How To Compute Monthly Salary Philippines 2023 Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSS GSIS PhilHealth and PAG IBIG mo sa mga expressway sa Pilipinas Download Toll Pinas an app that you can use to find out the toll fee you need to pay for expressways in the Philippines Input Employment Type Type Private

Calculate you Monthly salary after tax using the online Philippines Tax Calculator updated with the 2024 income tax rates in Philippines Calculate your income tax social security and pension deductions in seconds Philippines 2023 Income Tax Rates and thresholds Philippines 2022 Income Tax Rates and thresholds Advanced Features of the Philippines Income Tax Calculator Tax Assessment Year The tax assessment year is defaulted to 2024 you can change the tax year as required to calculate your salary after tax for a specific year Your Age You age is used to calculate specific age related tax credits and allowances in Philippines

How To Compute Monthly Salary Philippines 2023

How To Compute Monthly Salary Philippines 2023

https://netstorage-kami.akamaized.net/images/a68c08e0d7cfd13b.jpg

Paano Ang Tamang Pag Compute Ng 13th Month Pay

https://static.wixstatic.com/media/1c4fe7_506b8cdc908143d0ab01db74ab676312~mv2.png/v1/fill/w_1000,h_1000,al_c,q_90,usm_0.66_1.00_0.01/1c4fe7_506b8cdc908143d0ab01db74ab676312~mv2.png

Salary Slip Format Rewaminds

https://newdocer.cache.wpscdn.com/photo/20190827/77628f8f47614c8ca37c85581e680d82.jpg

Based on the revised withholding tax table of BIR since this taxable income is above 20 833 and below 33 332 we subtract 20 833 from 28 175 to get 7 342 Finally we calculate 20 of the taxable income for this compensation range to arrive at a tax value of 7 342 0 2 1 468 40 So the Net Pay after deductions is 30 452 45 on a monthly income of 35000 in the Philippines An Overview Of The Train Law The Tax Reform for Acceleration and Inclusion TRAIN Law was enacted in the Philippines on December 19 2017 It is an extensive tax reform package that amended several existing laws such as income taxes excise taxes value added taxes VAT real estate

Summary Enter your employment income into our salary calculator above to estimate how taxes in the Philippines may affect your finances You ll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when planning your Salary PH or Salary Philippines is a salary calculator app built for Filipinos to effortlessly compute their net income take home pay government mandated benefits like SSS GSIS Philhealth PAGIBIG and widthholding tax with computation based on the TRAIN law The Tax Reform for Acceleration and Inclusion law The app would be useful to starters who are planning for their asking salary

More picture related to How To Compute Monthly Salary Philippines 2023

How To Compute 13th month Pay In The Philippines NewstoGov

http://newstogov.com/wp-content/uploads/2020/10/13.png

13th Month Pay In The Philippines How To Compute The 13th Month Pay

https://filipiknow.net/wp-content/uploads/2020/04/how-to-compute-13th-month-pay-2.jpg

How To Compute Tax On Monthly Salary Monthly Withholding Tax On

https://i.ytimg.com/vi/5dkPPFL84bw/maxresdefault.jpg

Income Tax Tables to be applied from the year 2023 onwards Under TRAIN a taxable income of Php 250 000 will be subject to the rate of 20 to 35 for the year 2018 and 15 to 35 starting on 2023 In addition to this the deductible 13 th month pay and other benefits are now higher at Php 90 000 compared to Php 82 000 under the old NIRC law Graduated income tax rates for January 1 2023 and onwards How To Compute Your Income Tax Based on Graduated Rates Sample income tax computation for the taxable year 2020 Scenario 1 Employee with a gross monthly salary of Php 30 000 and receiving 13th month pay of the same amount Scenario 2 Employee with a gross monthly salary of Php

Step 2 Calculate the 8 Tax Rate To compute the 8 tax rate follow these steps Determine your total gross sales or receipts and other non operating income Subtract P250 000 from the total gross sales or receipts and other non operating income Multiply the result by 8 0 08 to get your income tax due To compute the income tax due multiply the difference by 8 Php 230 000 x 0 08 Php 18 400 Scenario 2 Call center employee with a gross monthly salary of Php 20 000 receiving 13th month pay of the same amount earning Php 15 000 monthly as a freelance photographer and availed of the 8 tax rate on business income 1

