Corporate Income Tax Rate In Philippines The corporate tax rate in the Philippines is 25 with a minimum corporate income tax MCIT of 2 on gross income However until June 30 2023 the MCIT is temporarily reduced to 1 There are lower tax rates available for corporations with net taxable income under 5 million PHP and total assets below 100 million PHP

Corporate income tax is levied on a corporation s profits typically comprised of business and trade income In computing taxable income standard business expenses can be deducted Instead of itemised deductions a foreign and domestic corporation may choose to compute taxable income for the taxable quarter year using the optional standard The Corporate Income Tax Rate in the Philippines is a critical factor for businesses to consider Understanding the Corporate Income Tax Rate in the Philippines helps ensure compliance and effective tax planning Regular Corporate Income Tax RCIT Rate 25 for corporations with a taxable income exceeding PHP 5 million For corporations with

Corporate Income Tax Rate In Philippines

Corporate Income Tax Rate In Philippines

https://i.ytimg.com/vi/cAHQECPu95E/maxresdefault.jpg

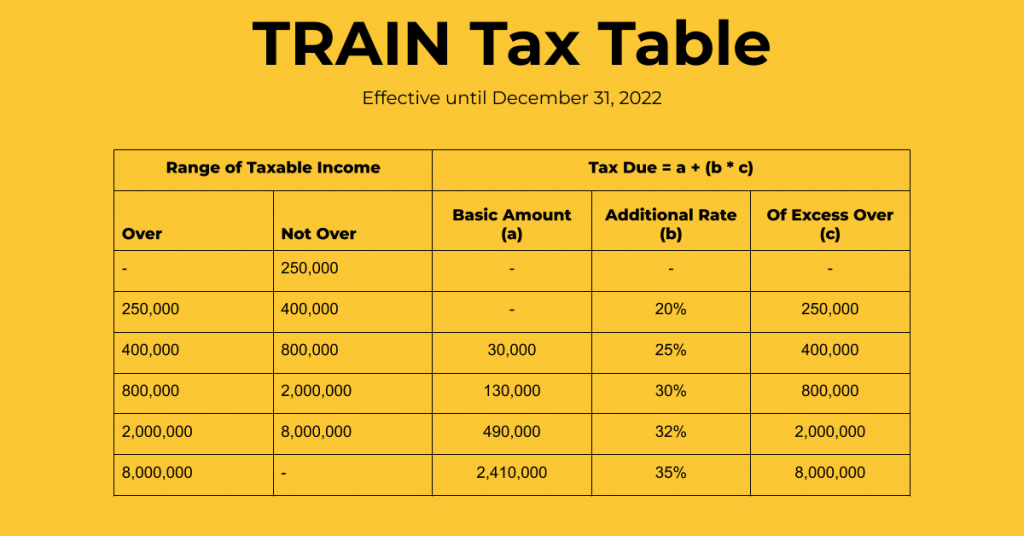

Income Tax Rate Philippines 2021 Olin Barone

https://cdn.taxumo.com/wp-content/uploads/2019/07/train-tax-table-1024x536.png

States With The Lowest Corporate Income Tax Rates Infographic

https://assets.entrepreneur.com/article/1398974418-states-lowest-corporate-income-tax-rates-infographic.jpg

Here are some points to consider in the preparation of 2023 Annual ITR in Philippines I Income Tax Rate 20 25 2 MCIT 5 GIT ITH Republic Act R A No 11534 otherwise known as Corporate Recovery for Tax Incentives and Enterprises CREATE Act amending further the Tax Code of the Philippines has changed among others the tax There is a minimum corporate income tax MCIT of 2 on gross income but a temporary reduction to 1 is in effect from 1 July 2020 to 30 June 2023 Tax Rate Overview In the Philippines corporations face a standard income tax rate of 25 with a preferential 20 rate for smaller enterprises meeting specific income and asset criteria

Graduated tax rates corporate income tax CIT rates domestic corporation varies between 2 to 25 resident foreign corporation varies between 2 5 to 10 non resident foreign corporation varies between 4 5 to 25 capital gains tax CGT rates varies between 0 6 to 15 withholding tax WHT rate for residents and non The Philippines applies a tax arbitrage rule on deductible interest that reduces the allowable deduction for interest expenses by 20 of the interest income subject to final tax This is intended to bridge the gap between the ordinary corporate income tax rate of 25 and the final tax rate on interest income which is generally 20

More picture related to Corporate Income Tax Rate In Philippines

BIR Implements New Tax Rates For 2023 CloudCfo

https://cloudcfo.ph/wp-content/uploads/2023/01/Taxable-Income-Table-1.png

2019 Income Tax Philippines Table Carfare me 2019 2020

http://business.inquirer.net/files/2016/08/tax-rates.jpg

Corporate Tax Definition And Meaning Market Business News

https://i2.wp.com/marketbusinessnews.com/wp-content/uploads/2016/09/Corporate-tax-rates-in-the-United-States.jpg?resize=610%2C667

In the Philippines corporations face a 25 income tax rate with certain entities eligible for exemptions or a reduced rate of 20 If you re operating a domestic corporation or a resident foreign corporation you re subjected to this 25 corporate income tax on your Philippine source income The Corporate Tax Rate in Philippines stands at 25 percent Corporate Tax Rate in Philippines averaged 30 66 percent from 1997 until 2025 reaching an all time high of 35 00 percent in 1997 and a record low of 25 00 percent in 2022 source Bureau of Internal Revenue

[desc-10] [desc-11]

Corporate Income Tax And Effective Tax Rate Download Table

https://www.researchgate.net/profile/Alban-Elshani/publication/277327805/figure/download/tbl2/AS:668937700257800@1536498584860/Corporate-Income-Tax-and-effective-tax-rate.png

Company Income Tax Malaysia Jacob Berry

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Corporate Income Tax Rate In Philippines - The Philippines applies a tax arbitrage rule on deductible interest that reduces the allowable deduction for interest expenses by 20 of the interest income subject to final tax This is intended to bridge the gap between the ordinary corporate income tax rate of 25 and the final tax rate on interest income which is generally 20