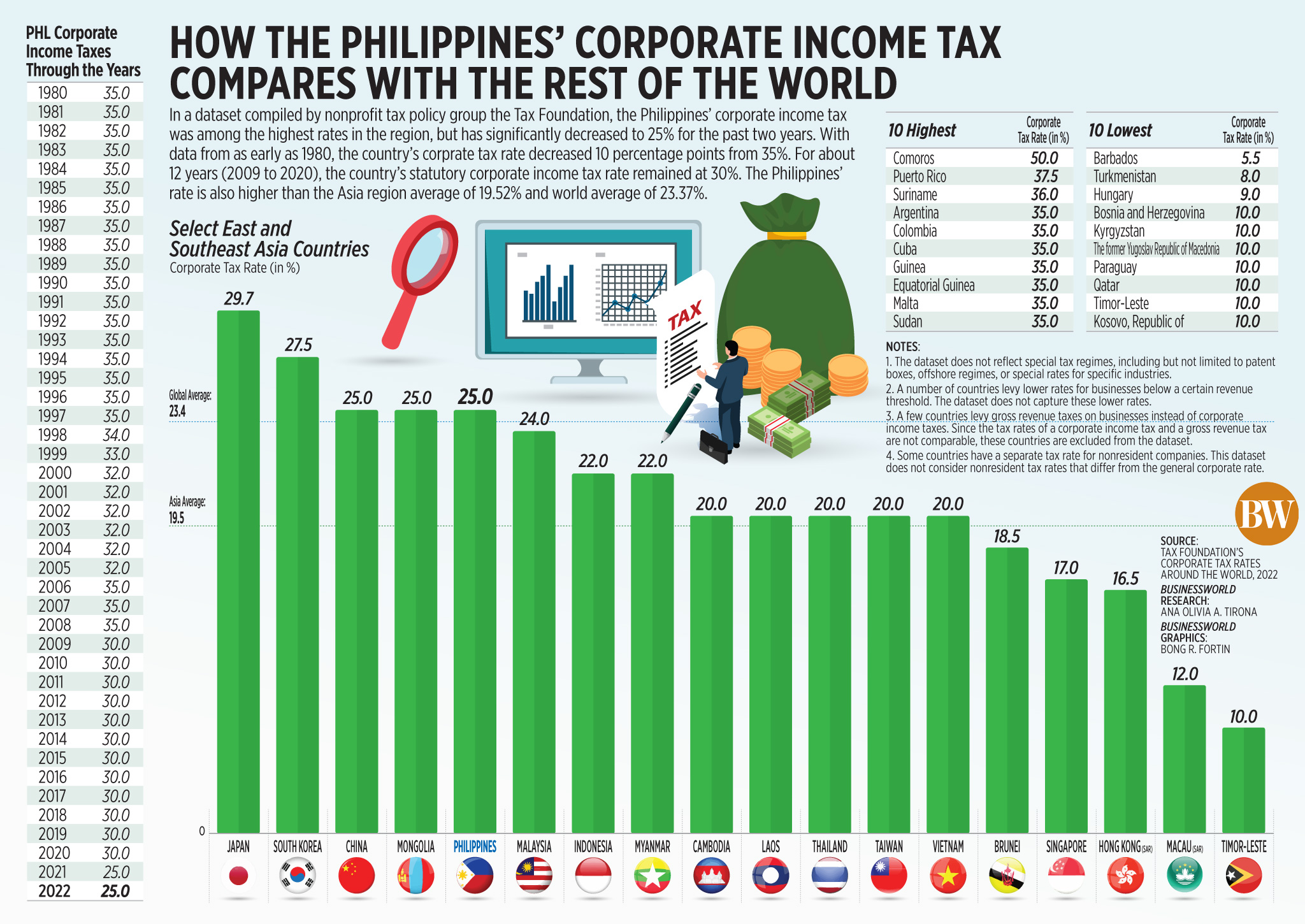

Salary Tax Rate Philippines 2022 Philippines Tax Tables 2022 Tax Rates and Thresholds in Philippines Philippines Residents Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from 000 00 to 250 000 00 20 Income from 250 000 01 to

The Bureau of Internal Revenue BIR Website www bir gov ph is a transaction hub where the taxpaying public can conveniently access anytime anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances including information on BIR Programs and Projects It also contains copy of the Tax Code BIR Forms Zonal Values of real properties and Here are the BIR Tax Tables for 2022 and some points on income tax and other tax related concerns that prospective and current employees should note Resident citizens receiving income from sources within or outside the Philippines whose annual income exceeds PhP250 000 Your tax rate goes up as your taxable income increases

