How To Compute Gross Monthly Income Philippines This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income So just in case you are wondering how much tax you are paying to the government of the Philippines take a look at this tax table Net Salary Gross Salary Monthly Contributions Income

Now that you know your yearly income you can divide it by 12 the total number of months in a year Taking the above mentioned figure then we d perform the following calculation 11 440 12 953 333333333 Converted to a monetary figure that would be 953 33 In this example that is your gross monthly income To calculate this she uses this equation Gross income per month 90 000 12 Gross income per month 7 500 With this figure in mind she also can add her rental income of 2 000 which means Victoria s gross income per month is 9 500 She knows her average monthly expenses are around 4 000 so if she budgets appropriately she can afford

How To Compute Gross Monthly Income Philippines

How To Compute Gross Monthly Income Philippines

http://www.dof.gov.ph/taxreform/wp-content/uploads/2017/12/CTRP-Package-ONE-v2-17.png

How To Compute Tax On Monthly Salary Monthly Withholding Tax On

https://i.ytimg.com/vi/5dkPPFL84bw/maxresdefault.jpg

Gross Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17235937/Gross-Income-Calculator.jpg

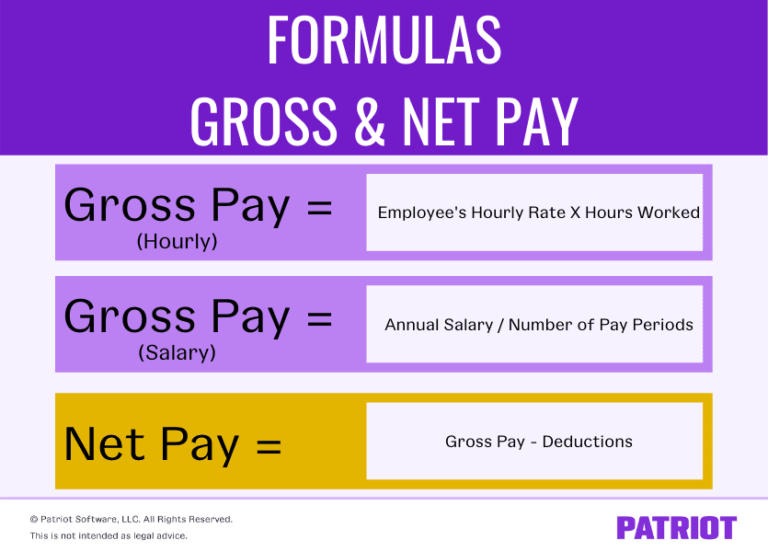

Here are the steps you can use to calculate your gross monthly income Your hourly rate multiplied by the hours per week you work is your weekly pay The weekly pay times 52 is your yearly salary Your annual Salary divided by 12 gives you your gross individual income per month Ad Here s the breakdown Compute your annual gross salary first We ll use the monthly gross salary from our previous example and multiply it by 12 25 000 x 12 300 000 Get the total annual employee contributions they fall under allowable deductions SSS 25 000 x 0 045 1 125 then 1 125 x 12 months 13 500

Image gross monthly household income Gross monthly income formula With an annual salary you can easily find your gross monthly income by dividing your yearly earnings salary by 12 For example if Irene earns 65 000 annually she would divide her yearly salary by 12 resulting in a gross monthly income of 5 417 How to calculate gross monthly income You can calculate gross monthly income similarly to gross yearly income Follow these steps to determine gross pay 1 Add up W 2 wages for the month Tally up the gross pay or income listed on each of your paystubs for a given month 2

More picture related to How To Compute Gross Monthly Income Philippines

How To Calculate Gross Monthly Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

The Gross Profit Formula Lower Costs Raise Revenue QuickBooks Australia

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

Is Base Salary The Same As Gross Pay

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

The formula for calculating gross monthly income from an hourly rate is Hourly pay x number of hours per week X 52 weeks 12 Gross monthly income For example assume you get paid 18 per hour for 40 hours per week This yields 720 per week Multiply that by 52 weeks in the year to get 37 440 annually How To Compute Income Tax in the Philippines 4 Ways Scenario 2 Call center employee with a gross monthly salary of Php 20 000 receiving 13th month pay of the same amount Multiply the gross income by 8 to compute the income tax due Php 180 000 x 0 08 Php 14 400 3 Computation of total income tax due

The Takeaway To calculate gross monthly income from a biweekly paycheck find the gross amount listed on the pay stub multiply by 26 then divide by 12 Do not use this formula if you re paid twice a month on the same dates rather than the same days of the week For your monthly net pay substitute your net or take home pay for the gross Simply take the total amount of money salary you re paid for the year and divide it by 12 Image source The Motley Fool For example if you re paid an annual salary of 75 000 per year the

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Solved 2 RSDV Corporation A Domestic Corporation Owns Twenty

https://www.coursehero.com/qa/attachment/20524374/

How To Compute Gross Monthly Income Philippines - Step Three Calculate Your Monthly Income Now you re ready to calculate your monthly income To do so simply divide your annual income by 12 since there are 12 months in a year You can also take your hourly wage times the number of hours per week you work typically 40 times 4 weeks per month monthly income annual income 12