How Do I Calculate Tax On Total Taxable Income Step 1 Calculate Your Gross Income Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc To illustrate say your income for 2022

Total Estimated 2023 Tax Burden First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

How Do I Calculate Tax On Total Taxable Income

How Do I Calculate Tax On Total Taxable Income

https://img.homeworklib.com/questions/1f89a1d0-6f23-11ea-b815-0f087af5aa5c.png?x-oss-process=image/resize,w_560

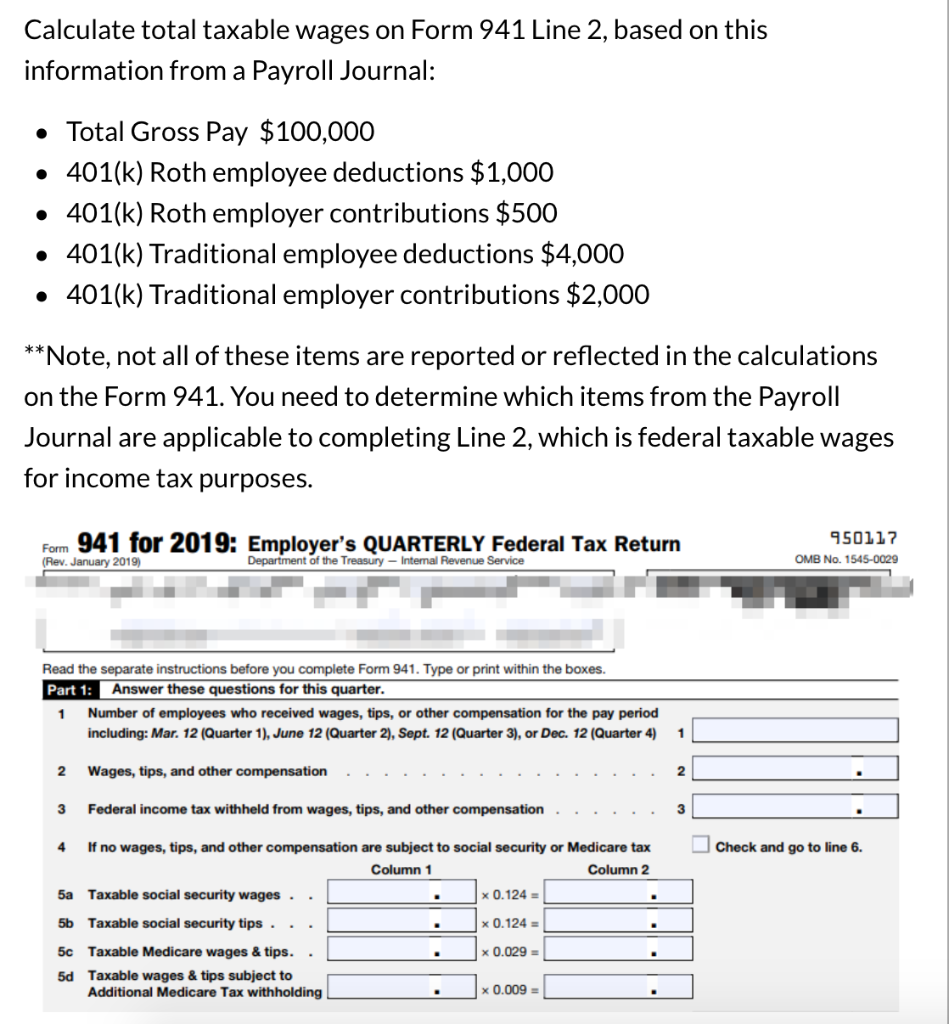

Solved Calculate Total Taxable Wages On Form 941 Line 2 Chegg

https://media.cheggcdn.com/media/2cd/2cda5fe7-42af-4468-bf32-cf9b38fa9cb0/phpw88aPO.png

HOW TO CALCULATE INCOME TAX Example 1 YouTube

https://i.ytimg.com/vi/jxNo7WZyLfE/maxresdefault.jpg

All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate Step 1 Determine Your Filing Status First determine your filing status If you are married your best option is usually to file jointly If you file your taxes jointly with your spouse you are required to add all of your income together to determine the total You can combine your deductions and you pay your taxes jointly

