How To Compute Monthly Salary Philippines Calculate you Monthly salary after tax using the online Philippines Tax Calculator updated with the 2024 income tax rates in Philippines Calculate your income tax social security and pension deductions in seconds

Find out how much income tax you need to pay in 2024 with this easy to use tax calculator for the Philippines Compare different scenarios and plan your budget Calculate and compare your 2024 Monthly salary after tax to other salaries using the online Philippines Salary Comparison Calculator updated with the 2024 income tax rates in Philippines

How To Compute Monthly Salary Philippines

How To Compute Monthly Salary Philippines

https://pbs.twimg.com/media/DRK0BM-VoAAMpbF.jpg

Monthly pa DOLE Bureau Of Workers With Special Concerns Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1320891731334658

DIFFERENCE National Wages And Productivity Commission

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1880756785281554

Calculate your income tax in Philippines and salary deduction in Philippines to calculate and compare salary after tax for income in Philippines in the 2024 tax year How To Use BIR Tax Calculator Philippines Using this BIR Income Tax Calculator in the Philippines is quite simple and easy You just need to enter your monthly income and then use the calculator to compute your taxable income monthly tax due and Net Pay after deductions

Use this income tax in the Philippines calculator to help you quickly determine your income tax as a Filipino citizen your benefits contributions and your net pay after tax and deductions Estimate your take home pay after income tax in the Philippines with our easy to use salary calculator

More picture related to How To Compute Monthly Salary Philippines

How To Compute Tax On Monthly Salary Monthly Withholding Tax On

https://i.ytimg.com/vi/5dkPPFL84bw/maxresdefault.jpg

How To Compute Income Tax In The Philippines

http://www.thinkpesos.com/wp-content/uploads/2016/07/BIR-Tax-table.png

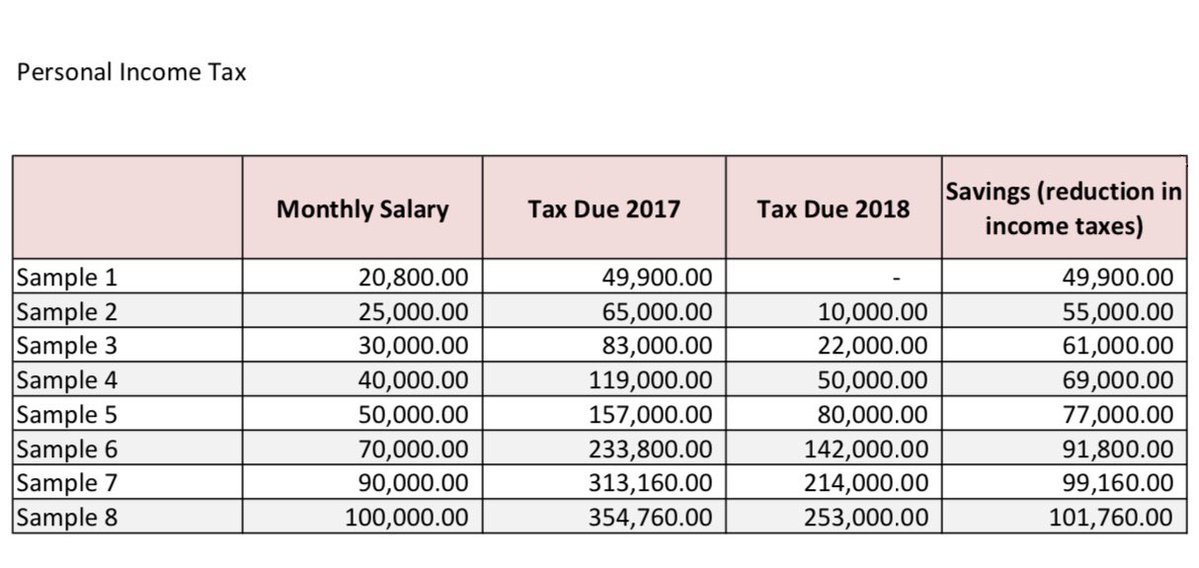

How To Compute Philippine BIR Taxes TRAIN Law PayrollHero Support

http://www.dof.gov.ph/taxreform/wp-content/uploads/2017/12/CTRP-Package-ONE-v2-17.png

How To Use the NTRC Income Tax Calculator Enter your gross monthly salary Under Monthly Mandatory Contributions choose SSS if you re a private employee or GSIS if you re a government employee Enter the total amount of 13th month pay and other benefits you ve received in a year Learn how to compute income tax in the Philippines in 2024 Follow these steps to calculate your income tax return tax due and tax payable

