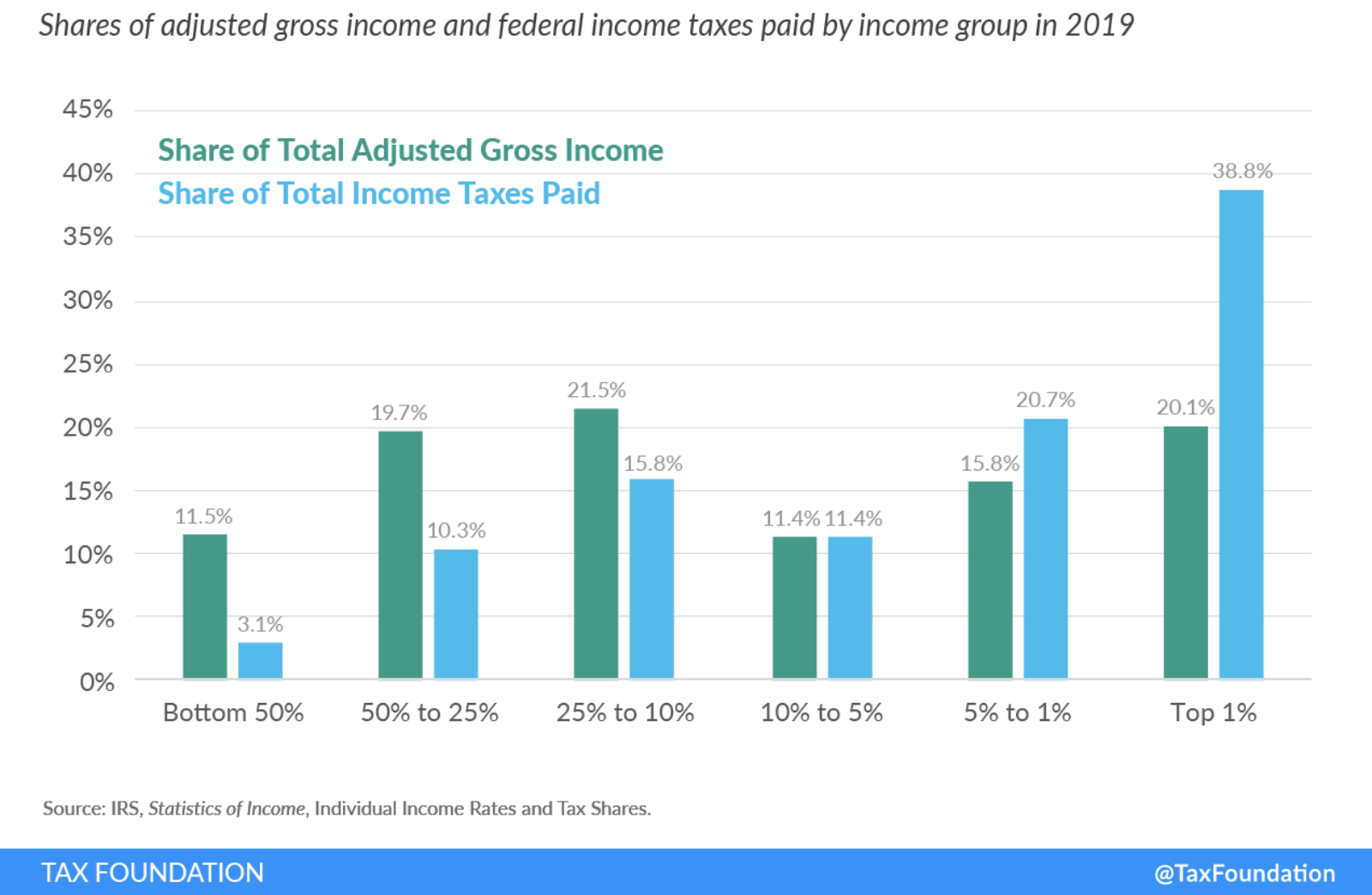

Half Of US Taxpayers Pay 97 Of Income Taxes BRINK Conversations

https://www.brinknews.com/wp-content/uploads/2022/04/FedData2022_1-1600x0-c-default.png

2019 Income Tax Philippines Table Carfare me 2019 2020

http://business.inquirer.net/files/2016/08/tax-rates.jpg

Income Tax Rate In The Philippines 2016 - 1 Determine the standard deduction by multiplying the gross income by 40 Php 840 000 x 0 40 Php 336 000 2 To get the taxable income subtract the OSD from the gross income Php 840 000 Php 336 000 Php 504 000 3 Refer to the BIR s graduated tax table for the applicable tax rate