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

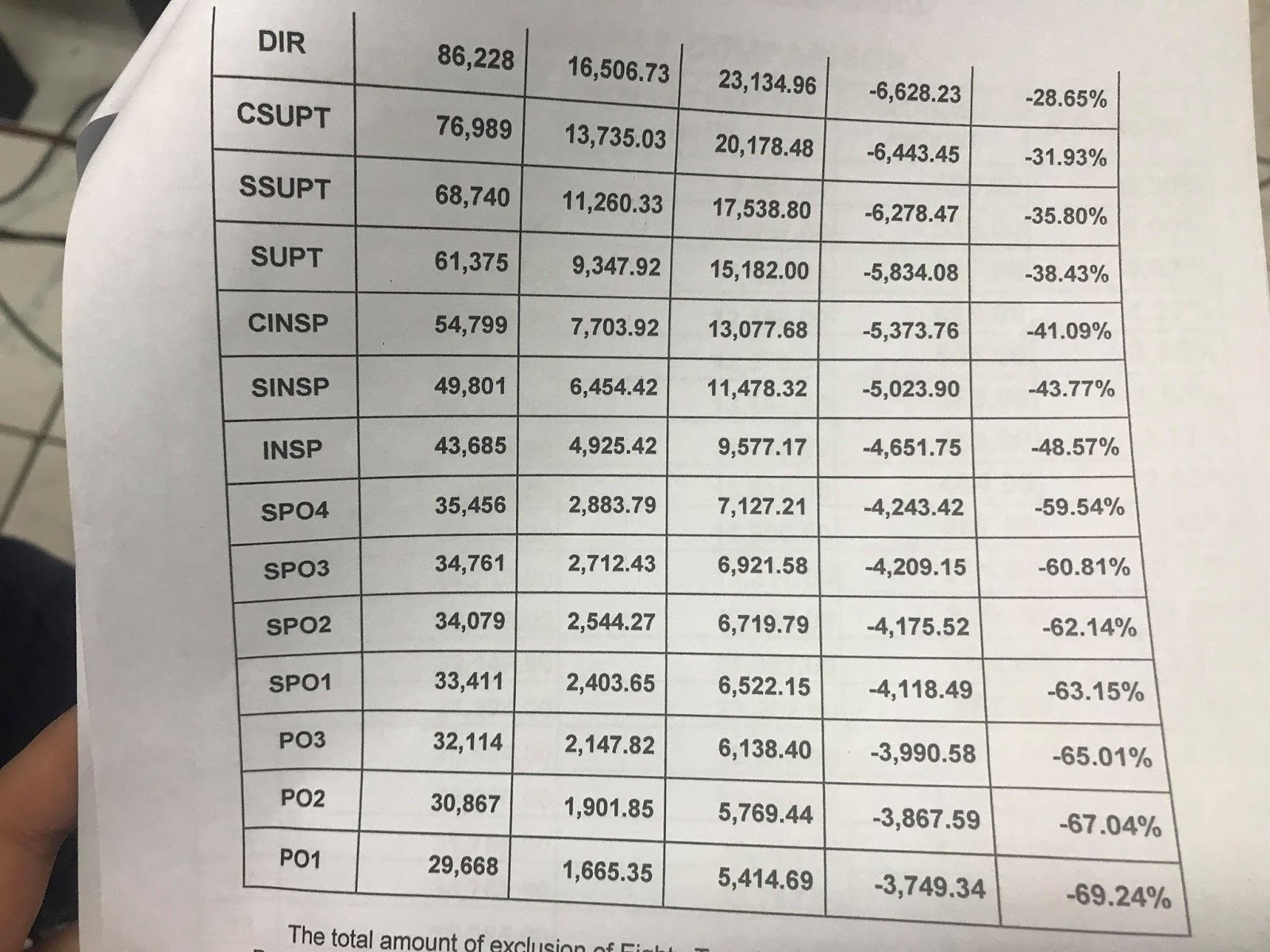

Philippine Salary Grade Chart

https://4.bp.blogspot.com/-DiFKy9sL8sE/WldIMnhbFOI/AAAAAAAADeI/S9ZMbvxa22MPG88G7l7qFrnQLu86PjL0wCLcBGAs/s1600/Police%2BSalary%2BIncrease%2B2017%2B3.jpg

How To Compute Monthly Salary Philippines 2023 - Summary Enter your employment income into our salary calculator above to estimate how taxes in the Philippines may affect your finances You ll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when planning your