This calculator estimates the average tax rate as the state income tax liability divided by the total gross income Some calculators may use taxable income when calculating the average tax rate 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April Change the information currently provided in the calculator to match your personal information

More picture related to How Do I Calculate Tax On Total Taxable Income

How To Create An Income Tax Calculator In Excel YouTube

https://i.ytimg.com/vi/LndP9MigxAE/maxresdefault.jpg

Here s How To Find How What Tax Bracket You re In For 2020 Business

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

https://i0.wp.com/nairametrics.com/wp-content/uploads/2016/07/Tax-payable.jpg?ssl=1

Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year It is generally described as gross income or adjusted

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison File Status As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are

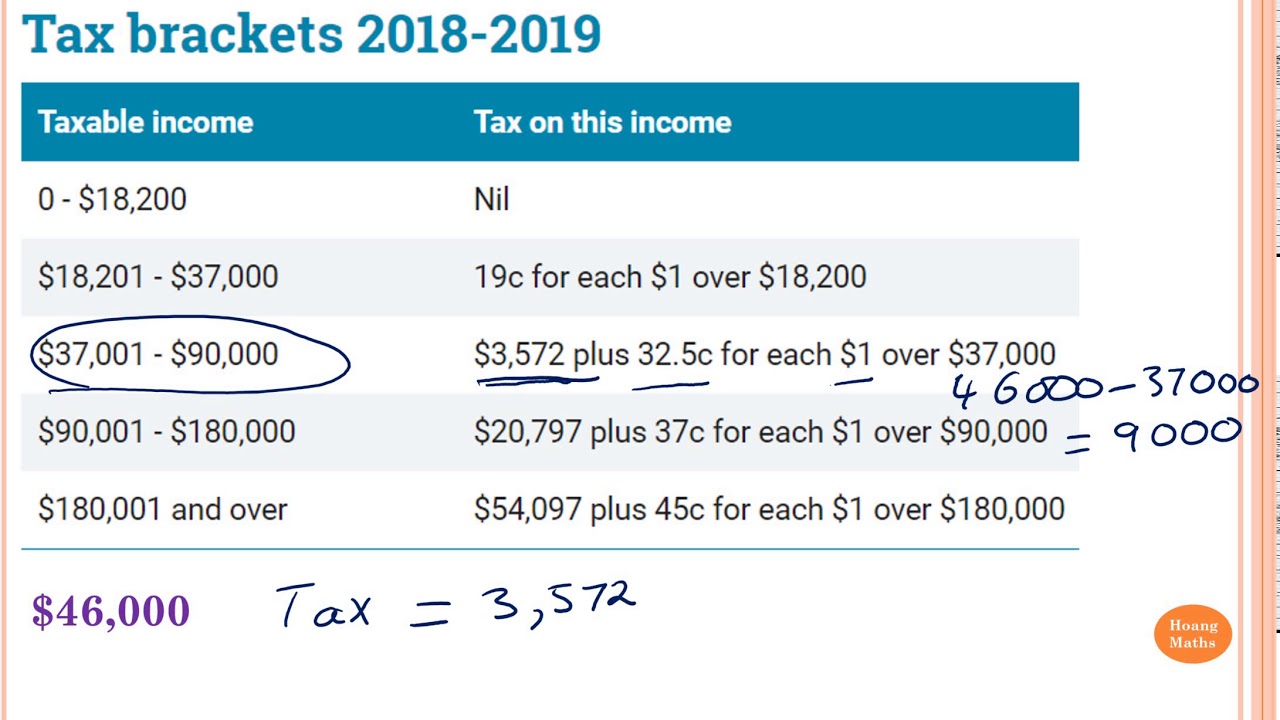

Calculating Tax Payable Part 1 YouTube

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

How To Check You Tax Return Agencypriority21

http://www.tax-rates.org/wp-content/uploads/2012/04/1040-total.png

How Do I Calculate Tax On Total Taxable Income - This calculator estimates the average tax rate as the state income tax liability divided by the total gross income Some calculators may use taxable income when calculating the average tax rate