How To Calculate Tax Payable On Total Taxable Income Taking gross income subtract deductions and exemptions such as contributions to a 401 k or pension plan The resulting figure should be the taxable income amount Other Taxable Income Interest Income Most interest will be taxed as ordinary income including interest earned on checking and savings accounts CDs and income tax refunds

Annual gross income In this field enter your total household income before taxes Include wages tips commission income earned from interest dividends investments rental income retirement Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck This is tax withholding See how your withholding affects your refund take home pay or tax due How it works Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by

How To Calculate Tax Payable On Total Taxable Income

How To Calculate Tax Payable On Total Taxable Income

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

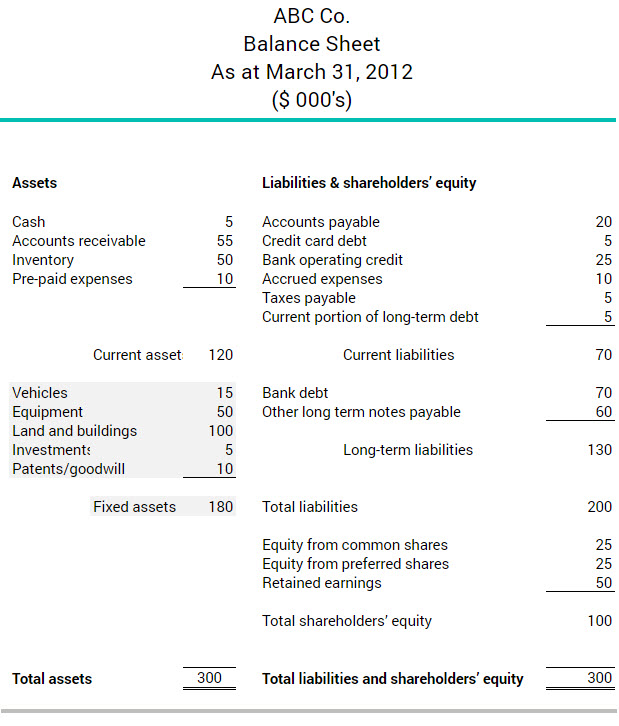

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

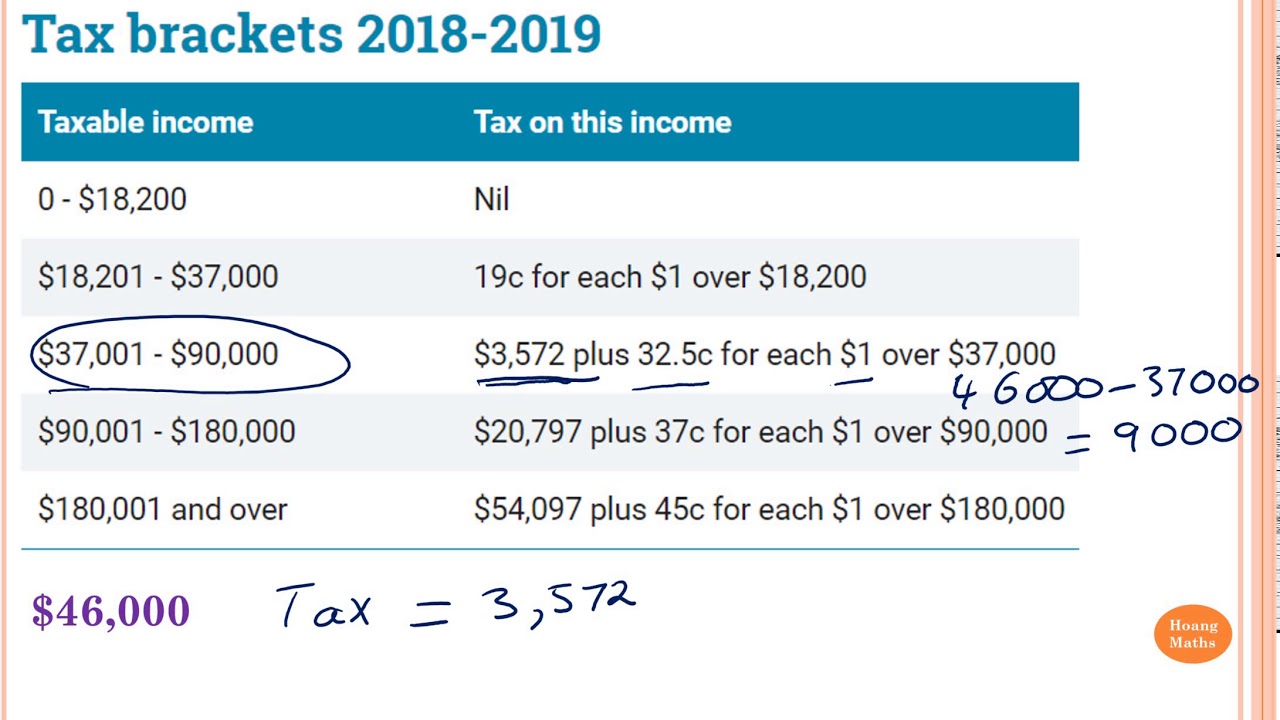

Calculating Tax Payable Part 1 YouTube

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

The term taxable income refers to any gross income earned that is used to calculate the amount of tax you owe Put simply it is your adjusted gross income less any deductions These taxes include Social Security tax income tax Medicare tax and other state income taxes that benefit W 2 employees Both employers and employees split the Federal Insurance Contribution Act FICA taxes that pay for Social Security and Medicare programs

Total Tax 0 00 Payments Credits Tax Owed 0 00 0 00 0 00 This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The provided information does not constitute financial tax or legal advice Finally the taxable income formula is calculated by total exemptions and deductions from the individual s total gross income as shown below Taxable Earning Gross total income Total exemptions Total deductions The taxable income formula for an organization can be derived by using the following five steps

More picture related to How To Calculate Tax Payable On Total Taxable Income

How To Calculate Tax Payable On The Sale Of Your Rental Properties

https://secureservercdn.net/45.40.152.202/k1z.242.myftpupload.com/wp-content/uploads/2016/08/facebook_1470672080045.jpg

What Is The Difference Between Tax Expense And Taxes Payable

http://4.bp.blogspot.com/-6GvW7nVPB9Y/U2S77OCodOI/AAAAAAAANek/_KV-_gHK7sk/s1600/tax+payable+and+tax+expenses.PNG

How To Calculate Tax Payable On The Sale Of Your Rental Properties

https://realestatetaxtips.ca/wp-content/uploads/2016/08/Newmarket-landlords-avoid-Newmarket-Real-Estate-Agents-To-Get-the-Best-Highest-Price-1.jpg

This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800 The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied

[desc-10] [desc-11]

Sales Taxes Payable Meaning Journal Entries Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/08/Sales-Taxes-Payable.jpg

What Are Long term Assets BDC ca

https://www.bdc.ca/globalassets/digizuite/15171-long-term-assets-exemple.jpg?v=4a4b90

How To Calculate Tax Payable On Total Taxable Income - [desc-14]