Salary Tax Rate Philippines 2022

Salary Tax Rate Philippines 2022

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

Philippines Corporate Tax Rate 1997 2021 Data 2022 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=phlcorptax&v=202107132317V20200908

8 tax on gross sales receipts and other non operating income in excess of PHP 250 000 in lieu of the graduated income tax rates and percentage tax business tax or the graduated tax rates Business income subjected to graduated tax rates shall also be subject to business tax i e 12 VAT or 3 percentage tax as applicable The calculator is updated with the latest tax rates and brackets as per the 2022 tax year in Philippines This tool is designed for simplicity and ease of use focusing solely on income tax calculations For a more detailed assessment including other deductions or specific tax advice consult a tax professional

Philippines Annual Salary After Tax Calculator 2022 The Annual Salary Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income The calculator is designed to be used online with mobile desktop and tablet devices What are the income tax rates in the Philippines in 2022 Philippines Residents Income Tax Tables in 2022 Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from 0 00 to 250 000 00 20 Income from 250 000 01 There are seven federal income tax rates in 2022 The revised withholding table

More picture related to Salary Tax Rate Philippines 2022

BIR Implements New Tax Rates For 2023 CloudCfo

https://cloudcfo.ph/wp-content/uploads/2023/01/Taxable-Income-Table-1.png

How The Philippines Corporate Income Tax Compares With The Rest Of The

https://live.staticflickr.com/65535/52575587835_9656887d20_o.jpg

2022 Tax Brackets PersiaKiylah

https://www.kitces.com/wp-content/uploads/2021/09/01-Ordinary-Income-Tax-Rates-Under-The-Proposed-Legislation-1.png

Estimate your take home pay after income tax in the Philippines with our easy to use salary calculator Taxable Income PHP Tax Rate First 250 000 0 From 250 000 to 400 000 20 The data here for the Philippines was last reviewed in 2022 Step 3 Compute your income tax base on your salary taxable income and income tax rate Base on what s on the column 2 our Prescribed Minimum Withholding Tax is 0 00 15 over Compensation Level CL Relax this is relatively easy to compute Let s break this one by one First we have fixed 0 00 tax

[desc-10] [desc-11]

2022 Tax Rate Schedules Latest News Update

https://i2.wp.com/3.bp.blogspot.com/-xTk92mpRwC4/XGQO_r085XI/AAAAAAAAC-A/07M9e5o3yeA7O6YeHogZ7rsNqiZaqaR4gCLcBGAs/s1600/2018-%2B2022%2B%2Band%2B2023%2Bonwards%2BIncome%2Btax%2Brates.JPG

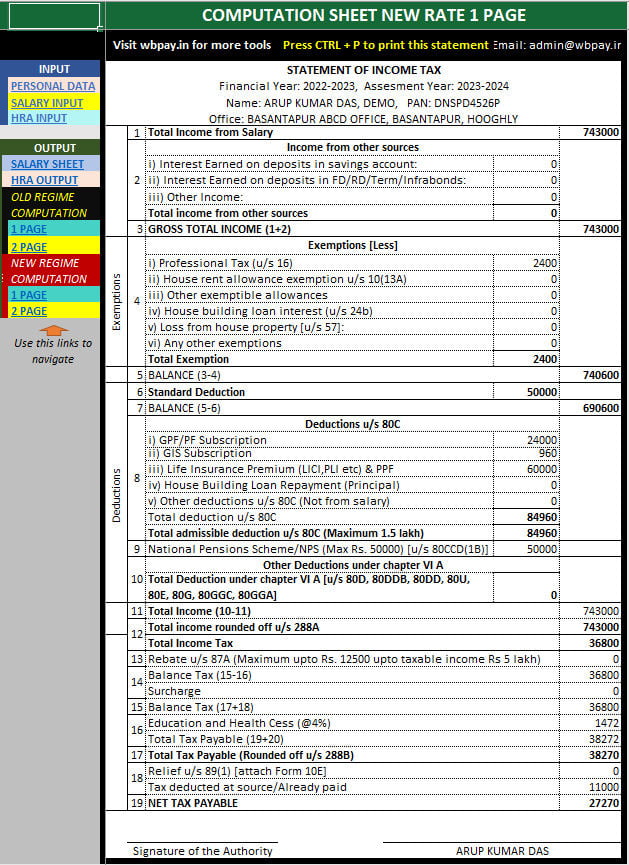

All In One Income Tax Calculator For The FY 2022 23

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

Salary Tax Rate Philippines 2022 - Philippines Annual Salary After Tax Calculator 2022 The Annual Salary Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income The calculator is designed to be used online with mobile desktop and tablet devices