Learn how to compute income tax from the manual method using the tax table to the most straightforward option of using online tax calculators This is a very helpful app especially those who are receiving semi monthly salary Salary PH or Salary Philippines is a salary calculator app built for Filipinos to effortlessly compute their net income take home pay government mandated benefits like SSS GSIS Philhealth PAGIBIG and widthholding tax with computation based on the TRAIN law

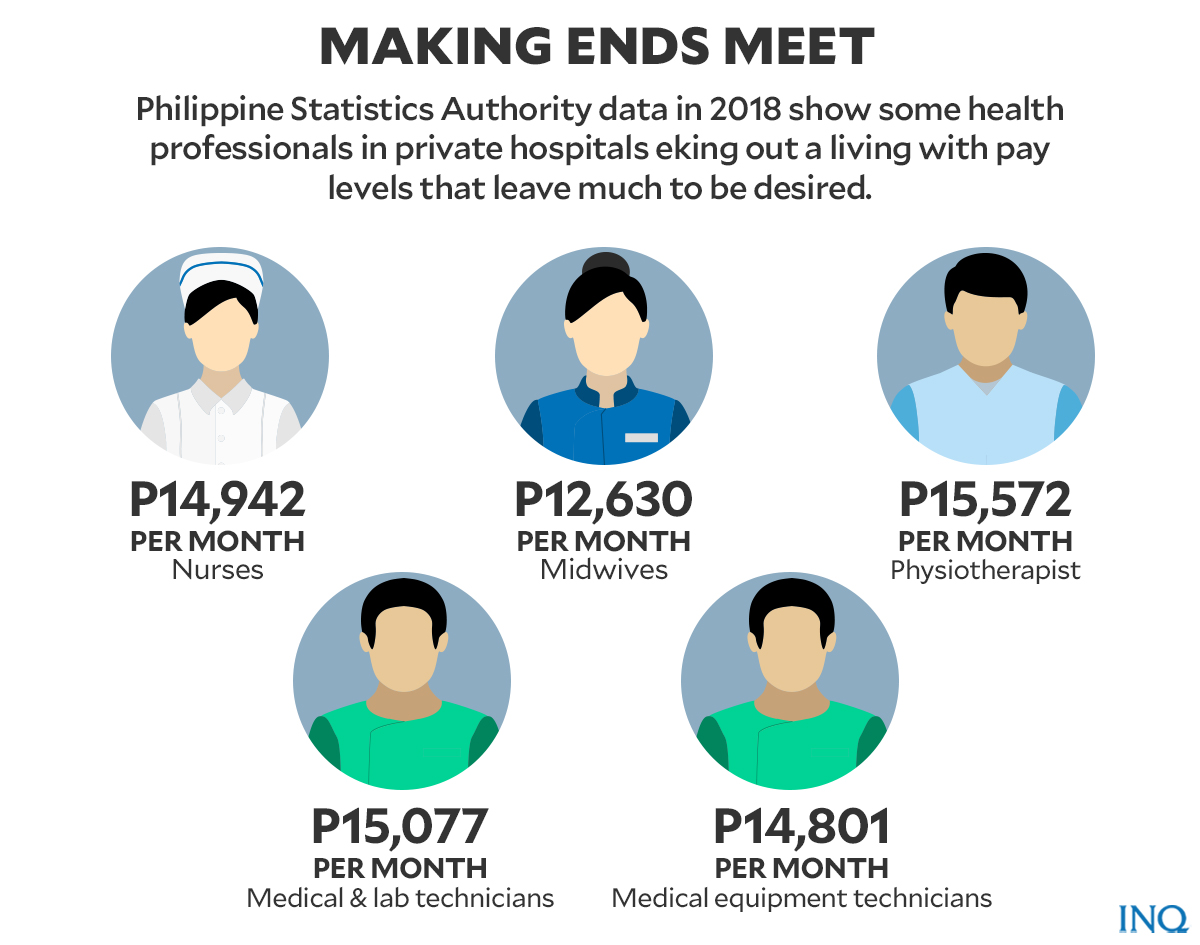

Researcher Salary Philippines Company Salaries 2023

https://newsinfo.inquirer.net/files/2021/06/unknown_1-2.jpg

How To Compute Separation Pay In 2023 In Philippines DOLE Calculator

https://netstorage-kami.akamaized.net/images/a68c08e0d7cfd13b.jpg

How To Compute Monthly Salary Philippines - Estimate your take home pay after income tax in the Philippines with our easy to use salary calculator