How To Compute Monthly Minimum Wage Philippines Daily rate Example Daily rate 500 00 of days worked 10 Total pay P500 00 x 10 P5 000 00 Monthly rate employees are paid a fixed amount per month If the payroll frequency is semi monthly the employee will receive half his her monthly rate per pay period If the employee incurred any absences late or undertime his her salary

Step 1 Daily Rate 500 PHP Step 2 Basic Salary Earned Daily Rate x Number of Days Worked Step 3 13th Month Pay Basic Salary Earned 12 Therefore the 13th month pay for an employee working 5 days a week who has worked for 7 months and 10 days with a daily rate of 500 PHP would be 6 833 33 PHP The minimum wage in the Philippines remained unchanged at 610 day in 2024 from 610 day in 2023 While modest in USD terms the minimum wage plays a vital role in ensuring decent living standards for Filipino workers and supporting economic development The monthly minimum wage in the Philippines when converted to USD may vary

How To Compute Monthly Minimum Wage Philippines

How To Compute Monthly Minimum Wage Philippines

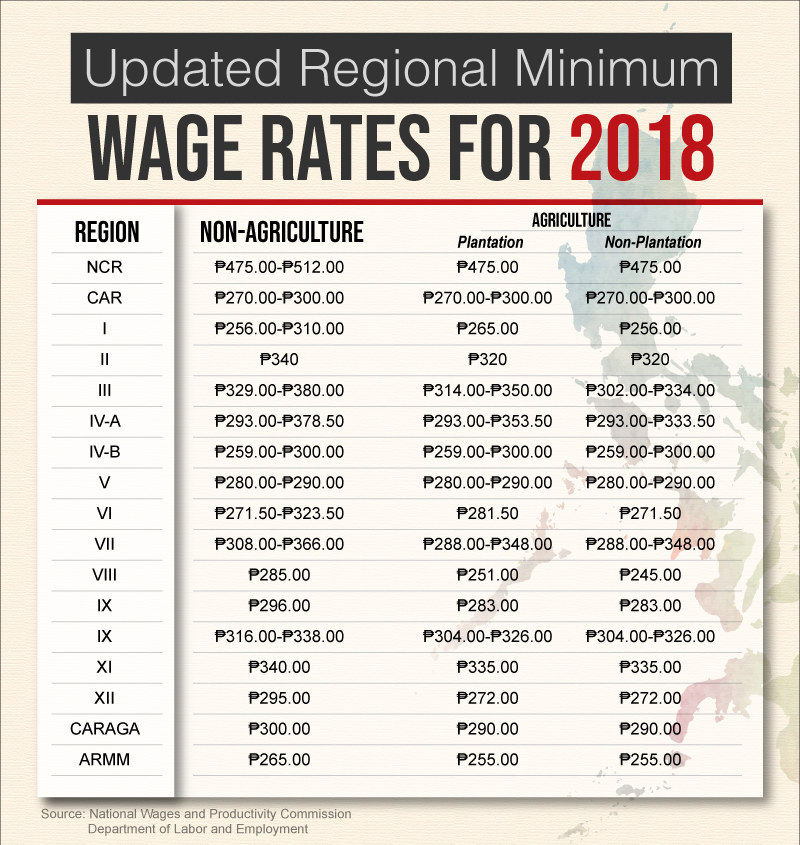

https://kittelsoncarpo.com/wp-content/uploads/2018/03/Wage-Rates-for-2018-opt.png

Here s A National Wages And Productivity Commission

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2141864185837478

Citing Steep Price Hikes DOLE Orders Wage Review Inquirer News

https://newsinfo.inquirer.net/files/2022/11/wage-11092022.jpg

Download Toll Pinas an app that you can use to find out the toll fee you need to pay for expressways in the Philippines Input Employment Type Type Private Employee Government Employee Self Employed Individual RHQ ROHQ Employee Minimum Wage Employee Payroll Period Period Daily Weekly Semi Monthly Monthly Annual Rates Rate To determine the equivalent monthly rate EMR simply multiply the statutory daily minimum wage by the denominator in Step 1 P481 00 a day multiplied by 313 days divided by 12 months equals P12 546 08 Alternatively you can convert the employee s actual monthly rate to daily rate to check whether or not such daily rate is equivalent to

Special days can be anything from company holidays to Employee Appreciation Day and the like The calculated daily rate is based on Daily rate x 130 Using the daily rate above as a basis P689 66 x 1 30 P896 56 For Special Working Days scheduled on an employee rest day the computation is Daily rate x 150 COLA or cost of living adjustment is applicable to everyone earning minimum wages in the private sector in the Philippines This includes employees regardless of their job position or employment status According to the Philippine Wage Order it also does not matter how they receive their compensation

More picture related to How To Compute Monthly Minimum Wage Philippines

How To Compute Night Differential In The Philippines With Free

https://filipiknow.net/wp-content/uploads/2022/06/how-to-compute-night-differential-1.png

How To Compute Philippine BIR Taxes TRAIN Law PayrollHero Support

http://www.dof.gov.ph/taxreform/wp-content/uploads/2017/12/CTRP-Package-ONE-v2-17.png

Minimum Wage Philippines 2021 Detailed

https://fastloans.ph/wp-content/uploads/2021/11/Philippines-Nominal-Minimum-Wage-Rates-2021.jpeg

The Board issues Wage Orders containing the prescribed minimum wage at a given time including the requirements and procedures for exemption thereof If granted an establishment may be exempted from complying with the minimum wage for a period of one 1 year It is recommended for an employer to inquire with the RTWPB for the prevailing rates Here are the minimum wage rates of some provinces in the Philippines Minimum wage in Bukidnon is Php 411 Php 438 Minimum wage in Surigao del Sur is Php 385 Minimum wage in Davao Oriental is Php 438 Php 443 Minimum wage in Quezon City is Php 610 Php 573 Minimum wage in Pampanga is Php 454 Php 500

There are 10 criteria for minimum wage fixing under RA 6727 and one under the Rules of Procedures for Minimum Wage Fixing categorized into four major groups namely 1 Needs of workers and their families demand for living wage wage adjustment vis vis CPI cost of living and changes therein The minimum wage in the Philippines can vary a lot depending on region In 2024 the minimum wage in Manila the capital city of the Philippines ranged from PHP 530 to PHP 610 per day depending on location and the classification of the business For an 8 hour day this would mean the minimum wage in the Philippines per hour is between PHP 66 25 and PHP 75 per hour

New Minimum Wage Rate In Northern Mindanao Iligan News

https://i0.wp.com/www.iligannews.com/storage/2022/06/new-minimum-wage-rate-in-mindanao.jpg?w=843&ssl=1

New Metro Manila Minimum Wage Set At P500 To P537

https://www.rappler.com/tachyon/r3-assets/F5E60AA790B449308915CDEA640B87B4/img/CDDC4709019E483A804801101D4A29D6/labor-day-job-fair-may-1-2018-005.jpg

How To Compute Monthly Minimum Wage Philippines - The computation of daily rate will be 11 000 x 12 312 423 08 423 08 is below minimum wage and you don t need to deduct withholding tax to the employees salary in fact at the time of this writing June 2016 423 08 is below minimum wage and should be increased to the correct minimum wage That rate will also be your basis when